The Mississippi state tax form 89-350 is a required document for individuals and businesses to report their state income tax. Filling out this form accurately and efficiently is crucial to avoid any delays or penalties. In this article, we will guide you through the 5 steps to fill out MS state tax form 89-350.

Understanding the MS State Tax Form 89-350

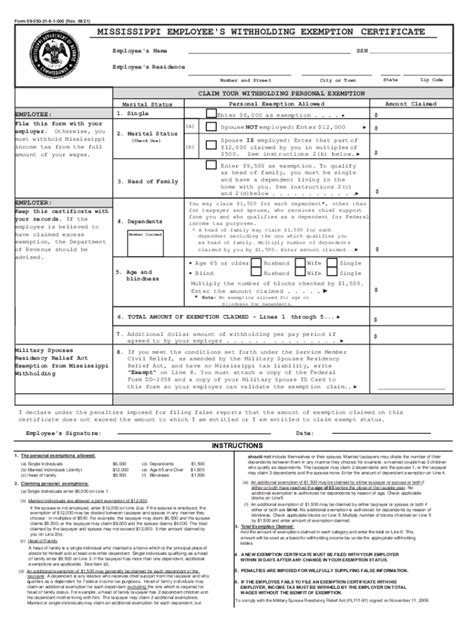

Before we dive into the steps, it's essential to understand the purpose of the MS state tax form 89-350. This form is used to report an individual's or business's state income tax liability. The form is divided into several sections, including personal information, income, deductions, credits, and tax calculations.

Who Needs to File the MS State Tax Form 89-350?

Not everyone needs to file the MS state tax form 89-350. However, if you are a resident of Mississippi or have income from Mississippi sources, you may need to file this form. This includes individuals, businesses, and organizations that have a tax liability in the state.

Step 1: Gather Required Documents and Information

Before you start filling out the MS state tax form 89-350, gather all the required documents and information. This includes:

- Your social security number or federal employer identification number (FEIN)

- Your Mississippi state tax identification number (if applicable)

- Your federal income tax return (Form 1040 or Form 1120)

- W-2 forms for all employment income

- 1099 forms for all self-employment income

- Any other relevant tax documents, such as receipts for charitable donations or medical expenses

What to Do If You're Missing Documents

If you're missing any required documents, don't worry. You can still file your tax return, but you may need to provide an explanation for the missing documents. You can also request an extension to file your tax return if you need more time to gather the necessary documents.

Step 2: Fill Out Personal Information and Income Sections

The first sections of the MS state tax form 89-350 require you to fill out your personal information and income. This includes:

- Your name and address

- Your social security number or FEIN

- Your marital status and number of dependents

- Your income from all sources, including employment, self-employment, and investments

What to Do If You Have Multiple Income Sources

If you have multiple income sources, you'll need to report each source separately on the MS state tax form 89-350. This may include income from multiple jobs, self-employment income, or income from investments.

Step 3: Calculate Deductions and Credits

The next step is to calculate your deductions and credits. This includes:

- Standard deduction or itemized deductions

- Charitable donations and medical expenses

- Credits for education expenses or child care

What to Do If You're Eligible for Multiple Credits

If you're eligible for multiple credits, you'll need to calculate each credit separately and claim the maximum amount allowed.

Step 4: Calculate Tax Liability and Payment

The final step is to calculate your tax liability and payment. This includes:

- Calculating your total tax liability based on your income and deductions

- Determining if you owe taxes or are due a refund

- Making a payment or claiming a refund

What to Do If You Owe Taxes

If you owe taxes, you can make a payment online, by phone, or by mail. You can also set up a payment plan if you're unable to pay the full amount.

Step 5: Review and Submit Your Tax Return

The final step is to review and submit your tax return. This includes:

- Reviewing your tax return for accuracy and completeness

- Signing and dating your tax return

- Submitting your tax return electronically or by mail

What to Do If You Need Help with Your Tax Return

If you need help with your tax return, you can contact the Mississippi Department of Revenue or seek the assistance of a tax professional.

What is the deadline for filing the MS state tax form 89-350?

+The deadline for filing the MS state tax form 89-350 is April 15th of each year.

Can I file my MS state tax form 89-350 electronically?

+Yes, you can file your MS state tax form 89-350 electronically through the Mississippi Department of Revenue website.

What if I need an extension to file my MS state tax form 89-350?

+You can request an extension to file your MS state tax form 89-350 by submitting Form 89-203, Application for Automatic Extension of Time to File Mississippi Individual Income Tax Return.

We hope this article has provided you with a comprehensive guide to filling out the MS state tax form 89-350. If you have any further questions or need additional assistance, please don't hesitate to comment below.