Farmers and agricultural businesses play a crucial role in the economy, and it's essential to understand the tax implications of their operations. When it comes to reporting farm income and expenses, two forms are commonly used: Form 4835 and Schedule F. While both forms are used to report farm income, there are key differences between them. In this article, we'll delve into the differences between Form 4835 and Schedule F, helping farmers and agricultural businesses navigate the complexities of tax reporting.

What is Form 4835?

Form 4835, also known as the Farm Rental Income and Expenses form, is used to report rental income and expenses from farmland. This form is typically used by individuals who rent out their farmland to other farmers or agricultural businesses. Form 4835 is used to calculate the net rental income from farmland, which is then reported on the taxpayer's personal tax return.

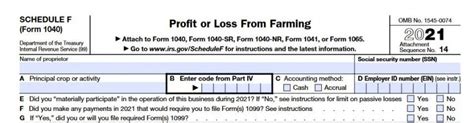

What is Schedule F?

Schedule F, also known as the Farm Income and Expenses schedule, is used to report farm income and expenses from farming operations. This schedule is used by farmers and agricultural businesses to report their farm income, including sales of crops and livestock, as well as expenses related to farming operations. Schedule F is used to calculate the net farm profit or loss, which is then reported on the taxpayer's personal tax return.

Key Differences Between Form 4835 and Schedule F

While both forms are used to report farm income, there are key differences between Form 4835 and Schedule F.

1. Purpose of the Forms

The primary purpose of Form 4835 is to report rental income and expenses from farmland, while the primary purpose of Schedule F is to report farm income and expenses from farming operations.

2. Types of Income Reported

Form 4835 is used to report rental income from farmland, while Schedule F is used to report farm income from sales of crops and livestock, as well as other farming operations.

3. Types of Expenses Reported

Form 4835 is used to report expenses related to renting out farmland, such as property taxes and insurance, while Schedule F is used to report expenses related to farming operations, such as seed, fertilizer, and equipment expenses.

4. Calculation of Net Income

Form 4835 is used to calculate the net rental income from farmland, while Schedule F is used to calculate the net farm profit or loss from farming operations.

5. Reporting Requirements

Form 4835 is typically used by individuals who rent out their farmland, while Schedule F is used by farmers and agricultural businesses who operate farming operations.

Benefits of Using Form 4835

Using Form 4835 to report rental income and expenses from farmland can provide several benefits, including:

- Simplified tax reporting: Form 4835 provides a simplified way to report rental income and expenses from farmland.

- Reduced tax liability: By reporting rental income and expenses on Form 4835, taxpayers may be able to reduce their tax liability.

- Improved accuracy: Form 4835 helps to ensure accuracy in reporting rental income and expenses from farmland.

Benefits of Using Schedule F

Using Schedule F to report farm income and expenses from farming operations can provide several benefits, including:

- Comprehensive tax reporting: Schedule F provides a comprehensive way to report farm income and expenses from farming operations.

- Reduced tax liability: By reporting farm income and expenses on Schedule F, taxpayers may be able to reduce their tax liability.

- Improved accuracy: Schedule F helps to ensure accuracy in reporting farm income and expenses from farming operations.

Common Mistakes to Avoid

When using Form 4835 and Schedule F, there are several common mistakes to avoid, including:

- Incorrect reporting of rental income and expenses on Form 4835.

- Failure to report all farm income and expenses on Schedule F.

- Inaccurate calculation of net rental income or net farm profit or loss.

- Failure to keep accurate records of rental income and expenses or farm income and expenses.

Best Practices for Using Form 4835 and Schedule F

To get the most out of using Form 4835 and Schedule F, follow these best practices:

- Keep accurate records of rental income and expenses or farm income and expenses.

- Use Form 4835 to report rental income and expenses from farmland.

- Use Schedule F to report farm income and expenses from farming operations.

- Consult with a tax professional to ensure accurate reporting and calculation of net rental income or net farm profit or loss.

Conclusion

In conclusion, Form 4835 and Schedule F are two important forms used to report farm income and expenses. While both forms are used to report farm income, there are key differences between them. By understanding the differences between Form 4835 and Schedule F, farmers and agricultural businesses can ensure accurate reporting and calculation of net rental income or net farm profit or loss. By following best practices and avoiding common mistakes, taxpayers can get the most out of using Form 4835 and Schedule F.

We encourage you to share your thoughts and experiences with using Form 4835 and Schedule F in the comments below. If you have any questions or need further clarification on any of the topics discussed in this article, please don't hesitate to ask.

What is the purpose of Form 4835?

+Form 4835 is used to report rental income and expenses from farmland.

What is the purpose of Schedule F?

+Schedule F is used to report farm income and expenses from farming operations.

What are the key differences between Form 4835 and Schedule F?

+The key differences between Form 4835 and Schedule F include the purpose of the forms, types of income reported, types of expenses reported, calculation of net income, and reporting requirements.