As a brewery owner or operator, navigating the complex world of regulatory compliance can be a daunting task. One crucial aspect of compliance is the TTB F 5120.17 form, also known as the "Report of Wine Premises Operations" or "Brewery Report." In this article, we will delve into the world of TTB F 5120.17, exploring its purpose, requirements, and steps to ensure compliance.

Understanding the TTB F 5120.17 Form

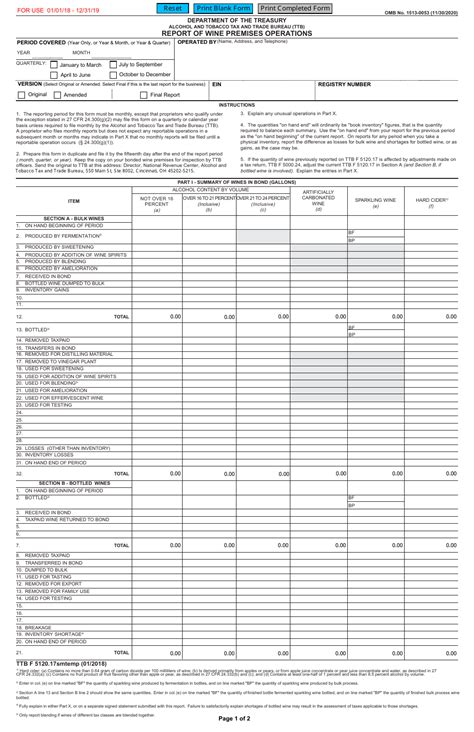

The TTB F 5120.17 form is a mandatory report that breweries must submit to the Alcohol and Tobacco Tax and Trade Bureau (TTB) on a monthly basis. The report provides the TTB with essential information about the brewery's operations, including production, storage, and shipments of beer. The data collected from this report helps the TTB to monitor and regulate the brewing industry, ensuring compliance with federal laws and regulations.

Why is the TTB F 5120.17 Form Important?

The TTB F 5120.17 form is a critical component of a brewery's compliance program. Failure to submit the report or providing inaccurate information can result in severe penalties, fines, and even revocation of the brewery's permit. Moreover, the report helps breweries to track their operations, identify trends, and make informed business decisions.

Who Needs to File the TTB F 5120.17 Form?

All breweries, regardless of their size or production levels, must file the TTB F 5120.17 form. This includes:

- Domestic breweries

- Importers of beer

- Wholesalers and distributors of beer

What Information is Required on the TTB F 5120.17 Form?

The TTB F 5120.17 form requires breweries to report the following information:

- Brewery name and address

- Report period (monthly)

- Production data, including:

- Beer produced

- Beer stored

- Beer shipped

- Storage data, including:

- Beer stored on the premises

- Beer stored off the premises

- Shipment data, including:

- Beer shipped to wholesalers

- Beer shipped to retailers

- Beer shipped to other breweries

Steps to Ensure Compliance with the TTB F 5120.17 Form

To ensure compliance with the TTB F 5120.17 form, breweries should follow these steps:

- Understand the reporting requirements: Familiarize yourself with the TTB F 5120.17 form and its requirements.

- Maintain accurate records: Keep accurate and detailed records of production, storage, and shipments.

- Submit the report on time: Submit the report by the 15th of each month for the previous month's operations.

- Ensure accuracy and completeness: Verify the accuracy and completeness of the report before submission.

Tips for Filing the TTB F 5120.17 Form

- Use the TTB's online filing system: The TTB offers an online filing system that makes it easy to submit the report and reduces the risk of errors.

- Keep records organized: Keep accurate and organized records of production, storage, and shipments to ensure easy reporting.

- Seek professional help: If you're unsure about the reporting requirements or need assistance with filing, consider seeking professional help from a compliance expert.

Penalties for Non-Compliance

Failure to comply with the TTB F 5120.17 form requirements can result in severe penalties, including:

- Fines: Up to $10,000 per violation

- Revocation of permit: The TTB can revoke a brewery's permit to operate

- Suspension of operations: The TTB can suspend a brewery's operations until compliance is achieved

Conclusion

The TTB F 5120.17 form is a critical component of a brewery's compliance program. By understanding the reporting requirements and following the steps outlined in this article, breweries can ensure compliance and avoid penalties. Remember to maintain accurate records, submit the report on time, and seek professional help if needed.

Frequently Asked Questions

What is the purpose of the TTB F 5120.17 form?

+The TTB F 5120.17 form is used to collect data on a brewery's operations, including production, storage, and shipments of beer.

Who needs to file the TTB F 5120.17 form?

+All breweries, regardless of their size or production levels, must file the TTB F 5120.17 form.

What are the penalties for non-compliance?

+Penalties for non-compliance include fines, revocation of permit, and suspension of operations.