Purchasing a home is a significant milestone in one's life, and for many, it's a dream come true. However, the process of buying a home can be overwhelming, especially for first-time homebuyers. One of the many benefits of being a first-time homebuyer is the ability to claim the First-Time Homebuyer Credit, which can help reduce your tax liability. In this article, we will guide you through the process of claiming the First-Time Homebuyer Credit using Form 5405 and TurboTax.

The First-Time Homebuyer Credit was introduced in 2008 as part of the Housing and Economic Recovery Act. The credit is designed to help first-time homebuyers offset the costs of purchasing a home, such as down payments and closing costs. The credit is a refundable tax credit, which means that you can receive a refund even if the credit exceeds your tax liability.

Who Qualifies for the First-Time Homebuyer Credit?

To qualify for the First-Time Homebuyer Credit, you must meet certain requirements. These requirements include:

- You must be a first-time homebuyer, which means that you have not owned a primary residence in the past three years.

- You must purchase a primary residence, such as a single-family home, townhouse, condominium, or cooperative apartment.

- The home must be located in the United States.

- You must occupy the home as your primary residence for at least 36 months after the purchase date.

How to Claim the First-Time Homebuyer Credit with Form 5405

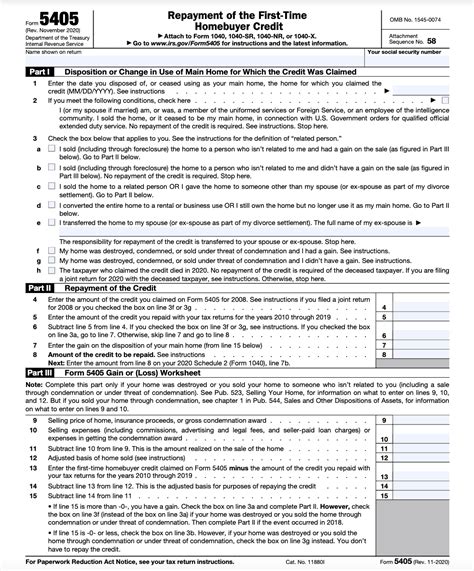

To claim the First-Time Homebuyer Credit, you will need to complete Form 5405 and attach it to your tax return. Here's a step-by-step guide to help you complete Form 5405:

- Determine the Credit Amount: The First-Time Homebuyer Credit is equal to 10% of the purchase price of the home, up to a maximum of $7,500. You can calculate the credit amount using the formula: Credit Amount = 10% x Purchase Price.

- Complete Form 5405: You can download Form 5405 from the IRS website or use tax preparation software like TurboTax. The form will ask for your name, address, and Social Security number, as well as information about the home you purchased, such as the purchase price and date.

- Attach Supporting Documentation: You will need to attach supporting documentation to Form 5405, such as a copy of the settlement statement or a certified copy of the deed.

Using TurboTax to Claim the First-Time Homebuyer Credit

TurboTax is a popular tax preparation software that can help you claim the First-Time Homebuyer Credit. Here's how to use TurboTax to claim the credit:

- Sign Up for TurboTax: If you haven't already, sign up for a TurboTax account.

- Select the First-Time Homebuyer Credit: When you're asked about your tax situation, select the option that indicates you're a first-time homebuyer.

- Complete the Form 5405 Interview: TurboTax will guide you through a series of questions to complete Form 5405. You'll need to provide information about the home you purchased, such as the purchase price and date.

- Review and Submit Your Return: Once you've completed the Form 5405 interview, review your return carefully and submit it to the IRS.

Benefits of Using TurboTax to Claim the First-Time Homebuyer Credit

Using TurboTax to claim the First-Time Homebuyer Credit has several benefits. These benefits include:

- Accuracy Guarantee: TurboTax guarantees the accuracy of your return, so you can rest assured that your credit will be calculated correctly.

- Maximum Refund Guarantee: TurboTax also guarantees that you'll receive the maximum refund you're eligible for, including the First-Time Homebuyer Credit.

- Easy to Use: TurboTax is designed to be user-friendly, so you can easily navigate the Form 5405 interview and claim your credit.

Common Mistakes to Avoid When Claiming the First-Time Homebuyer Credit

When claiming the First-Time Homebuyer Credit, there are several common mistakes to avoid. These mistakes include:

- Incorrect Credit Amount: Make sure to calculate the credit amount correctly using the formula: Credit Amount = 10% x Purchase Price.

- Missing Supporting Documentation: Make sure to attach supporting documentation, such as a copy of the settlement statement or a certified copy of the deed.

- Incorrect Filing Status: Make sure to select the correct filing status, such as single or married filing jointly.

How to Avoid an Audit When Claiming the First-Time Homebuyer Credit

To avoid an audit when claiming the First-Time Homebuyer Credit, make sure to:

- Keep Accurate Records: Keep accurate records of your home purchase, including the settlement statement and deed.

- Report the Credit Correctly: Make sure to report the credit correctly on Form 5405 and attach supporting documentation.

- Be Honest and Transparent: Be honest and transparent when completing Form 5405 and answering questions from the IRS.

Conclusion

Claiming the First-Time Homebuyer Credit can be a complex process, but using Form 5405 and TurboTax can make it easier. By following the steps outlined in this article and avoiding common mistakes, you can ensure that you receive the maximum credit you're eligible for. Remember to keep accurate records, report the credit correctly, and be honest and transparent when completing Form 5405.

We hope this article has been helpful in guiding you through the process of claiming the First-Time Homebuyer Credit. If you have any questions or comments, please leave them below.

FAQ Section

Who is eligible for the First-Time Homebuyer Credit?

+To be eligible for the First-Time Homebuyer Credit, you must be a first-time homebuyer, which means that you have not owned a primary residence in the past three years.

How much is the First-Time Homebuyer Credit?

+The First-Time Homebuyer Credit is equal to 10% of the purchase price of the home, up to a maximum of $7,500.

Can I claim the First-Time Homebuyer Credit if I'm married?

+Yes, you can claim the First-Time Homebuyer Credit if you're married, as long as you and your spouse meet the eligibility requirements.