The world of employee benefits compliance can be complex and overwhelming, especially when it comes to filing Form 5500. As an employer-sponsored retirement plan administrator, you're likely no stranger to the importance of accurate and timely filings. One crucial component of the Form 5500 is Schedule R, which reports on the retirement plan's distributions and loan activity. In this article, we'll delve into the top 5 compliance tips for mastering Form 5500 Schedule R.

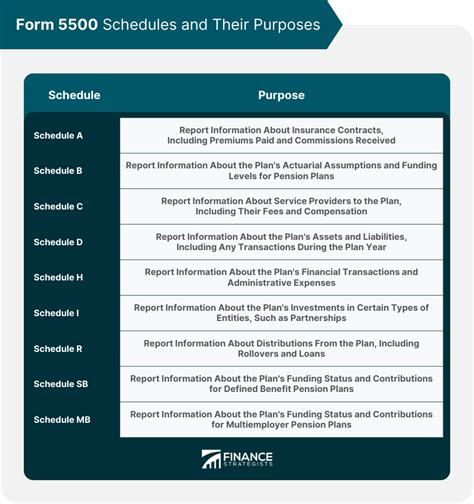

Understanding the Purpose of Schedule R

Before we dive into the compliance tips, it's essential to understand the purpose of Schedule R. This schedule is used to report on the distributions and loan activity of a retirement plan, including the number of participants who received distributions, the total amount of distributions, and the number of participants with outstanding loans. Accurate completion of Schedule R is crucial to ensure compliance with ERISA (Employee Retirement Income Security Act) regulations.

Tip #1: Verify Plan Data and Participant Information

The first step in mastering Form 5500 Schedule R is to verify the accuracy of your plan data and participant information. This includes reviewing the plan's documentation, such as the plan document, summary plan description, and participant data. Ensure that all participant information is up-to-date and accurate, including names, addresses, and social security numbers. Inaccurate or incomplete information can lead to errors on Schedule R, which can result in costly penalties and fines.

Common Errors to Avoid on Schedule R

When completing Schedule R, it's essential to avoid common errors that can lead to compliance issues. Some common errors include:

- Inaccurate or incomplete participant information

- Failure to report distributions and loan activity

- Incorrect calculation of distributions and loan amounts

- Failure to sign and date the schedule

Tip #2: Review and Understand Distribution Reporting

Distribution reporting is a critical component of Schedule R. It's essential to review and understand the types of distributions that must be reported, including:

- Normal retirements

- Disability retirements

- Death benefits

- Loans

- Withdrawals

Ensure that you accurately report all distributions made during the plan year, including the date and amount of each distribution. Failure to report distributions can result in penalties and fines.

Types of Distributions and Reporting Requirements

The following types of distributions must be reported on Schedule R:

- Normal retirements: Report the number of participants who received normal retirements and the total amount of distributions.

- Disability retirements: Report the number of participants who received disability retirements and the total amount of distributions.

- Death benefits: Report the number of participants who received death benefits and the total amount of distributions.

- Loans: Report the number of participants with outstanding loans and the total amount of loans.

- Withdrawals: Report the number of participants who made withdrawals and the total amount of withdrawals.

Tip #3: Accurately Calculate Loan Activity

Loan activity is another critical component of Schedule R. It's essential to accurately calculate the number of participants with outstanding loans and the total amount of loans. Ensure that you report all loan activity, including:

- Loan amounts

- Loan interest rates

- Loan repayment terms

Failure to accurately report loan activity can result in penalties and fines.

Tip #4: Ensure Timely Filing and Electronic Filing

Form 5500, including Schedule R, must be filed electronically with the Department of Labor (DOL) by the last day of the seventh month following the plan year. For example, for a plan year ending December 31, the filing deadline is July 31. Ensure that you file Schedule R on time to avoid penalties and fines.

Tip #5: Review and Verify Before Filing

Before filing Schedule R, review and verify the accuracy of all information reported. Ensure that all participant information is accurate, and all distribution and loan activity is reported correctly. Reviewing and verifying the schedule before filing can help prevent errors and ensure compliance with ERISA regulations.

Stay Ahead of Compliance with Best Practices

To stay ahead of compliance and ensure accurate completion of Form 5500 Schedule R, consider the following best practices:

- Regularly review and update plan documentation and participant information

- Implement a system to track distribution and loan activity

- Verify the accuracy of all information reported on Schedule R

- File electronically and on time

- Review and verify the schedule before filing

By following these compliance tips and best practices, you can ensure accurate completion of Form 5500 Schedule R and maintain compliance with ERISA regulations.

Take Action and Share Your Thoughts

We hope this article has provided valuable insights and tips for mastering Form 5500 Schedule R. If you have any questions or comments, please share them below. Don't forget to share this article with your colleagues and peers to help them stay ahead of compliance.

What is the purpose of Schedule R?

+Schedule R is used to report on the distributions and loan activity of a retirement plan, including the number of participants who received distributions, the total amount of distributions, and the number of participants with outstanding loans.

What are common errors to avoid on Schedule R?

+Common errors to avoid on Schedule R include inaccurate or incomplete participant information, failure to report distributions and loan activity, incorrect calculation of distributions and loan amounts, and failure to sign and date the schedule.

What types of distributions must be reported on Schedule R?

+The following types of distributions must be reported on Schedule R: normal retirements, disability retirements, death benefits, loans, and withdrawals.