In today's digital age, individuals and businesses alike are constantly seeking ways to simplify and streamline their financial transactions and paperwork. One such document that plays a crucial role in this process is Form 15G. For those who may be unfamiliar, Form 15G is a declaration that an individual can submit to a bank or other financial institution to claim exemption from tax deduction at source (TDS) on certain types of income. In this article, we will delve into the world of Form 15G, its significance, and provide guidance on how to download and utilize it in Word format.

Understanding Form 15G

Form 15G is a self-declaration form that individuals can submit to their bank or financial institution to claim exemption from TDS on their income. This form is particularly useful for individuals who have invested in fixed deposits, recurring deposits, or other savings schemes, and are not liable to pay income tax. By submitting Form 15G, individuals can ensure that their income is not subject to TDS, thereby avoiding unnecessary tax deductions.

Who Can Submit Form 15G?

To be eligible to submit Form 15G, an individual must meet certain criteria. These include:

- The individual must be a resident Indian

- The individual's tax liability for the financial year should be nil

- The individual should not have any tax deductions at source (TDS) on their income

Benefits of Form 15G

There are several benefits to submitting Form 15G. Some of these include:

- Avoidance of TDS on income: By submitting Form 15G, individuals can ensure that their income is not subject to TDS, thereby avoiding unnecessary tax deductions.

- Simplified tax compliance: Form 15G simplifies the tax compliance process for individuals, as they do not have to worry about TDS on their income.

- Increased savings: By avoiding TDS, individuals can retain more of their income, leading to increased savings.

How to Download Form 15G in Word Format

To download Form 15G in Word format, individuals can follow these steps:

- Visit the official website of the Income Tax Department or the bank's website

- Click on the "Downloads" or "Forms" section

- Select the "Form 15G" option

- Choose the "Word" format

- Click on the "Download" button

- Save the form to your computer

Filling Out Form 15G

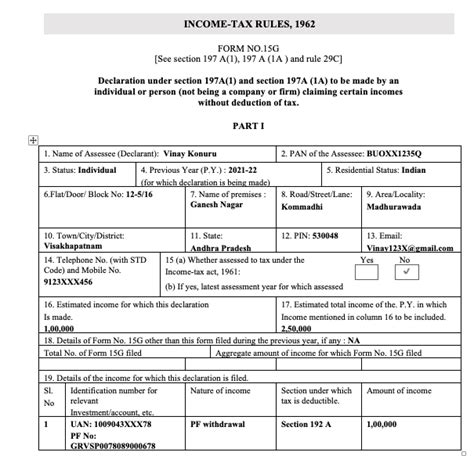

To fill out Form 15G, individuals will need to provide certain information, including:

- Personal details: name, address, PAN number, etc.

- Bank account details: account number, IFSC code, etc.

- Income details: type of income, amount of income, etc.

Individuals should ensure that they provide accurate and complete information to avoid any errors or delays.

Submission of Form 15G

Once the form is filled out, individuals can submit it to their bank or financial institution. The submission process may vary depending on the bank or institution, so individuals should check with their bank for specific instructions.

Common Mistakes to Avoid

When filling out Form 15G, individuals should avoid common mistakes, such as:

- Providing incomplete or inaccurate information

- Failing to sign the form

- Submitting the form late

These mistakes can lead to delays or errors, so individuals should ensure that they fill out the form carefully and accurately.

FAQs

Here are some frequently asked questions about Form 15G:

- Q: Who can submit Form 15G? A: Individuals who are resident Indians and have no tax liability for the financial year can submit Form 15G.

- Q: What is the purpose of Form 15G? A: The purpose of Form 15G is to claim exemption from TDS on certain types of income.

- Q: How can I download Form 15G in Word format? A: Individuals can download Form 15G in Word format from the official website of the Income Tax Department or the bank's website.

What is the penalty for not submitting Form 15G?

+If an individual fails to submit Form 15G, they may be subject to a penalty of up to Rs. 10,000.

Can I submit Form 15G online?

+Yes, individuals can submit Form 15G online through the bank's website or the Income Tax Department's website.

What is the validity period of Form 15G?

+The validity period of Form 15G is one financial year.

In conclusion, Form 15G is an essential document for individuals who want to claim exemption from TDS on their income. By understanding the benefits and process of submitting Form 15G, individuals can simplify their tax compliance and avoid unnecessary tax deductions. We hope this article has provided valuable insights into the world of Form 15G and has helped readers navigate the process of downloading and utilizing it in Word format.