Understanding the Importance of IRA Transfers

When it comes to managing your Individual Retirement Account (IRA), one of the most critical decisions you'll make is transferring your funds to a new account. This process can be daunting, especially if you're new to the world of IRAs. That's why we've put together this comprehensive guide on the Discover Bank IRA transfer form. In this article, we'll walk you through the process step-by-step, ensuring you're equipped with the knowledge you need to make informed decisions about your retirement savings.

Transferring your IRA funds can be a smart move for several reasons. Perhaps you're looking for better investment options, lower fees, or more comprehensive customer support. Whatever your reason, it's essential to understand the process and requirements involved in transferring your IRA. In this article, we'll cover everything you need to know, from the benefits of IRA transfers to the necessary forms and steps involved.

Benefits of IRA Transfers

Before we dive into the Discover Bank IRA transfer form, let's take a look at the benefits of transferring your IRA funds. Here are some of the most significant advantages:

• Better Investment Options: By transferring your IRA, you may gain access to a wider range of investment options, including stocks, bonds, mutual funds, and more. • Lower Fees: You may be able to reduce your fees by transferring your IRA to a new account with lower maintenance costs. • Improved Customer Support: If you're unhappy with your current IRA provider's customer support, transferring your account can provide you with better service and support. • Consolidation: If you have multiple IRA accounts, transferring your funds to a single account can help you consolidate your retirement savings and simplify your financial management.

Understanding the Discover Bank IRA Transfer Form

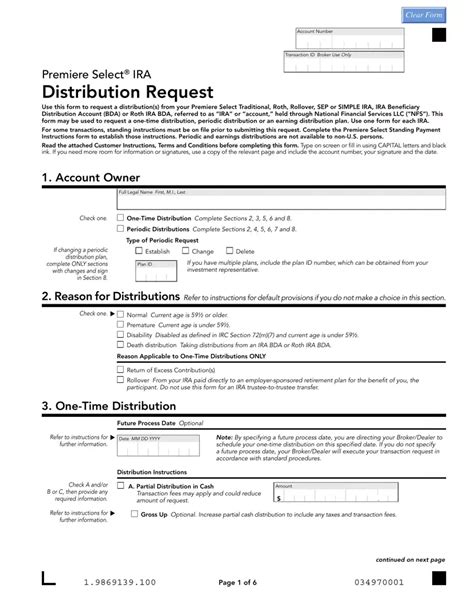

The Discover Bank IRA transfer form is a critical document required to initiate the transfer process. Here's what you need to know:

- Form Purpose: The Discover Bank IRA transfer form is used to transfer your IRA funds from your current account to a new account at Discover Bank.

- Form Requirements: You'll need to provide personal and account information, including your name, address, social security number, and account details.

- Form Submission: Once you've completed the form, you'll need to submit it to Discover Bank, either online, by mail, or by fax.

Step-by-Step Guide to Completing the Discover Bank IRA Transfer Form

To help you navigate the process, we've put together a step-by-step guide to completing the Discover Bank IRA transfer form:

- Gather Required Documents: Before you start, ensure you have all the necessary documents, including your current IRA account information and identification.

- Download and Complete the Form: Download the Discover Bank IRA transfer form from the bank's website or obtain a copy by mail. Complete the form carefully, ensuring all information is accurate and complete.

- Submit the Form: Once you've completed the form, submit it to Discover Bank, either online, by mail, or by fax.

- Verify Your Identity: Discover Bank may require you to verify your identity before processing the transfer. This may involve providing additional documentation or information.

- Wait for Processing: Once your form is received, Discover Bank will process the transfer, which may take several days or weeks.

Common Mistakes to Avoid When Transferring Your IRA

When transferring your IRA, it's essential to avoid common mistakes that can delay or complicate the process. Here are some mistakes to watch out for:

- Inaccurate or Incomplete Information: Ensure all information on the transfer form is accurate and complete to avoid delays or rejections.

- Insufficient Funds: Verify that you have sufficient funds in your current IRA account to cover the transfer amount.

- Failure to Verify Identity: Ensure you provide all required documentation and information to verify your identity and avoid delays.

Conclusion and Next Steps

Transferring your IRA funds can be a smart move, but it's essential to understand the process and requirements involved. By following this step-by-step guide and avoiding common mistakes, you can ensure a smooth and successful transfer. If you have any questions or concerns, don't hesitate to reach out to Discover Bank's customer support team for assistance.

We hope this comprehensive guide has provided you with the knowledge and confidence to take control of your IRA funds. Remember to stay informed, plan carefully, and make informed decisions about your retirement savings.

Call to Action: If you have any questions or comments about the Discover Bank IRA transfer form, please share them with us in the comments section below. We'd love to hear from you and help you navigate the process.

What is the purpose of the Discover Bank IRA transfer form?

+The Discover Bank IRA transfer form is used to transfer your IRA funds from your current account to a new account at Discover Bank.

What information is required on the Discover Bank IRA transfer form?

+You'll need to provide personal and account information, including your name, address, social security number, and account details.

How long does it take to process an IRA transfer?

+The processing time may vary, but it typically takes several days or weeks for the transfer to be completed.