The world of tax compliance can be complex and overwhelming, especially for businesses and individuals dealing with the nuances of employment taxes. One crucial aspect of this process is Form 3554, also known as the Base Year Form. This document plays a significant role in determining the base year used for calculating employment tax credits. In this article, we will delve into the key facts about Form 3554 and its significance in the tax compliance landscape.

Understanding Form 3554: Base Year Fundamentals

To grasp the concept of Form 3554, it is essential to understand what the base year represents. The base year is the period used as a reference point for calculating employment tax credits, such as the Federal Unemployment Tax Act (FUTA) credit. This calculation is critical, as it determines the amount of credit an employer can claim against their FUTA tax liability.

What is Form 3554 Used For?

Form 3554 is used to report the base year wages and employment tax liability for a specific period. This information is crucial for determining the FUTA credit, which can significantly impact an employer's tax liability. The form requires employers to provide detailed information about their employment tax obligations, including wages paid, taxes withheld, and taxes deposited.

Key Facts About Form 3554

Now that we have a basic understanding of Form 3554, let's dive into the five key facts about this essential document:

1. Who Needs to File Form 3554?

Form 3554 is required for employers who have employees subject to FUTA tax. This includes most private-sector employers, as well as some government entities and non-profit organizations. If an employer has paid wages subject to FUTA tax, they must file Form 3554 to report their base year information.

2. When is Form 3554 Due?

The due date for Form 3554 varies depending on the employer's tax year. Generally, the form is due on the last day of the first quarter following the end of the tax year. For example, if an employer's tax year ends on December 31, the Form 3554 would be due on March 31 of the following year.

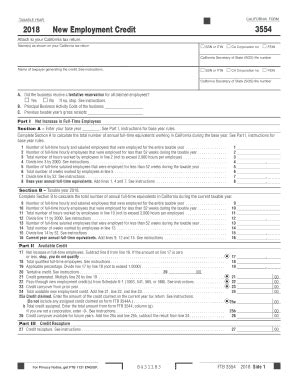

3. What Information is Required on Form 3554?

Form 3554 requires employers to provide detailed information about their employment tax obligations, including:

- Wages paid during the base year

- Taxes withheld from employee wages

- Taxes deposited with the IRS

- FUTA tax liability for the base year

Employers must also report any adjustments or amendments made to their employment tax returns.

4. How Does Form 3554 Impact FUTA Credit?

The information reported on Form 3554 is used to calculate the FUTA credit, which can significantly impact an employer's tax liability. The FUTA credit is calculated based on the employer's FUTA tax liability and the state unemployment tax rate. By accurately reporting base year information on Form 3554, employers can ensure they receive the correct FUTA credit.

5. Consequences of Failing to File Form 3554

Failure to file Form 3554 can result in significant penalties and fines. Employers who fail to file the form or provide inaccurate information may be subject to:

- Late filing penalties

- Accuracy-related penalties

- Interest on unpaid taxes

It is essential for employers to prioritize the timely and accurate filing of Form 3554 to avoid these consequences.

Best Practices for Filing Form 3554

To ensure a smooth and accurate filing process, employers should follow these best practices:

- Maintain accurate and detailed records of employment tax obligations

- Verify the accuracy of Form 3554 before submission

- File Form 3554 on time to avoid penalties and fines

- Seek professional assistance if unsure about the filing process

By following these best practices, employers can ensure compliance with Form 3554 requirements and avoid any potential issues.

Conclusion: The Importance of Form 3554 in Tax Compliance

In conclusion, Form 3554 plays a vital role in determining the base year used for calculating employment tax credits. Employers must prioritize the accurate and timely filing of this form to ensure compliance with tax regulations and avoid any potential penalties. By understanding the key facts about Form 3554 and following best practices, employers can navigate the complex world of tax compliance with confidence.

We hope this article has provided valuable insights into the world of Form 3554. If you have any questions or comments, please feel free to share them below. Share this article with your colleagues and friends to help them understand the importance of Form 3554 in tax compliance.

What is the purpose of Form 3554?

+Form 3554 is used to report the base year wages and employment tax liability for a specific period. This information is crucial for determining the FUTA credit, which can significantly impact an employer's tax liability.

Who needs to file Form 3554?

+Form 3554 is required for employers who have employees subject to FUTA tax. This includes most private-sector employers, as well as some government entities and non-profit organizations.

What are the consequences of failing to file Form 3554?

+Failure to file Form 3554 can result in significant penalties and fines, including late filing penalties, accuracy-related penalties, and interest on unpaid taxes.