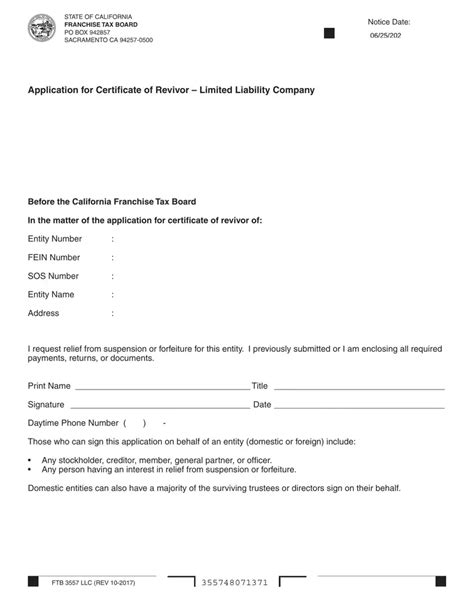

The Form 3557 LLC, also known as the Limited Liability Company Information Report, is a crucial document that provides essential information about a Limited Liability Company (LLC). In this article, we will delve into the details of Form 3557 LLC, its purpose, and its significance in the business world.

What is Form 3557 LLC?

Form 3557 LLC is a document filed with the Secretary of State's office in the United States, typically on an annual basis. The form provides updated information about the LLC, including its business address, management structure, and ownership details. The report helps maintain accurate records of the LLC's existence and operations.

Why is Form 3557 LLC Important?

The Form 3557 LLC is essential for several reasons:

- Compliance: Filing the Form 3557 LLC is a statutory requirement for LLCs in many states. Failure to file the report may result in penalties, fines, or even the dissolution of the LLC.

- Public Record: The Form 3557 LLC is a public record, providing transparency and allowing interested parties to access information about the LLC.

- Business Identity: The report helps establish and maintain the LLC's business identity, which is crucial for building credibility and trust with customers, vendors, and partners.

What Information is Required on Form 3557 LLC?

The Form 3557 LLC typically requires the following information:

- Business Name and Address: The LLC's name, business address, and mailing address.

- Management Structure: The LLC's management structure, including the names and addresses of managers or members.

- Ownership Details: The names and addresses of the LLC's owners (members).

- Registered Agent: The name and address of the LLC's registered agent.

- Business Purpose: A brief description of the LLC's business purpose.

How to File Form 3557 LLC?

Filing the Form 3557 LLC involves the following steps:

- Obtain the Form: Download the Form 3557 LLC from the Secretary of State's website or obtain a copy from the LLC's registered agent.

- Complete the Form: Fill out the form accurately and completely, ensuring all required information is provided.

- Sign the Form: Sign the form as required, typically by the LLC's manager or member.

- File the Form: Submit the completed form to the Secretary of State's office, along with the required filing fee.

Benefits of Filing Form 3557 LLC

Filing the Form 3557 LLC offers several benefits, including:

- Maintaining Compliance: Filing the report helps the LLC maintain compliance with state regulations.

- Updating Records: The report ensures the LLC's records are up-to-date and accurate.

- Establishing Credibility: Filing the report demonstrates the LLC's commitment to transparency and accountability.

Consequences of Not Filing Form 3557 LLC

Failure to file the Form 3557 LLC can result in:

- Penalties and Fines: The LLC may be subject to penalties and fines for non-compliance.

- Dissolution: In extreme cases, the LLC may be dissolved for failure to file the report.

- Loss of Credibility: Non-compliance can damage the LLC's reputation and credibility.

Conclusion

In conclusion, the Form 3557 LLC is a critical document that provides essential information about a Limited Liability Company. Filing the report is a statutory requirement, and failure to do so can result in penalties and fines. By understanding the purpose and significance of Form 3557 LLC, business owners can ensure compliance and maintain the integrity of their LLC.

We hope this article has provided valuable insights into the world of Form 3557 LLC. If you have any questions or comments, please feel free to share them below.

What is the purpose of Form 3557 LLC?

+The purpose of Form 3557 LLC is to provide updated information about a Limited Liability Company (LLC), including its business address, management structure, and ownership details.

What information is required on Form 3557 LLC?

+The Form 3557 LLC typically requires information such as the LLC's business name and address, management structure, ownership details, registered agent, and business purpose.

What are the consequences of not filing Form 3557 LLC?

+Failure to file the Form 3557 LLC can result in penalties and fines, dissolution of the LLC, and damage to the LLC's reputation and credibility.