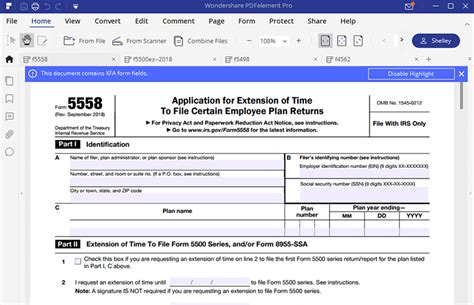

Finding the correct mailing address for Form 5558 can be a daunting task, especially when dealing with the complexities of tax-related documents. The Application for Extension of Time To File Certain Employee Plan Returns form is a crucial document for businesses and individuals who need to request an extension of time to file their employee plan returns. In this article, we will explore three easy ways to find the correct mailing address for Form 5558.

Why is it essential to find the correct mailing address for Form 5558?

Before we dive into the methods of finding the correct mailing address, it is crucial to understand the importance of accuracy in this context. Filing Form 5558 with the incorrect mailing address can lead to delays, penalties, and even rejection of the application. The IRS is strict about the timely filing of tax-related documents, and any mistakes can have severe consequences.

Method 1: Check the IRS Website

The most straightforward way to find the correct mailing address for Form 5558 is to visit the official IRS website. The IRS provides a comprehensive guide to filing employee plan returns, including the correct mailing addresses for various forms. You can search for "Form 5558 mailing address" on the IRS website, and you will be directed to the relevant page.

To find the mailing address on the IRS website, follow these steps:

- Go to the IRS website ()

- Click on the "Forms and Publications" tab

- Search for "Form 5558"

- Click on the "Instructions for Form 5558" link

- Scroll down to the "Where to File" section

The IRS website will provide you with the most up-to-date and accurate mailing address for Form 5558.

Method 2: Consult the Form 5558 Instructions

Another way to find the correct mailing address for Form 5558 is to consult the instructions provided with the form. The IRS includes detailed instructions with every form, and the mailing address is usually mentioned in the "Where to File" section.

To find the mailing address in the Form 5558 instructions, follow these steps:

- Download the Form 5558 instructions from the IRS website or obtain a printed copy

- Go to the "Where to File" section

- Look for the mailing address specific to your location (e.g., state or region)

The instructions will provide you with the correct mailing address for Form 5558, ensuring that your application is filed accurately and efficiently.

Method 3: Contact the IRS or a Tax Professional

If you are still unsure about the correct mailing address for Form 5558, you can contact the IRS directly or consult a tax professional. The IRS provides a customer service number and email address for tax-related inquiries. You can also reach out to a tax professional or accountant who specializes in employee plan returns.

To contact the IRS or a tax professional, follow these steps:

- Call the IRS customer service number (1-800-829-1040) or email them through the IRS website

- Explain your situation and ask for the correct mailing address for Form 5558

- Alternatively, consult a tax professional or accountant who specializes in employee plan returns

By following these three easy methods, you can ensure that you find the correct mailing address for Form 5558 and avoid any potential delays or penalties.

What is the purpose of Form 5558?

+Form 5558 is used to request an extension of time to file certain employee plan returns, including Form 5500 and Form 5500-EZ.

What is the deadline for filing Form 5558?

+The deadline for filing Form 5558 is the 15th day of the 5th month after the end of the plan year (e.g., May 15th for a plan year ending on December 31st).

Can I file Form 5558 electronically?

+Yes, you can file Form 5558 electronically through the IRS website or through a tax professional or accountant.

We hope this article has provided you with a comprehensive guide to finding the correct mailing address for Form 5558. Remember to double-check the address to avoid any potential delays or penalties. If you have any further questions or concerns, feel free to comment below or share this article with others who may find it helpful.