As an employer in the state of Michigan, it's essential to understand the process of registering for unemployment taxes. This registration is mandatory for most employers, and failure to comply can result in penalties and fines. In this comprehensive guide, we will walk you through the process of registering for unemployment taxes using Michigan Form 3372.

Michigan's unemployment tax registration process is designed to ensure that employers contribute to the state's unemployment insurance fund, which provides financial assistance to workers who lose their jobs through no fault of their own. As an employer, you play a critical role in supporting this system, and registering for unemployment taxes is the first step.

Who Needs to Register for Unemployment Taxes in Michigan?

In Michigan, most employers are required to register for unemployment taxes. This includes:

- Employers who have paid wages of $1,000 or more in a calendar quarter

- Employers who have employed one or more workers for some portion of a day in 20 or more different weeks in a calendar year

- Employers who are required to pay federal unemployment taxes under the Federal Unemployment Tax Act (FUTA)

Additionally, some employers may be required to register for unemployment taxes even if they don't meet the above criteria. These include:

- Non-profit organizations with four or more employees

- Government agencies

- Indian tribes and their subsidiaries

What Information Do I Need to Register for Unemployment Taxes?

To register for unemployment taxes in Michigan, you'll need to provide the following information:

- Business name and address

- Federal Employer Identification Number (FEIN)

- Type of business (sole proprietorship, partnership, corporation, etc.)

- Date of hire for the first employee

- Number of employees

- Wages paid in the most recent calendar quarter

You'll also need to provide information about your business's ownership structure, including the names and addresses of all owners and officers.

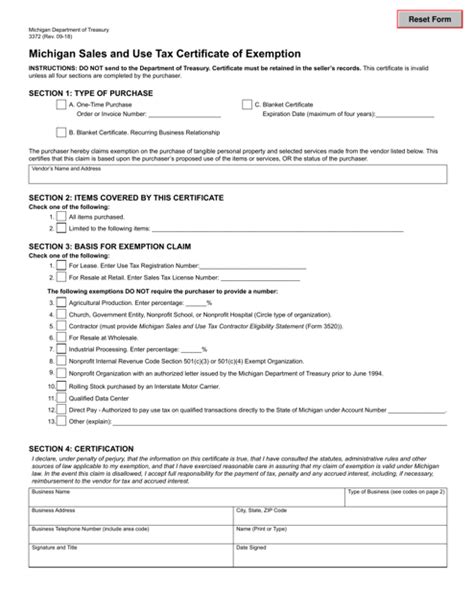

Filling Out Michigan Form 3372

Michigan Form 3372 is the official form used to register for unemployment taxes in the state. The form is divided into several sections, each requiring specific information about your business. Here's a breakdown of what you'll need to provide:

- Section 1: Business Information

- Business name and address

- FEIN

- Type of business

- Date of hire for the first employee

- Section 2: Ownership Information

- Names and addresses of all owners and officers

- Percentage of ownership for each owner

- Section 3: Employee Information

- Number of employees

- Wages paid in the most recent calendar quarter

- Section 4: Certification

- Signature of the business owner or authorized representative

How to File Michigan Form 3372

Once you've completed Michigan Form 3372, you can file it with the Michigan Unemployment Insurance Agency (UIA) in several ways:

- Online: You can file the form electronically through the UIA's website.

- Mail: You can mail the completed form to the UIA at the address listed on the form.

- Fax: You can fax the completed form to the UIA at the number listed on the form.

It's essential to file the form accurately and on time to avoid penalties and fines.

What Happens After I File Michigan Form 3372?

After you file Michigan Form 3372, the UIA will review your application and determine your unemployment tax rate. This rate is based on your business's past experience with unemployment claims, as well as the state's unemployment insurance fund balance.

Once your application is approved, you'll receive a confirmation letter from the UIA, which will include your unemployment tax rate and any other relevant information.

Unemployment Tax Rates in Michigan

In Michigan, unemployment tax rates range from 0.06% to 10.3% of taxable wages. The rate is determined by the UIA based on your business's past experience with unemployment claims, as well as the state's unemployment insurance fund balance.

Here's a breakdown of the unemployment tax rates in Michigan:

- New employers: 2.7% of taxable wages

- Experienced employers: 0.06% to 10.3% of taxable wages

- Construction industry employers: 6.1% to 10.3% of taxable wages

Common Mistakes to Avoid When Registering for Unemployment Taxes in Michigan

When registering for unemployment taxes in Michigan, it's essential to avoid common mistakes that can result in penalties and fines. Here are some mistakes to avoid:

- Failing to register for unemployment taxes

- Failing to file Michigan Form 3372 on time

- Providing inaccurate information on Michigan Form 3372

- Failing to pay unemployment taxes on time

To avoid these mistakes, make sure to:

- Register for unemployment taxes as soon as possible after hiring your first employee

- File Michigan Form 3372 accurately and on time

- Keep accurate records of your business's employment and wage information

- Pay unemployment taxes on time and in full

Penalties for Non-Compliance

Failure to comply with Michigan's unemployment tax registration requirements can result in penalties and fines. Here are some penalties you may face:

- Late filing fee: $100 to $500

- Late payment fee: 1% to 2% of unpaid taxes per month

- Interest on unpaid taxes: 1% to 2% per month

- Penalty for failing to register: $100 to $1,000

To avoid these penalties, make sure to register for unemployment taxes on time and pay your taxes in full and on time.

Conclusion

Registering for unemployment taxes in Michigan is a critical step in supporting the state's unemployment insurance system. By understanding the process and avoiding common mistakes, you can ensure compliance with the state's requirements and avoid penalties and fines.

If you're new to the process, we hope this guide has provided you with a comprehensive understanding of what to expect. If you have any further questions or concerns, don't hesitate to reach out to the Michigan Unemployment Insurance Agency or a qualified tax professional.

FAQ Section:

Who is required to register for unemployment taxes in Michigan?

+Most employers in Michigan are required to register for unemployment taxes, including those who have paid wages of $1,000 or more in a calendar quarter, or who have employed one or more workers for some portion of a day in 20 or more different weeks in a calendar year.

What information do I need to provide on Michigan Form 3372?

+You'll need to provide information about your business, including your business name and address, Federal Employer Identification Number (FEIN), type of business, date of hire for the first employee, number of employees, and wages paid in the most recent calendar quarter.

What are the unemployment tax rates in Michigan?

+Unemployment tax rates in Michigan range from 0.06% to 10.3% of taxable wages. The rate is determined by the Michigan Unemployment Insurance Agency (UIA) based on your business's past experience with unemployment claims, as well as the state's unemployment insurance fund balance.