The divorce process can be a complex and emotionally challenging experience, especially when it comes to dividing assets and determining financial arrangements. One crucial aspect of divorce proceedings is the division of retirement accounts, such as those held by Merrill Lynch. A Qualified Domestic Relations Order (QDRO) is a court order that directs the plan administrator to divide a retirement account between the plan participant and their spouse or former spouse. In this article, we will explore the Merrill Lynch QDRO form and provide a comprehensive guide to help you navigate this process.

Divorce and Retirement Accounts: Understanding the Basics

When a couple gets divorced, they must consider how to divide their assets, including retirement accounts such as 401(k), pension plans, and individual retirement accounts (IRAs). These accounts often represent a significant portion of a person's wealth, and dividing them can be a complex process. A QDRO is a court order that is used to divide these types of accounts.

What is a QDRO?

A QDRO is a court order that is issued as part of a divorce or separation proceeding. It directs the plan administrator to divide a retirement account between the plan participant and their spouse or former spouse. The QDRO must meet specific requirements under the Employee Retirement Income Security Act of 1974 (ERISA) and the Internal Revenue Code.

Types of QDROs

There are two types of QDROs: defined benefit QDROs and defined contribution QDROs. Defined benefit QDROs apply to pension plans that provide a fixed benefit amount, while defined contribution QDROs apply to plans such as 401(k) and 403(b) plans.

Merrill Lynch QDRO Form: What You Need to Know

The Merrill Lynch QDRO form is a document that is used to divide a Merrill Lynch retirement account between the plan participant and their spouse or former spouse. The form must be completed and submitted to the court, which will then review and approve it.

To obtain a Merrill Lynch QDRO form, you can contact Merrill Lynch directly or consult with a financial advisor or attorney who specializes in QDROs. The form will typically require the following information:

- The names and addresses of the plan participant and their spouse or former spouse

- The name and address of the plan administrator

- The type of retirement account being divided

- The amount or percentage of the account being awarded to each party

How to Complete the Merrill Lynch QDRO Form

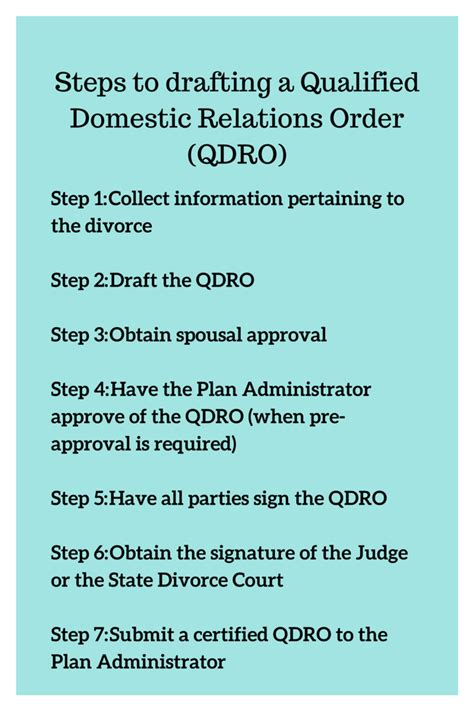

Completing the Merrill Lynch QDRO form can be a complex process, and it's recommended that you seek the assistance of a financial advisor or attorney who specializes in QDROs. Here are some general steps to follow:

- Gather information: Collect all necessary information, including the plan participant's name and address, the spouse or former spouse's name and address, and the name and address of the plan administrator.

- Determine the type of QDRO: Decide whether you need a defined benefit QDRO or a defined contribution QDRO.

- Complete the form: Fill out the Merrill Lynch QDRO form, making sure to include all required information.

- Review and sign: Review the form carefully and sign it in the presence of a notary public.

- Submit the form: Submit the completed form to the court for review and approval.

Benefits of Using a QDRO

Using a QDRO to divide a retirement account can provide several benefits, including:

- Avoiding early withdrawal penalties

- Preserving the tax-deferred status of the account

- Ensuring a smooth and efficient division of assets

Common Mistakes to Avoid

When completing a Merrill Lynch QDRO form, there are several common mistakes to avoid, including:

- Failing to provide required information

- Using the wrong type of QDRO

- Not having the form reviewed and approved by the court

- Not completing the form correctly

Best Practices for QDROs

Here are some best practices to follow when using a QDRO to divide a retirement account:

- Seek the assistance of a financial advisor or attorney who specializes in QDROs

- Ensure that the form is completed correctly and thoroughly

- Review and sign the form in the presence of a notary public

- Submit the form to the court for review and approval

Frequently Asked Questions

Here are some frequently asked questions about QDROs and the Merrill Lynch QDRO form:

- What is a QDRO, and how does it work?

- How do I obtain a Merrill Lynch QDRO form?

- What information do I need to complete the form?

- Can I complete the form myself, or do I need to hire a professional?

What is a QDRO, and how does it work?

+A QDRO is a court order that directs the plan administrator to divide a retirement account between the plan participant and their spouse or former spouse.

How do I obtain a Merrill Lynch QDRO form?

+You can contact Merrill Lynch directly or consult with a financial advisor or attorney who specializes in QDROs.

What information do I need to complete the form?

+You will need to provide information such as the names and addresses of the plan participant and their spouse or former spouse, the name and address of the plan administrator, and the type of retirement account being divided.

Conclusion

Dividing retirement accounts during a divorce can be a complex and emotionally challenging experience. Using a QDRO to divide a Merrill Lynch retirement account can provide several benefits, including avoiding early withdrawal penalties and preserving the tax-deferred status of the account. By understanding the process and following best practices, you can ensure a smooth and efficient division of assets.

We hope this article has provided you with valuable information and insights into the Merrill Lynch QDRO form and the QDRO process. If you have any further questions or concerns, please don't hesitate to reach out to us.