The world of tax preparation can be overwhelming, especially with the numerous forms and documents that need to be filed accurately and on time. One such form that plays a crucial role in the tax filing process is Form 5498. In this article, we will delve into the intricacies of Form 5498 and explore how Lacerte software can simplify the process of working with this form.

For individuals who are new to the world of tax preparation, Form 5498 might seem like just another form in the sea of paperwork. However, this form holds significant importance, particularly for those who have Individual Retirement Accounts (IRAs) or other qualified retirement plans. Form 5498 is used to report the fair market value (FMV) of the account holder's interest in the plan as of the end of the calendar year.

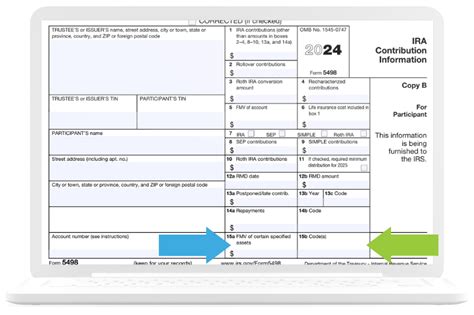

What is Form 5498?

Form 5498 is an annual report that custodians of IRAs and other qualified retirement plans are required to file with the Internal Revenue Service (IRS) by May 31st of each year. This form reports the FMV of the account holder's interest in the plan as of December 31st of the previous tax year. The form also reports any contributions made to the account during the tax year, including rollover contributions and recharacterizations.

Types of Accounts Reported on Form 5498

Form 5498 is used to report the FMV of various types of accounts, including:

- IRAs (traditional and Roth)

- SEP-IRAs

- SIMPLE IRAs

- 401(k) plans

- 403(b) plans

- Thrift Savings Plans

How to Complete Form 5498

Completing Form 5498 requires careful attention to detail to ensure accuracy and compliance with IRS regulations. Here are the steps to complete Form 5498:

- Gather all necessary information: Before starting to complete Form 5498, gather all necessary information, including the account holder's name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Determine the FMV: Calculate the FMV of the account holder's interest in the plan as of December 31st of the previous tax year.

- Report contributions: Report any contributions made to the account during the tax year, including rollover contributions and recharacterizations.

- Complete the form: Complete Form 5498 using the information gathered and calculated in steps 1-3.

How Lacerte Software Simplifies the Form 5498 Process

Lacerte software is a powerful tool that simplifies the process of working with Form 5498. Here are some ways Lacerte software can help:

- Automatic calculations: Lacerte software automatically calculates the FMV of the account holder's interest in the plan, reducing the risk of errors.

- Data import: Lacerte software allows for easy import of data from other sources, reducing the need for manual entry.

- Form preparation: Lacerte software prepares Form 5498 based on the data entered, reducing the risk of errors and ensuring compliance with IRS regulations.

- Electronic filing: Lacerte software allows for electronic filing of Form 5498, reducing the risk of delays and errors associated with paper filing.

Benefits of Using Lacerte Software for Form 5498

Using Lacerte software for Form 5498 offers several benefits, including:

- Reduced risk of errors

- Increased efficiency

- Improved accuracy

- Compliance with IRS regulations

- Electronic filing

Common Mistakes to Avoid When Completing Form 5498

When completing Form 5498, it's essential to avoid common mistakes that can lead to errors and delays. Here are some common mistakes to avoid:

- Inaccurate FMV calculations

- Failure to report contributions

- Incorrect account holder information

- Failure to file electronically

Conclusion

Form 5498 is a critical form that plays a significant role in the tax filing process for individuals with IRAs and other qualified retirement plans. By understanding the requirements and complexities of Form 5498, individuals can ensure accurate and timely filing. Lacerte software simplifies the process of working with Form 5498, reducing the risk of errors and improving efficiency. By using Lacerte software, individuals can ensure compliance with IRS regulations and avoid common mistakes.

We hope this article has provided valuable insights into the world of Form 5498 and Lacerte software. If you have any questions or comments, please feel free to share them below.

What is the deadline for filing Form 5498?

+Form 5498 must be filed with the IRS by May 31st of each year.

Can I file Form 5498 electronically?

+Yes, Form 5498 can be filed electronically using Lacerte software.

What types of accounts are reported on Form 5498?

+Form 5498 reports the fair market value of IRAs, SEP-IRAs, SIMPLE IRAs, 401(k) plans, 403(b) plans, and Thrift Savings Plans.