The quit claim deed form Iowa is a popular tool for individuals looking to transfer ownership of real estate in the Hawkeye State. Whether you're a seasoned property owner or a first-time buyer, understanding the uses and benefits of this form can help you navigate the complexities of Iowa real estate law. In this article, we'll explore five ways to use the quit claim deed form Iowa and provide practical tips to ensure a smooth transfer process.

What is a Quit Claim Deed Form Iowa?

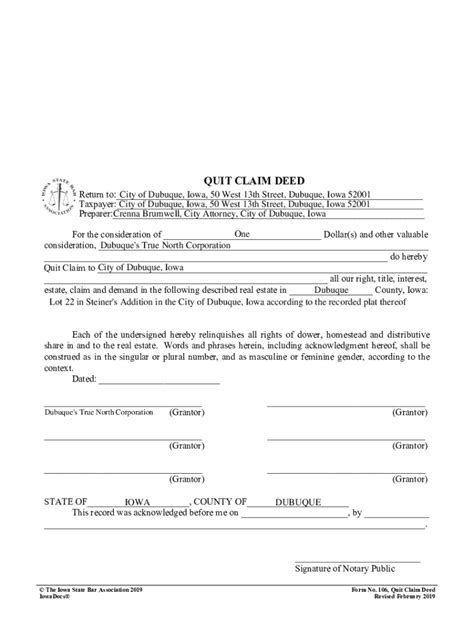

Before diving into the uses of the quit claim deed form Iowa, it's essential to understand what this document is and how it works. A quit claim deed is a type of deed that transfers the grantor's (seller's) interest in a property to the grantee (buyer). Unlike other types of deeds, a quit claim deed does not guarantee that the grantor has clear title to the property. Instead, it simply transfers whatever interest the grantor has at the time of the transfer.

Benefits of Using a Quit Claim Deed Form Iowa

So, why would you want to use a quit claim deed form Iowa? Here are a few benefits:

- Easy to use: Quit claim deeds are relatively simple documents that can be completed quickly and easily.

- Fast transfer: Quit claim deeds can be used to transfer ownership of a property quickly, often in a matter of days.

- Cost-effective: Quit claim deeds are generally less expensive than other types of deeds, making them a cost-effective option for property transfers.

1. Transferring Property Between Family Members

One common use for the quit claim deed form Iowa is to transfer property between family members. For example, if you want to transfer ownership of a family home to your child or spouse, a quit claim deed can be a convenient and cost-effective option. This type of transfer is often used to avoid probate or to simplify the transfer process.

Example:

John wants to transfer ownership of his family home to his son, Michael. John can complete a quit claim deed form Iowa, naming Michael as the grantee, and file it with the county recorder's office. This will transfer ownership of the property to Michael, subject to any outstanding liens or encumbrances.

2. Divorce and Property Settlement

Quit claim deeds are also commonly used in divorce and property settlement situations. When a couple gets divorced, they may need to divide their marital property, including real estate. A quit claim deed can be used to transfer ownership of a property from one spouse to the other as part of the divorce settlement.

Example:

In a divorce settlement, Sarah agrees to transfer ownership of the family home to her ex-husband, Tom. Sarah can complete a quit claim deed form Iowa, naming Tom as the grantee, and file it with the county recorder's office. This will transfer ownership of the property to Tom, subject to any outstanding liens or encumbrances.

3. Gift Deeds

Quit claim deeds can also be used to make gifts of real estate. For example, if you want to gift a property to a friend or family member, you can use a quit claim deed to transfer ownership.

Example:

Emily wants to gift her vacation home to her niece, Rachel. Emily can complete a quit claim deed form Iowa, naming Rachel as the grantee, and file it with the county recorder's office. This will transfer ownership of the property to Rachel, subject to any outstanding liens or encumbrances.

4. Inheritance and Estate Planning

Quit claim deeds can also be used in inheritance and estate planning situations. For example, if you want to transfer ownership of a property to a beneficiary after your death, you can use a quit claim deed to make the transfer.

Example:

James wants to transfer ownership of his family farm to his daughter, Lisa, after his death. James can complete a quit claim deed form Iowa, naming Lisa as the grantee, and file it with the county recorder's office. This will transfer ownership of the property to Lisa, subject to any outstanding liens or encumbrances, after James' death.

5. Business and Investment Transactions

Finally, quit claim deeds can be used in business and investment transactions. For example, if you want to transfer ownership of a commercial property to a business partner or investor, you can use a quit claim deed to make the transfer.

Example:

Mark wants to transfer ownership of his commercial property to his business partner, Sarah. Mark can complete a quit claim deed form Iowa, naming Sarah as the grantee, and file it with the county recorder's office. This will transfer ownership of the property to Sarah, subject to any outstanding liens or encumbrances.

Conclusion: Take Control of Your Property Transfers

In conclusion, the quit claim deed form Iowa is a versatile tool that can be used in a variety of situations to transfer ownership of real estate. Whether you're transferring property between family members, settling a divorce, making a gift, or engaging in business or investment transactions, a quit claim deed can help you achieve your goals. By understanding the uses and benefits of this form, you can take control of your property transfers and ensure a smooth and efficient process.

What is the difference between a quit claim deed and a warranty deed?

+A quit claim deed transfers the grantor's interest in a property to the grantee, but does not guarantee clear title. A warranty deed, on the other hand, guarantees that the grantor has clear title to the property and will defend the grantee against any claims or liens.

Do I need an attorney to complete a quit claim deed form Iowa?

+No, you do not need an attorney to complete a quit claim deed form Iowa. However, it is recommended that you consult with an attorney to ensure that the transfer is done correctly and that your rights are protected.

Can I use a quit claim deed to transfer property to a minor?

+No, you cannot use a quit claim deed to transfer property to a minor. Minors are not legally competent to own property, and a quit claim deed would not be valid. Instead, you would need to use a different type of transfer, such as a guardianship or a trust.