As a tax professional, you're likely no stranger to the complexities of tax forms. One of the most critical forms you'll encounter is Form 3922, also known as the Exercise of an Incentive Stock Option Under Section 422(b). Mastering this form is crucial to ensure accurate reporting and compliance with IRS regulations. In this article, we'll delve into the world of Form 3922 and explore five ways to master it in Lacerte.

The importance of accurate reporting cannot be overstated. Inaccurate or incomplete reporting can lead to penalties, fines, and even audits. Moreover, with the ever-changing tax landscape, it's essential to stay up-to-date on the latest regulations and requirements. By mastering Form 3922, you'll not only ensure compliance but also provide your clients with the highest level of service.

Understanding Form 3922

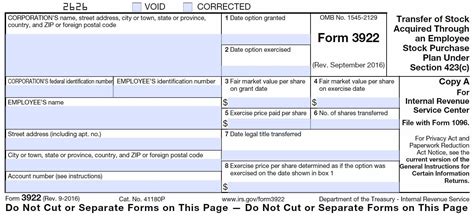

Before we dive into the five ways to master Form 3922, let's take a closer look at what this form entails. Form 3922 is used to report the exercise of an incentive stock option (ISO) under Section 422(b) of the Internal Revenue Code. This form is typically filed by the corporation that issued the ISO, and it's used to report the following information:

- The name, address, and employer identification number (EIN) of the corporation

- The name, address, and taxpayer identification number (TIN) of the employee who exercised the ISO

- The date the ISO was granted

- The date the ISO was exercised

- The number of shares acquired

- The fair market value of the shares acquired

- The exercise price per share

Why Mastering Form 3922 is Crucial

Mastering Form 3922 is essential for several reasons:

- Accurate reporting: By accurately completing Form 3922, you'll ensure compliance with IRS regulations and avoid potential penalties.

- Client satisfaction: Providing accurate and timely reporting is crucial for maintaining client satisfaction and building trust.

- Reduced audit risk: By mastering Form 3922, you'll reduce the risk of audits and minimize the potential for errors.

5 Ways to Master Form 3922 in Lacerte

Now that we've explored the importance of mastering Form 3922, let's dive into the five ways to do so in Lacerte:

1. Familiarize Yourself with Lacerte's Form 3922 Module

Lacerte's Form 3922 module is designed to simplify the reporting process. Take some time to familiarize yourself with the module's features and functionality. Understand how to navigate the module, enter data, and generate the form.

2. Understand the Reporting Requirements

To master Form 3922, you need to understand the reporting requirements. Familiarize yourself with the IRS regulations and guidelines for reporting ISO exercises. Understand what information needs to be reported, when it needs to be reported, and how it needs to be reported.

3. Use Lacerte's Built-in Tools and Resources

Lacerte offers a range of built-in tools and resources to help you master Form 3922. Take advantage of these resources, including:

- Lacerte's Form 3922 guide

- Lacerte's ISO reporting webinar

- Lacerte's customer support team

4. Practice, Practice, Practice

Practice makes perfect, and mastering Form 3922 is no exception. Take some time to practice completing the form using Lacerte's module. Practice entering data, generating the form, and reviewing the output.

5. Stay Up-to-Date on IRS Regulations and Lacerte Updates

Finally, it's essential to stay up-to-date on IRS regulations and Lacerte updates. Regularly check the IRS website for updates on Form 3922, and stay informed about Lacerte's latest software updates and releases.

By following these five ways to master Form 3922 in Lacerte, you'll be well on your way to becoming a Form 3922 expert. Remember to stay up-to-date on IRS regulations and Lacerte updates, and don't hesitate to reach out to Lacerte's customer support team if you have any questions or need further guidance.

Conclusion

Mastering Form 3922 is crucial for tax professionals who want to provide accurate and compliant reporting. By following the five ways outlined in this article, you'll be well on your way to becoming a Form 3922 expert. Remember to stay up-to-date on IRS regulations and Lacerte updates, and don't hesitate to reach out to Lacerte's customer support team if you have any questions or need further guidance.

We hope you found this article informative and helpful. If you have any questions or comments, please don't hesitate to reach out. Share your thoughts with us in the comments section below, and let's start a conversation about mastering Form 3922 in Lacerte.

What is Form 3922?

+Form 3922 is used to report the exercise of an incentive stock option (ISO) under Section 422(b) of the Internal Revenue Code.

Why is mastering Form 3922 important?

+Mastering Form 3922 is crucial for accurate reporting, client satisfaction, and reducing audit risk.

What are the reporting requirements for Form 3922?

+The reporting requirements for Form 3922 include the name, address, and employer identification number (EIN) of the corporation, the name, address, and taxpayer identification number (TIN) of the employee who exercised the ISO, and other relevant information.