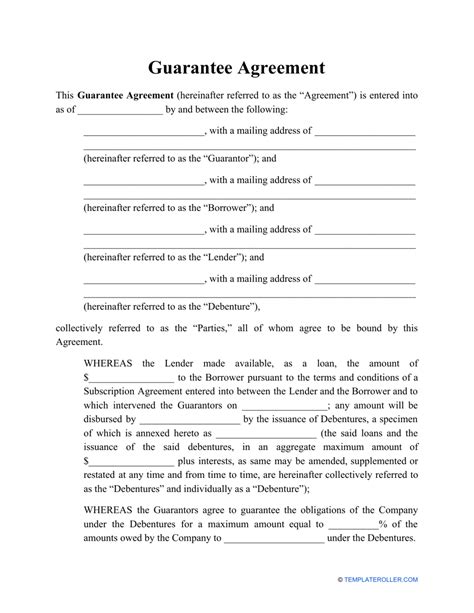

In today's complex business landscape, navigating the intricacies of financial agreements can be a daunting task. One such agreement that has garnered significant attention in recent years is the SLB Guarantee Agreement Form. For those unfamiliar, the SLB Guarantee Agreement Form is a crucial document that outlines the terms and conditions of a guarantee arrangement between a guarantor and a lender. In this article, we will delve into the world of SLB Guarantee Agreement Forms and break down the process of understanding them in 5 easy steps.

The importance of understanding SLB Guarantee Agreement Forms cannot be overstated. These agreements play a vital role in facilitating business transactions, and their implications can be far-reaching. By grasping the fundamental concepts and provisions outlined in these forms, individuals and organizations can make informed decisions, mitigate risks, and ensure compliance with regulatory requirements.

So, let's dive into the world of SLB Guarantee Agreement Forms and explore the 5 easy steps to understanding them.

Step 1: Define the Key Parties and Their Roles

At the heart of any SLB Guarantee Agreement Form are the key parties involved. These typically include the guarantor, the lender, and the borrower. Understanding the roles and responsibilities of each party is crucial in grasping the agreement's provisions.

- The guarantor is the individual or organization that provides the guarantee, essentially assuming the risk of the borrower's default.

- The lender is the party that provides the loan or credit facility to the borrower.

- The borrower is the party that receives the loan or credit facility and is responsible for repaying the debt.

Step 2: Understand the Guarantee Arrangement

Types of Guarantee Arrangements

SLB Guarantee Agreement Forms typically outline the specific guarantee arrangement between the guarantor and the lender. There are several types of guarantee arrangements, including:

- Unconditional Guarantee: The guarantor assumes full responsibility for the borrower's debt, with no conditions or limitations.

- Conditional Guarantee: The guarantor's liability is limited to specific conditions or circumstances.

- Limited Guarantee: The guarantor's liability is capped at a specific amount or percentage of the total debt.

Step 3: Identify the Key Provisions

Guarantee Period

The SLB Guarantee Agreement Form will typically specify the guarantee period, which outlines the duration of the guarantor's liability. This can be a fixed period or a revolving period, depending on the agreement.

- Fixed Guarantee Period: The guarantor's liability is limited to a specific period, after which the guarantee expires.

- Revolving Guarantee Period: The guarantor's liability is ongoing, with the guarantee renewing automatically unless terminated by either party.

Step 4: Review the Obligations and Liabilities

Guarantor's Obligations

The SLB Guarantee Agreement Form will outline the guarantor's obligations, including:

- Payment Obligations: The guarantor's responsibility to pay the borrower's debt in the event of default.

- Notification Obligations: The guarantor's responsibility to notify the lender of any changes or updates to the guarantee arrangement.

Step 5: Understand the Termination and Dispute Resolution Provisions

Termination Provisions

The SLB Guarantee Agreement Form will typically outline the termination provisions, including:

- Notice Period: The notice period required to terminate the guarantee arrangement.

- Termination Events: The events that trigger termination of the guarantee arrangement.

By following these 5 easy steps, individuals and organizations can gain a deeper understanding of the SLB Guarantee Agreement Form and its implications. Whether you're a seasoned business professional or just starting out, navigating the complexities of financial agreements can be daunting. However, by grasping the fundamental concepts and provisions outlined in these forms, you can make informed decisions, mitigate risks, and ensure compliance with regulatory requirements.

What is an SLB Guarantee Agreement Form?

+An SLB Guarantee Agreement Form is a document that outlines the terms and conditions of a guarantee arrangement between a guarantor and a lender.

Who are the key parties involved in an SLB Guarantee Agreement Form?

+The key parties involved in an SLB Guarantee Agreement Form include the guarantor, the lender, and the borrower.

What are the different types of guarantee arrangements?

+There are several types of guarantee arrangements, including unconditional guarantee, conditional guarantee, and limited guarantee.

We hope this article has provided valuable insights into the world of SLB Guarantee Agreement Forms. Whether you're a business owner, entrepreneur, or simply looking to expand your knowledge, understanding these forms is crucial in today's complex business landscape. Share your thoughts and comments below, and don't forget to share this article with your colleagues and friends!