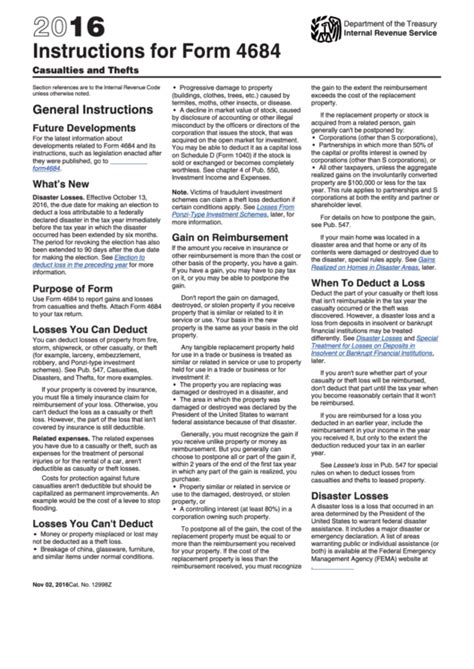

The Form 4684, also known as the Casualties and Thefts form, is a crucial document for individuals and businesses to claim deductions for losses due to casualties and thefts. The IRS provides this form to help taxpayers report and claim these losses, which can significantly impact their tax liabilities. In this comprehensive guide, we will walk you through the step-by-step process of filling out Form 4684, ensuring you maximize your deductions and minimize your tax burden.

Understanding Form 4684: Purpose and Eligibility

Form 4684 is designed for individuals and businesses to report losses due to casualties and thefts. A casualty loss is damage to or destruction of property due to a sudden, unexpected, or unusual event, such as a natural disaster, fire, or accident. A theft loss, on the other hand, occurs when property is stolen, embezzled, or lost due to a fraudulent scheme.

To be eligible to claim deductions on Form 4684, you must have experienced a loss due to a casualty or theft, and the loss must not be reimbursed by insurance or other means. Additionally, the loss must be directly related to your business or investment activities.

Types of Losses Reported on Form 4684

There are two main types of losses reported on Form 4684:

- Casualty losses: Damage to or destruction of property due to a sudden, unexpected, or unusual event.

- Theft losses: Loss of property due to theft, embezzlement, or a fraudulent scheme.

Step 1: Gather Required Information and Documents

Before starting the Form 4684, gather all necessary information and documents, including:

- A detailed description of the loss, including the date, time, and location of the event.

- Proof of ownership or interest in the lost property.

- Records of the fair market value of the property before and after the loss.

- Insurance policies and claims, if applicable.

- Police reports or other documentation related to the loss.

Calculating the Loss

To calculate the loss, you will need to determine the fair market value of the property before and after the loss. You can use the following methods to determine the fair market value:

- Appraisal by a qualified expert.

- Sales of similar properties in the same area.

- The property's original purchase price or cost basis.

Step 2: Complete Form 4684 Sections 1-4

Form 4684 is divided into four sections. Here's a brief overview of each section:

- Section 1: Casualty Losses: Report all casualty losses, including the date, time, and location of the event, as well as the fair market value of the property before and after the loss.

- Section 2: Theft Losses: Report all theft losses, including the date, time, and location of the event, as well as the fair market value of the property before and after the loss.

- Section 3: Reduction in Loss: If you received any insurance reimbursements or other compensation for the loss, report the amount in this section.

- Section 4: Deduction for Loss: Calculate the total deduction for the loss by subtracting the reduction in loss from the total loss.

Step 3: Complete Form 4684 Section 5-6

- Section 5: Net Operating Loss (NOL): If the loss is related to a business or investment activity, you may be able to claim a net operating loss (NOL). Complete this section to calculate the NOL.

- Section 6: Carryback and Carryforward: If you have a net operating loss, you may be able to carry it back or forward to other tax years. Complete this section to calculate the carryback and carryforward.

Step 4: Attach Supporting Documents and Submit Form 4684

Attach all supporting documents, including proof of ownership, insurance policies, and police reports, to Form 4684. Submit the form with your tax return (Form 1040 or Form 1120) to the IRS.

What to Expect After Submitting Form 4684

After submitting Form 4684, the IRS will review your claim and may request additional information or documentation. If your claim is approved, you will receive a refund or a reduction in your tax liability.

Conclusion

Filling out Form 4684 can be a complex and time-consuming process, but with the right guidance, you can ensure you receive the maximum deduction for your losses. By following these steps and gathering all necessary information and documents, you can successfully complete Form 4684 and minimize your tax burden.

We hope this guide has been helpful in understanding Form 4684 and the process of claiming deductions for casualties and thefts. If you have any further questions or concerns, please don't hesitate to comment below.

Take Action Today

Don't wait until it's too late. Start gathering your information and documents today, and complete Form 4684 to claim your deductions. Remember to attach all supporting documents and submit the form with your tax return.

Share Your Thoughts

Have you experienced a casualty or theft loss? Share your story and tips for completing Form 4684 in the comments below.

Frequently Asked Questions

What is Form 4684 used for?

+Form 4684 is used to report casualties and thefts, and to claim deductions for losses due to these events.

What types of losses can be reported on Form 4684?

+Casualty losses, such as damage to or destruction of property due to a sudden, unexpected, or unusual event, and theft losses, such as loss of property due to theft, embezzlement, or a fraudulent scheme.

What documentation is required to support a claim on Form 4684?

+Proof of ownership, insurance policies, police reports, and records of the fair market value of the property before and after the loss.