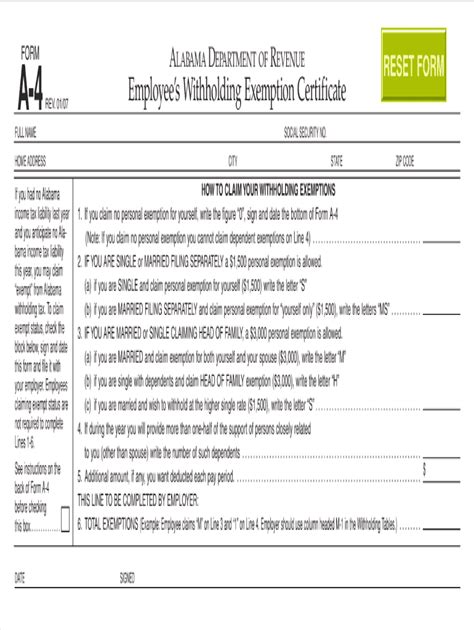

The Alabama A4 form, also known as the "Employee's Withholding Exemption Certificate," is a crucial document for employees in the state of Alabama. It determines the amount of state income tax withheld from an employee's paycheck. Filling out this form correctly is essential to avoid any tax-related issues. In this article, we will guide you through the process of filling out the Alabama A4 form in 5 easy steps.

Understanding the Alabama A4 Form

Before we dive into the steps, it's essential to understand the purpose of the Alabama A4 form. This form is used to determine the number of allowances an employee claims, which in turn affects the amount of state income tax withheld from their paycheck. The form consists of two main sections: the employee's information and the allowances claimed.

Step 1: Employee Information

The first step is to fill out the employee's information section. This section requires the following details:

- Employee's name

- Employee's address

- Employee's social security number

- Employee's date of birth

It's crucial to ensure that this information is accurate, as any errors may lead to delays or issues with tax withholding.

Step 1.1: Employee's Name

Enter your full name as it appears on your social security card. Ensure that the name is spelled correctly, and the format is consistent with your other identification documents.

Step 1.2: Employee's Address

Enter your current address, including the street number, city, state, and zip code. Make sure to update this information if you move to a new address.

Step 2: Claiming Allowances

The next step is to claim allowances, which determines the amount of state income tax withheld from your paycheck. You can claim allowances based on your marital status, dependents, and other factors.

Allowance Types:

- Single or married (claim 1 allowance for single, 2 for married)

- Head of household (claim 1 allowance)

- Dependent children (claim 1 allowance per child)

- Other dependents (claim 1 allowance per dependent)

Step 2.1: Claiming Single or Married

If you're single, claim 1 allowance. If you're married, claim 2 allowances, unless your spouse also claims 2 allowances.

Step 2.2: Claiming Head of Household

If you're the head of household, claim 1 allowance. You must meet specific IRS requirements to qualify as the head of household.

Step 3: Claiming Dependents

Claim allowances for your dependent children and other dependents. You can claim 1 allowance per dependent child and 1 allowance per other dependent.

Dependent Requirements:

- Dependent children must meet specific IRS requirements, such as age and relationship.

- Other dependents must meet specific IRS requirements, such as income and relationship.

Step 4: Signing and Dating the Form

Once you've completed the form, sign and date it. Ensure that your signature is legible, and the date is accurate.

Step 5: Submitting the Form

Submit the completed Alabama A4 form to your employer. Your employer will use this information to determine the correct amount of state income tax to withhold from your paycheck.

Conclusion

Filling out the Alabama A4 form correctly is essential to ensure accurate state income tax withholding. By following these 5 easy steps, you can complete the form with confidence. Remember to review and update your form as necessary to avoid any tax-related issues. If you have any questions or concerns, consult with your employer or a tax professional.

Now, take a moment to review the form and make sure you've completed it accurately. If you have any questions or need further clarification, don't hesitate to ask.

What is the purpose of the Alabama A4 form?

+The Alabama A4 form is used to determine the number of allowances an employee claims, which affects the amount of state income tax withheld from their paycheck.

How many allowances can I claim on the Alabama A4 form?

+You can claim allowances based on your marital status, dependents, and other factors. The number of allowances you can claim varies depending on your individual circumstances.

What happens if I don't submit the Alabama A4 form to my employer?

+If you don't submit the Alabama A4 form, your employer may not withhold the correct amount of state income tax from your paycheck, which could result in tax-related issues.