Understanding Form 2439 and its Importance

As a taxpayer, you may have encountered situations where you need to report certain transactions or activities on your tax return. One such form that plays a crucial role in this process is Form 2439, also known as the Notice to Shareholder of Undistributed Long-Term Capital Gains. In this article, we will delve into the world of Form 2439, its significance, and how to easily file it using TurboTax.

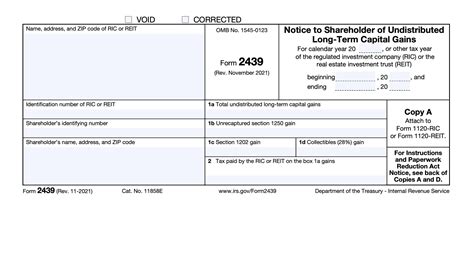

What is Form 2439?

Form 2439 is a document that corporations use to notify their shareholders about undistributed long-term capital gains. These gains occur when a corporation sells assets, such as stocks, bonds, or real estate, and realizes a profit. The corporation is required to distribute these gains to its shareholders, who must then report them on their individual tax returns.

Who Needs to File Form 2439?

Form 2439 is typically filed by corporations that have realized long-term capital gains and need to distribute them to their shareholders. However, it's the shareholders who ultimately need to report these gains on their tax returns. If you're a shareholder who has received a Form 2439, you'll need to use the information on the form to complete your tax return.

How to File Form 2439 with TurboTax

Filing Form 2439 with TurboTax is a straightforward process. Here's a step-by-step guide to help you get started:

- Gather required documents: Before you begin, make sure you have the following documents:

- Form 2439, Notice to Shareholder of Undistributed Long-Term Capital Gains

- Your tax return from the previous year (if applicable)

- Any other relevant tax documents, such as W-2s or 1099s

- Sign in to TurboTax: Log in to your TurboTax account or create a new one if you don't already have one.

- Select the correct tax form: Choose the tax form that corresponds to your situation (e.g., Form 1040, Form 1040A, or Form 1040EZ).

- Enter your shareholder information: Follow the prompts to enter your shareholder information, including your name, address, and Social Security number.

- Enter the information from Form 2439: TurboTax will guide you through the process of entering the information from Form 2439, including the undistributed long-term capital gains.

- Review and submit your return: Once you've completed the necessary steps, review your return to ensure everything is accurate and complete. Then, submit your return to the IRS.

Benefits of Using TurboTax to File Form 2439

Using TurboTax to file Form 2439 offers several benefits, including:

- Ease of use: TurboTax guides you through the filing process, making it easy to complete and submit your return.

- Accuracy: TurboTax ensures that your return is accurate and complete, reducing the risk of errors or audits.

- Time-saving: Filing with TurboTax saves you time and effort, allowing you to focus on other important tasks.

- Support: TurboTax offers support and guidance throughout the filing process, so you can get help when you need it.

Common Mistakes to Avoid When Filing Form 2439

When filing Form 2439, it's essential to avoid common mistakes that can delay or even reject your return. Here are some mistakes to watch out for:

- Incorrect shareholder information: Make sure to enter your shareholder information accurately, including your name, address, and Social Security number.

- Incorrect undistributed long-term capital gains: Double-check the information on Form 2439 to ensure you're reporting the correct undistributed long-term capital gains.

- Missing or incomplete documentation: Ensure you have all the necessary documents, including Form 2439 and your tax return from the previous year (if applicable).

Conclusion

Filing Form 2439 with TurboTax is a straightforward process that can save you time and effort. By following the steps outlined in this article and avoiding common mistakes, you can ensure a smooth and accurate filing experience. Remember to take advantage of TurboTax's support and guidance throughout the process, and don't hesitate to reach out if you have any questions or concerns.

What is the purpose of Form 2439?

+Form 2439 is used by corporations to notify shareholders about undistributed long-term capital gains. The form provides information about the gains, which shareholders must report on their individual tax returns.

Who needs to file Form 2439?

+Corporations that have realized long-term capital gains and need to distribute them to their shareholders must file Form 2439. Shareholders who receive the form must report the gains on their individual tax returns.

How do I file Form 2439 with TurboTax?

+To file Form 2439 with TurboTax, gather the required documents, sign in to your TurboTax account, select the correct tax form, enter your shareholder information, and enter the information from Form 2439. Review and submit your return to the IRS.