Taxpayers who are struggling to pay their tax debts often face a daunting task when dealing with the Internal Revenue Service (IRS). One of the key documents used by the IRS to collect information about a taxpayer's financial situation is the Form 433-D, also known as the Collection Information Statement. In this article, we will explore the importance of the Form 433-D, its contents, and how to properly submit it to the IRS.

Understanding the Purpose of Form 433-D

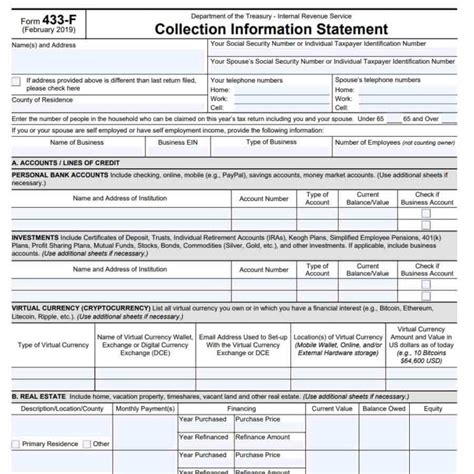

The Form 433-D is a critical document used by the IRS to assess a taxpayer's financial situation and determine their ability to pay their tax debt. The form is typically used when a taxpayer is facing financial hardship and is unable to pay their tax debt in full. By completing the Form 433-D, taxpayers provide the IRS with a comprehensive picture of their income, expenses, assets, and liabilities.

What Information is Required on Form 433-D?

The Form 433-D is a detailed document that requires taxpayers to provide a wide range of financial information. This includes:

- Personal and business income

- Monthly living expenses

- Assets, such as bank accounts, investments, and real estate

- Liabilities, such as credit card debt and loans

- Business expenses and income (if applicable)

How to Complete Form 433-D

To complete the Form 433-D, taxpayers should follow these steps:

- Gather all necessary financial documents, including pay stubs, bank statements, and tax returns.

- Complete the form accurately and thoroughly, making sure to include all required information.

- Attach supporting documentation, such as receipts and invoices, to the form.

- Review the form carefully to ensure accuracy and completeness.

Common Mistakes to Avoid When Completing Form 433-D

When completing the Form 433-D, taxpayers should be aware of common mistakes that can delay or even prevent the IRS from processing their request. These include:

- Failing to provide complete and accurate information

- Not attaching required supporting documentation

- Not signing and dating the form

- Not using the correct mailing address

Mailing Address for Form 433-D

Taxpayers should mail their completed Form 433-D to the following address:

Internal Revenue Service Centralized Insolvency Operation PO Box 7346 Philadelphia, PA 19101-7346

Alternatively, taxpayers can also fax their completed form to (855) 214-2223.

What to Expect After Submitting Form 433-D

After submitting the Form 433-D, taxpayers can expect the IRS to review their financial information and determine the best course of action for their tax debt. This may include:

- Approval of an installment agreement

- Approval of an offer in compromise

- Denial of the request

Taxpayers should receive a response from the IRS within 30-60 days after submitting the form.

Conclusion

In conclusion, the Form 433-D is a critical document used by the IRS to collect information about a taxpayer's financial situation. By providing complete and accurate information, taxpayers can increase their chances of receiving a favorable response from the IRS. It is essential to follow the instructions carefully and avoid common mistakes to ensure a smooth process.

We encourage our readers to share their experiences with the Form 433-D in the comments section below. If you have any questions or concerns, please don't hesitate to ask.

FAQ Section:

What is the purpose of the Form 433-D?

+The Form 433-D is used by the IRS to collect information about a taxpayer's financial situation and determine their ability to pay their tax debt.

How long does it take to process the Form 433-D?

+The IRS typically responds to the Form 433-D within 30-60 days after submission.

Can I fax the Form 433-D to the IRS?

+Yes, taxpayers can fax their completed Form 433-D to (855) 214-2223.