Texas, being one of the largest states in the US, has a vast number of businesses operating within its borders. As a business owner in Texas, it's essential to understand the various forms and regulations that govern your operations. One such form is the Texas Comptroller Form 50-162, also known as the Dealers Refund Claim. In this article, we'll delve into the details of this form, its purpose, and how to navigate it.

The Texas Comptroller Form 50-162 is used by businesses to claim a refund for certain taxes paid on purchases made for resale or other exempt purposes. The form is designed to help businesses recover taxes paid in error or on items that are exempt from taxation.

Understanding the Purpose of Form 50-162

The primary purpose of Form 50-162 is to provide a mechanism for businesses to claim a refund for taxes paid on purchases that are not subject to taxation. This can include items purchased for resale, items used in the manufacturing process, or items exempt from taxation under Texas law.

Who Can Use Form 50-162?

Form 50-162 can be used by any business that has paid taxes on purchases that are eligible for a refund. This includes:

- Retailers who have paid taxes on items purchased for resale

- Manufacturers who have paid taxes on items used in the manufacturing process

- Businesses that have paid taxes on items exempt from taxation under Texas law

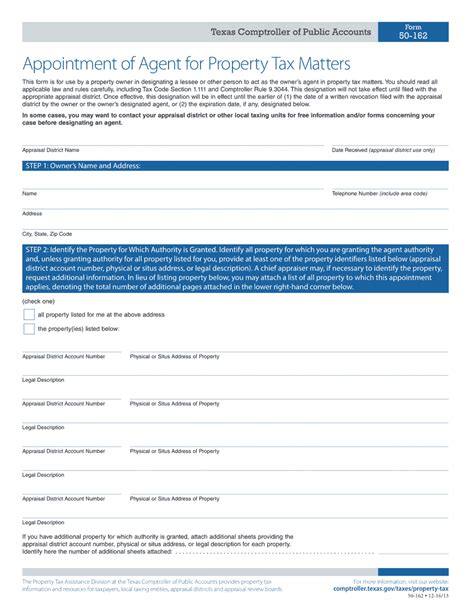

Step-by-Step Guide to Completing Form 50-162

Completing Form 50-162 requires careful attention to detail and a thorough understanding of the form's requirements. Here's a step-by-step guide to help you navigate the process:

- Gather required documents: Before starting the form, gather all required documents, including receipts, invoices, and proof of payment.

- Fill out the header section: The header section requires your business name, address, and taxpayer ID number.

- Complete the claim information section: This section requires you to provide details about the claim, including the date of purchase, amount of tax paid, and reason for the refund.

- List the purchases: List each purchase for which you are claiming a refund, including the date of purchase, amount of tax paid, and description of the item.

- Calculate the refund amount: Calculate the total refund amount due and enter it in the designated field.

- Sign and date the form: Sign and date the form to certify that the information provided is accurate and true.

Common Mistakes to Avoid When Completing Form 50-162

When completing Form 50-162, it's essential to avoid common mistakes that can delay or disqualify your refund claim. Here are some common mistakes to avoid:

- Incomplete or inaccurate information: Ensure that all information provided is complete and accurate.

- Missing documentation: Ensure that all required documentation is attached to the form.

- Incorrect calculation: Double-check your calculations to ensure accuracy.

- ** Unsigned or undated form**: Ensure that the form is signed and dated.

Tips for Ensuring a Smooth Refund Process

To ensure a smooth refund process, follow these tips:

- Keep accurate records: Keep accurate records of all purchases and tax payments.

- File claims promptly: File claims promptly to avoid missing the deadline.

- Ensure accuracy: Ensure that all information provided is accurate and complete.

- Seek professional help: If you're unsure about any aspect of the form, seek professional help.

Conclusion

In conclusion, the Texas Comptroller Form 50-162 is an essential tool for businesses in Texas to claim a refund for taxes paid on purchases that are not subject to taxation. By following the step-by-step guide and avoiding common mistakes, you can ensure a smooth refund process. Remember to keep accurate records, file claims promptly, and seek professional help if needed.

We hope this article has provided valuable insights into the Texas Comptroller Form 50-162. If you have any questions or comments, please feel free to share them below.

What is the purpose of Form 50-162?

+Form 50-162 is used to claim a refund for taxes paid on purchases that are not subject to taxation.

Who can use Form 50-162?

+Form 50-162 can be used by any business that has paid taxes on purchases that are eligible for a refund.

What are the common mistakes to avoid when completing Form 50-162?

+Common mistakes to avoid include incomplete or inaccurate information, missing documentation, incorrect calculation, and unsigned or undated form.