Filling out Form 500 GA, also known as the Georgia Tax Return Form, can be a daunting task for many individuals and businesses. With so many lines, boxes, and instructions to follow, it's easy to get overwhelmed and make mistakes. However, accurately completing this form is crucial to ensure you receive the correct refund or pay the right amount of taxes. In this article, we'll break down the process into manageable sections, providing you with expert tips and guidance on how to fill out Form 500 GA correctly.

Understanding Form 500 GA

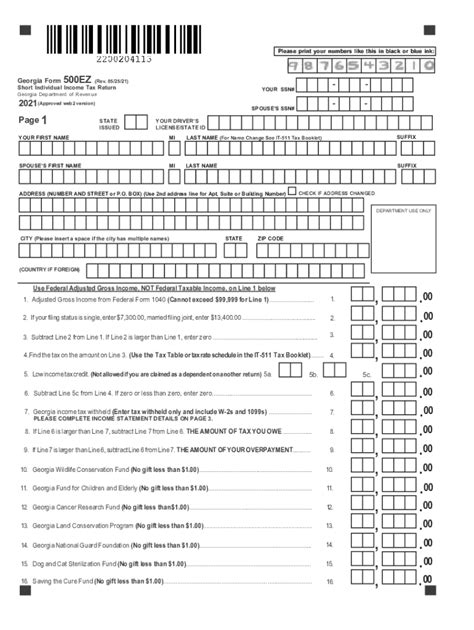

Before diving into the details, it's essential to understand what Form 500 GA is and what it's used for. This form is the standard Georgia state income tax return, which must be filed by all residents and non-residents who have earned income from Georgia sources. The form is used to report income, claim deductions and credits, and calculate the amount of taxes owed or refund due.

Who Needs to File Form 500 GA?

Not everyone needs to file Form 500 GA. Generally, you'll need to file this form if:

- You're a resident of Georgia and have income from any source

- You're a non-resident with income from Georgia sources, such as a job or rental property

- You're required to file a federal income tax return (Form 1040)

Gathering Necessary Documents

Before starting to fill out Form 500 GA, make sure you have all the necessary documents and information. This includes:

- Your federal income tax return (Form 1040)

- W-2 forms from your employer(s)

- 1099 forms for freelance work, interest, or dividends

- Receipts for deductions, such as charitable donations or medical expenses

- Information about your dependents, including their Social Security numbers and birthdays

Tips for Accurate Reporting

To ensure accurate reporting, follow these tips:

- Use your federal income tax return as a reference

- Report all income, including tips, freelance work, and interest

- Claim deductions and credits you're eligible for

- Double-check your math calculations

Line-by-Line Instructions for Form 500 GA

Now that you have all the necessary documents and information, it's time to start filling out Form 500 GA. Here's a line-by-line guide to help you:

- Lines 1-5: Report your income from various sources, including wages, salaries, tips, and interest.

- Lines 6-10: Claim deductions, such as the standard deduction or itemized deductions.

- Lines 11-15: Report your total income and calculate your tax liability.

- Lines 16-20: Claim credits, such as the earned income tax credit (EITC) or child tax credit.

- Lines 21-25: Calculate your total tax liability and determine if you owe taxes or are due a refund.

Avoiding Common Mistakes

To avoid common mistakes, keep the following tips in mind:

- Double-check your math calculations

- Ensure you've reported all income and claimed eligible deductions and credits

- Sign and date the form

E-Filing and Mailing Options

Once you've completed Form 500 GA, you have two options for submitting it: e-filing or mailing.

- E-filing: You can e-file your return through the Georgia Department of Revenue's website or through a tax preparation software. This method is faster and more convenient.

- Mailing: You can mail your return to the address listed on the form. Make sure to include all required documentation and sign the form.

Tips for a Smooth Filing Process

To ensure a smooth filing process, follow these tips:

- E-file your return, if possible

- Double-check your math calculations and ensure you've reported all income

- Sign and date the form

Additional Resources

If you're still unsure about filling out Form 500 GA or need additional guidance, consider the following resources:

- Georgia Department of Revenue's website:

- Tax preparation software, such as TurboTax or H&R Block

- Tax professionals or accountants

Seeking Professional Help

If you're still unsure about filling out Form 500 GA or need professional guidance, consider seeking help from a tax professional or accountant. They can provide personalized advice and ensure you're taking advantage of all eligible deductions and credits.

What is Form 500 GA?

+Form 500 GA is the standard Georgia state income tax return, which must be filed by all residents and non-residents who have earned income from Georgia sources.

Who needs to file Form 500 GA?

+You'll need to file Form 500 GA if you're a resident of Georgia and have income from any source, or if you're a non-resident with income from Georgia sources, such as a job or rental property.

What documents do I need to file Form 500 GA?

+You'll need your federal income tax return (Form 1040), W-2 forms from your employer(s), 1099 forms for freelance work, interest, or dividends, and receipts for deductions, such as charitable donations or medical expenses.