If you're a homeowner who has moved due to a job change or other qualifying circumstances, you may be eligible for tax deductions related to your moving expenses. One of the key forms you'll need to complete is Form 3903, also known as the Moving Expenses form. In this article, we'll delve into six essential facts about Form 3903 IRS, including its purpose, eligibility requirements, and how to claim your moving expenses.

What is Form 3903, and Why Do I Need It?

Understanding Form 3903 and Its Purpose

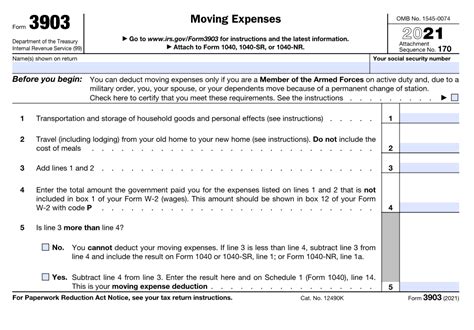

Form 3903 is an Internal Revenue Service (IRS) form used to calculate and claim moving expenses related to a job change, business relocation, or other qualifying circumstances. The form helps you determine the amount of moving expenses you can deduct from your taxable income. By completing Form 3903, you can reduce your tax liability and receive a larger refund.

Who is Eligible to Claim Moving Expenses on Form 3903?

Eligibility Requirements for Claiming Moving Expenses

To claim moving expenses on Form 3903, you must meet certain eligibility requirements. These include:

- Your move must be related to a job change, business relocation, or other qualifying circumstances, such as a change in your spouse's job or a change in your family's home.

- Your new home must be at least 50 miles farther from your old home than your old home was from your previous job location.

- You must work full-time for at least 39 weeks during the first 12 months after your move.

- You can only claim moving expenses for yourself and your dependents.

What Moving Expenses Can I Claim on Form 3903?

Qualified Moving Expenses for Tax Deduction

You can claim various moving expenses on Form 3903, including:

- Transportation costs, such as fuel, tolls, and parking fees, related to moving your household goods and personal effects.

- Storage costs for your household goods and personal effects.

- Travel expenses, such as lodging and food, for yourself and your family while moving.

- Costs related to disconnecting and reconnecting utilities at your old and new homes.

- Costs related to changing your address on documents, such as driver's licenses and vehicle registrations.

How Do I Complete Form 3903?

Step-by-Step Guide to Completing Form 3903

To complete Form 3903, follow these steps:

- Gather all relevant moving expense documents, including receipts, invoices, and bank statements.

- Complete Part I of the form, which requires your name, address, and social security number.

- Complete Part II of the form, which requires information about your moving expenses, including transportation costs, storage costs, and travel expenses.

- Calculate your total moving expenses and enter the amount on Line 22 of the form.

- Complete Part III of the form, which requires information about your business use of your moving expenses, if applicable.

- Sign and date the form, and attach it to your tax return.

Can I E-File Form 3903?

E-Filing Form 3903 with Your Tax Return

Yes, you can e-file Form 3903 with your tax return. In fact, the IRS encourages e-filing as it reduces errors and speeds up processing times. You can use tax preparation software, such as TurboTax or H&R Block, to e-file your tax return and Form 3903.

What Are the Deadlines for Filing Form 3903?

Deadlines for Filing Form 3903 and Claiming Moving Expenses

The deadlines for filing Form 3903 are the same as the deadlines for filing your tax return. For individual taxpayers, the deadline is typically April 15th of each year. However, if you need more time to complete your tax return and Form 3903, you can file for an extension by submitting Form 4868 by the original deadline.

If you have any questions or concerns about Form 3903 or claiming moving expenses, we encourage you to comment below. Additionally, if you found this article helpful, please share it with others who may be in a similar situation.

What is the purpose of Form 3903?

+Form 3903 is used to calculate and claim moving expenses related to a job change, business relocation, or other qualifying circumstances.

Who is eligible to claim moving expenses on Form 3903?

+To claim moving expenses on Form 3903, you must meet certain eligibility requirements, including a job change, business relocation, or other qualifying circumstances, and your new home must be at least 50 miles farther from your old home than your old home was from your previous job location.

What moving expenses can I claim on Form 3903?

+You can claim various moving expenses on Form 3903, including transportation costs, storage costs, travel expenses, and costs related to disconnecting and reconnecting utilities.