Navigating the complexities of tax forms can be a daunting task, especially for those who are new to the process. The Ej-125 form, in particular, is a crucial document for businesses operating in certain European countries. In this article, we will delve into the world of the Ej-125 form, exploring its purpose, benefits, and a step-by-step guide on how to complete it.

Understanding the Ej-125 Form

The Ej-125 form is a standardized document used for intra-Community acquisitions and deliveries of goods within the European Union. Its primary purpose is to provide a clear and transparent record of transactions between businesses operating in different EU countries. This form plays a vital role in ensuring compliance with EU regulations and facilitating the smooth exchange of goods across borders.

Benefits of the Ej-125 Form

Using the Ej-125 form offers several benefits for businesses operating within the EU:

- Simplified record-keeping: The form provides a standardized format for recording transactions, making it easier to manage and track sales and purchases.

- Reduced administrative burdens: By using the Ej-125 form, businesses can minimize the time and resources spent on paperwork and administrative tasks.

- Improved compliance: The form helps businesses ensure compliance with EU regulations, reducing the risk of fines and penalties.

Step-by-Step Guide to Completing the Ej-125 Form

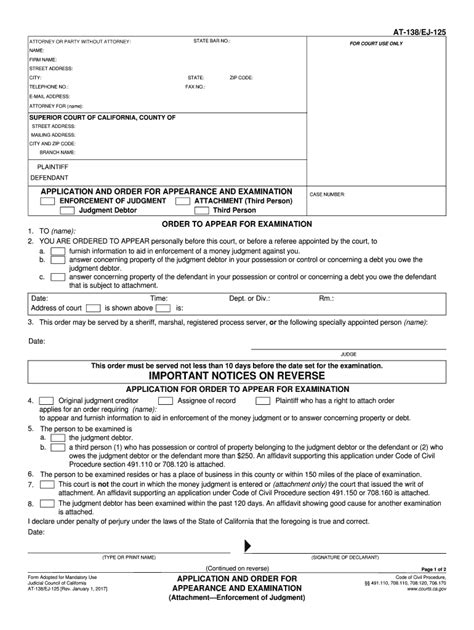

Completing the Ej-125 form requires attention to detail and a clear understanding of the required information. Here's a step-by-step guide to help you navigate the process:

- Obtain the Ej-125 form: You can obtain the form from your local tax authority or download it from their website.

- Identify the transaction type: Determine the type of transaction you are reporting, such as an intra-Community acquisition or delivery of goods.

- Provide business details: Enter your business name, address, and VAT identification number.

- Enter transaction details: Record the date, invoice number, and description of the goods or services being sold or purchased.

- Calculate the taxable amount: Determine the taxable amount of the transaction, including any applicable VAT rates.

- Complete additional fields: Depending on the transaction type, you may need to complete additional fields, such as the country of origin or destination.

Example of Completed Ej-125 Form

Here's an example of a completed Ej-125 form:

| Field | Description |

|---|---|

| Business Name | XYZ Ltd. |

| Address | 123 Main St, Anytown, EU |

| VAT Identification Number | EU123456789 |

| Transaction Type | Intra-Community acquisition |

| Date | 2023-02-15 |

| Invoice Number | INV001 |

| Description of Goods | Electronic components |

| Taxable Amount | 10,000 EUR |

| VAT Rate | 20% |

Conclusion

Completing the Ej-125 form is a crucial step in ensuring compliance with EU regulations and facilitating the smooth exchange of goods across borders. By following this step-by-step guide, businesses can ensure accurate and efficient completion of the form.