Form 4952 is a crucial tax form for individuals and businesses that need to report investment interest expense. Filing this form can be complex, but with the right guidance, you can ensure you're taking advantage of the deductions you're eligible for. In this article, we'll provide a step-by-step guide on how to complete Form 4952, making it easier for you to navigate the tax filing process.

Understanding Form 4952

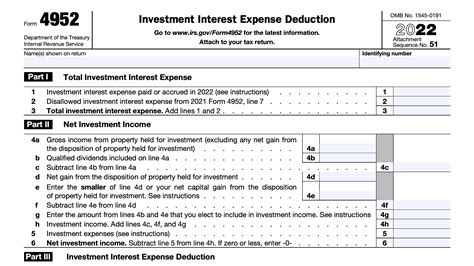

Form 4952, also known as the Investment Interest Expense Deduction form, is used to calculate the amount of investment interest expense that can be deducted on your tax return. This form is typically used by individuals and businesses that have investment interest expenses, such as margin interest on investments or interest on loans used to purchase investment property.

Who Needs to File Form 4952?

You'll need to file Form 4952 if you have investment interest expenses and you want to deduct them on your tax return. This includes:

- Individuals with investment interest expenses

- Businesses with investment interest expenses

- Estates and trusts with investment interest expenses

Gathering Necessary Information

Before you start filling out Form 4952, make sure you have the following information:

- Your investment interest expenses for the year

- Your net investment income for the year

- Your modified adjusted gross income (MAGI) for the year

- Any applicable phase-out limits

Step-by-Step Instructions for Form 4952

Here's a step-by-step guide to completing Form 4952:

- Enter your name and taxpayer identification number: Enter your name and taxpayer identification number (Social Security number or Employer Identification Number) at the top of the form.

- Report your investment interest expenses: List your investment interest expenses for the year on Line 1. You can include interest on loans used to purchase investment property, margin interest on investments, and other investment-related interest expenses.

- Calculate your net investment income: Calculate your net investment income for the year on Line 2. This includes income from investments, such as dividends, interest, and capital gains.

- Calculate your modified adjusted gross income (MAGI): Calculate your MAGI for the year on Line 3. This includes your adjusted gross income (AGI) plus certain deductions and exclusions.

- Apply the phase-out limits: If your MAGI exceeds certain limits, you may be subject to phase-out limits on your investment interest expense deduction. See the instructions for Form 4952 for more information.

- Calculate your investment interest expense deduction: Calculate your investment interest expense deduction on Line 4. This is the amount of investment interest expense you can deduct on your tax return.

Special Rules and Limitations

There are special rules and limitations that apply to Form 4952, including:

- Phase-out limits: If your MAGI exceeds certain limits, you may be subject to phase-out limits on your investment interest expense deduction.

- Net investment income: You can only deduct investment interest expense to the extent of your net investment income.

- Modified adjusted gross income (MAGI): You must calculate your MAGI to determine if you're subject to phase-out limits.

Common Mistakes to Avoid

When filling out Form 4952, make sure to avoid the following common mistakes:

- Incorrectly calculating net investment income: Make sure to calculate your net investment income correctly to avoid errors.

- Failing to apply phase-out limits: If your MAGI exceeds certain limits, make sure to apply the phase-out limits to avoid errors.

- Incorrectly reporting investment interest expenses: Make sure to report your investment interest expenses correctly to avoid errors.

Conclusion

Filing Form 4952 can be complex, but with the right guidance, you can ensure you're taking advantage of the deductions you're eligible for. By following these step-by-step instructions and avoiding common mistakes, you can accurately complete Form 4952 and reduce your tax liability.

What is Form 4952 used for?

+Form 4952 is used to calculate the amount of investment interest expense that can be deducted on your tax return.

Who needs to file Form 4952?

+You'll need to file Form 4952 if you have investment interest expenses and you want to deduct them on your tax return.

What information do I need to gather before filling out Form 4952?

+You'll need to gather your investment interest expenses, net investment income, modified adjusted gross income (MAGI), and any applicable phase-out limits.

We hope this article has provided you with a comprehensive guide to Form 4952. If you have any further questions or need additional guidance, please don't hesitate to reach out.