Filling out tax forms can be a daunting task, especially for those who are new to the process. Form 1040 Schedule B, also known as the Interest and Dividend Income form, is a crucial part of the tax filing process for individuals who receive interest and dividend income. In this article, we will provide you with 10 essential tips for filling out Form 1040 Schedule B accurately and efficiently.

Filling out Form 1040 Schedule B requires attention to detail and a clear understanding of the tax laws and regulations. The form is used to report interest and dividend income from various sources, including banks, brokerages, and investments. By following these tips, you can ensure that your tax return is accurate and complete.

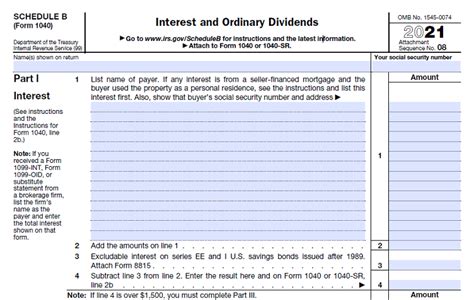

Understanding the Basics of Form 1040 Schedule B

Before we dive into the tips, let's take a brief look at the basics of Form 1040 Schedule B. The form is divided into two main sections: Part I, which reports interest income, and Part II, which reports dividend income. The form also includes a section for reporting foreign accounts and trusts.

Tip 1: Gather All Relevant Documents

Before starting to fill out Form 1040 Schedule B, make sure you have all the necessary documents, including:

- 1099-INT forms for interest income

- 1099-DIV forms for dividend income

- Statements from banks and brokerages

- Records of investments and interest-bearing accounts

Having all the necessary documents will help you accurately report your interest and dividend income.

Reporting Interest Income on Form 1040 Schedule B

Reporting interest income on Form 1040 Schedule B requires attention to detail and accuracy. Here are some tips to help you report interest income correctly:

Tip 2: Report All Interest Income

Make sure to report all interest income from various sources, including:

- Banks and credit unions

- Brokerages and investments

- Bonds and treasury bills

- Interest-bearing accounts

Tip 3: Use the Correct Column

When reporting interest income, use the correct column on Form 1040 Schedule B. Column (a) is for the payer's name, column (b) is for the payer's identification number, and column (c) is for the interest income amount.

Tip 4: Report Interest Income from Foreign Sources

If you have interest income from foreign sources, report it on Form 1040 Schedule B, Part I. You will also need to complete Form 8938, Statement of Specified Foreign Financial Assets.

Reporting Dividend Income on Form 1040 Schedule B

Reporting dividend income on Form 1040 Schedule B requires attention to detail and accuracy. Here are some tips to help you report dividend income correctly:

Tip 5: Report All Dividend Income

Make sure to report all dividend income from various sources, including:

- Stocks and mutual funds

- Real estate investment trusts (REITs)

- Master limited partnerships (MLPs)

Tip 6: Use the Correct Column

When reporting dividend income, use the correct column on Form 1040 Schedule B. Column (a) is for the payer's name, column (b) is for the payer's identification number, and column (c) is for the dividend income amount.

Tip 7: Report Dividend Income from Foreign Sources

If you have dividend income from foreign sources, report it on Form 1040 Schedule B, Part II. You will also need to complete Form 8938, Statement of Specified Foreign Financial Assets.

Additional Tips for Filling Out Form 1040 Schedule B

Here are some additional tips to help you fill out Form 1040 Schedule B accurately and efficiently:

Tip 8: Use the Correct Filing Status

Make sure to use the correct filing status on Form 1040 Schedule B. If you are married filing jointly, use the joint filing status. If you are single or married filing separately, use the single filing status.

Tip 9: Report Foreign Accounts and Trusts

If you have foreign accounts or trusts, report them on Form 1040 Schedule B. You will also need to complete Form 8938, Statement of Specified Foreign Financial Assets.

Tip 10: Review and Verify Your Return

Before submitting your tax return, review and verify your Form 1040 Schedule B to ensure accuracy and completeness. Make sure to sign and date your return, and keep a copy for your records.

By following these tips, you can ensure that your Form 1040 Schedule B is accurate and complete. Remember to gather all relevant documents, report all interest and dividend income, and use the correct columns and filing status.

We hope this article has been helpful in providing you with essential tips for filling out Form 1040 Schedule B. If you have any questions or need further assistance, please don't hesitate to comment below.

What is Form 1040 Schedule B?

+Form 1040 Schedule B is a tax form used to report interest and dividend income.

What documents do I need to fill out Form 1040 Schedule B?

+You will need 1099-INT forms for interest income, 1099-DIV forms for dividend income, statements from banks and brokerages, and records of investments and interest-bearing accounts.

How do I report foreign accounts and trusts on Form 1040 Schedule B?

+You will need to complete Form 8938, Statement of Specified Foreign Financial Assets, and report foreign accounts and trusts on Form 1040 Schedule B.