Colorado state tax form filing can be a daunting task, but it doesn't have to be. With the right approach, you can simplify the process and ensure that your tax return is accurate and complete. In this article, we'll explore five ways to simplify Colorado state tax form filing, making it easier for you to navigate the process and get the best possible outcome.

1. Understand Your Filing Requirements

Before you start filling out your Colorado state tax form, it's essential to understand your filing requirements. The Colorado Department of Revenue requires all residents to file a state tax return if their gross income exceeds certain thresholds. For the 2022 tax year, you must file a return if your gross income is:

- $12,000 or more for single filers

- $24,000 or more for joint filers

- $18,000 or more for head of household filers

Make sure you check the Colorado Department of Revenue's website for the most up-to-date information on filing requirements.

Who Must File a Colorado State Tax Return?

In addition to meeting the income thresholds, you may also need to file a Colorado state tax return if you:

- Have self-employment income

- Received unemployment benefits

- Sold or exchanged capital assets

- Claimed a refund or credit

It's crucial to review the Colorado Department of Revenue's guidelines to determine if you need to file a state tax return.

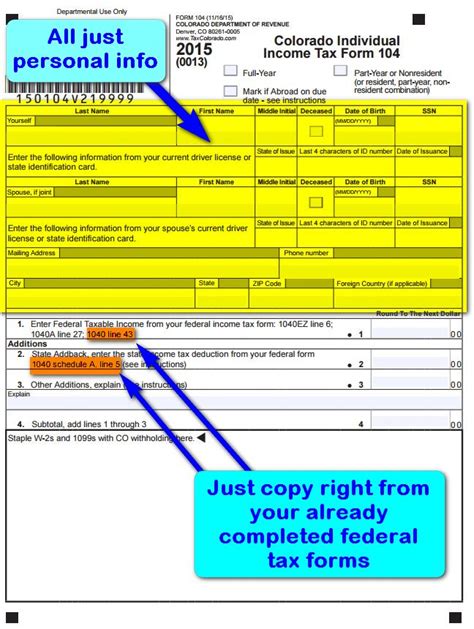

2. Gather All Necessary Documents

To simplify the tax filing process, gather all necessary documents before you start filling out your return. This includes:

- W-2 forms from your employer(s)

- 1099 forms for freelance or contract work

- Interest statements from banks and investments

- Dividend statements from investments

- Charitable donation receipts

- Medical expense records

Having all your documents in one place will save you time and reduce the risk of errors.

Organize Your Documents

Consider using a folder or binder to keep all your tax-related documents organized. This will make it easier to find the information you need when filling out your return.

3. Choose the Right Filing Status

Your filing status affects your tax rate and the deductions you can claim. Colorado recognizes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Make sure you choose the correct filing status to ensure you're taking advantage of the best tax rates and deductions.

How to Choose Your Filing Status

If you're unsure about your filing status, consider the following:

- Single: Unmarried individuals or those who are divorced or separated.

- Married filing jointly: Married couples who file together.

- Married filing separately: Married couples who file separately.

- Head of household: Unmarried individuals who claim dependents.

- Qualifying widow(er): Recently widowed individuals who claim dependents.

4. Take Advantage of Tax Credits and Deductions

Colorado offers various tax credits and deductions to reduce your tax liability. Some of the most common include:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

- Charitable contribution deductions

- Mortgage interest deductions

Make sure you review the Colorado Department of Revenue's guidelines to determine which credits and deductions you're eligible for.

How to Claim Tax Credits and Deductions

To claim tax credits and deductions, you'll need to:

- Complete the relevant schedules and forms

- Attach supporting documentation

- Claim the credits and deductions on your tax return

5. E-File Your Tax Return

E-filing your tax return is a convenient and efficient way to submit your return. The Colorado Department of Revenue offers e-filing options through their website or through approved tax preparation software.

Benefits of E-Filing

E-filing offers several benefits, including:

- Faster processing times

- Reduced risk of errors

- Faster refunds

- Environmental benefits

Make sure you review the Colorado Department of Revenue's guidelines for e-filing requirements and deadlines.

By following these five tips, you can simplify the Colorado state tax form filing process and ensure that your tax return is accurate and complete. Remember to stay organized, choose the right filing status, take advantage of tax credits and deductions, and e-file your return to make the process as smooth as possible.

What is the deadline for filing a Colorado state tax return?

+The deadline for filing a Colorado state tax return is typically April 15th of each year. However, this deadline may be extended if you file for an extension or if you owe taxes and make a payment by the original deadline.

Can I file my Colorado state tax return electronically?

+Yes, you can file your Colorado state tax return electronically through the Colorado Department of Revenue's website or through approved tax preparation software.

What are the most common tax credits and deductions available in Colorado?

+Some of the most common tax credits and deductions available in Colorado include the Earned Income Tax Credit (EITC), Child Tax Credit, education credits, charitable contribution deductions, and mortgage interest deductions.

We hope you found this article helpful in simplifying the Colorado state tax form filing process. If you have any further questions or concerns, please don't hesitate to reach out. Share this article with friends and family who may be struggling with their tax return, and remember to take advantage of the resources available to you to make the process as smooth as possible.