As a taxpayer, you may be required to submit Form 433-D, also known as the Installment Agreement, to the Internal Revenue Service (IRS) to set up a payment plan for your tax debt. Mailing this form can be a daunting task, but with the right guidance, you can ensure that it reaches the IRS safely and efficiently. In this article, we will explore three easy ways to mail Form 433-D, along with some valuable tips to help you navigate the process.

Understanding Form 433-D

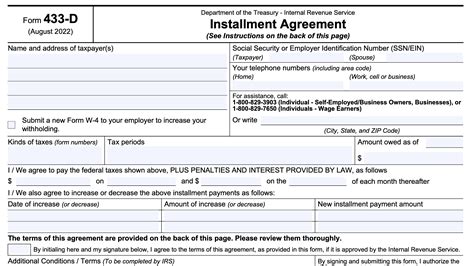

Before we dive into the mailing process, it's essential to understand the purpose of Form 433-D. This form is used to establish an installment agreement with the IRS, allowing you to make monthly payments towards your tax debt. The form requires you to provide personal and financial information, including your income, expenses, assets, and debt.

Method 1: Mailing via USPS

The most traditional way to mail Form 433-D is through the United States Postal Service (USPS). To ensure that your form reaches the IRS safely, follow these steps:

- Use a sturdy envelope and mail the form via certified mail with a return receipt requested. This will provide proof of mailing and delivery.

- Address the envelope to the IRS address listed in the Form 433-D instructions or on the IRS website.

- Include a cover letter with your name, address, and taxpayer identification number (TIN) to ensure that the IRS can match your payment plan with your tax account.

- Keep a copy of the form and cover letter for your records.

Method 2: Mailing via FedEx or UPS

If you prefer a faster and more secure mailing option, consider using FedEx or UPS. These carriers offer tracking and delivery confirmation, providing an added layer of security and proof of delivery.

- Use a sturdy envelope and mail the form via FedEx or UPS with a tracking number and signature upon delivery.

- Address the envelope to the IRS address listed in the Form 433-D instructions or on the IRS website.

- Include a cover letter with your name, address, and TIN to ensure that the IRS can match your payment plan with your tax account.

- Keep a copy of the form and cover letter for your records.

Method 3: Mailing via IRS e-file

The IRS offers an electronic filing option for Form 433-D, allowing you to submit the form online through the IRS website. This method is faster and more secure than traditional mailing, and it provides immediate confirmation of receipt.

- Visit the IRS website and access the online Form 433-D application.

- Complete the form online and submit it electronically.

- Keep a copy of the confirmation page for your records.

Tips and Reminders

Regardless of the mailing method you choose, it's essential to follow these tips and reminders:

- Make sure to sign and date the form before mailing.

- Use a secure and trackable mailing method to ensure proof of delivery.

- Keep a copy of the form and cover letter for your records.

- Include a cover letter with your name, address, and TIN to ensure that the IRS can match your payment plan with your tax account.

- Check the IRS website for any updates or changes to the mailing address or form instructions.

Getting Help with Form 433-D

If you need help with completing or mailing Form 433-D, consider consulting a tax professional or seeking assistance from the IRS. The IRS offers a variety of resources, including online forms and instructions, phone support, and face-to-face assistance at local IRS offices.

Stay Organized and Informed

Mailing Form 433-D is just the first step in establishing an installment agreement with the IRS. To ensure that you stay on track with your payments and avoid any penalties or fees, it's essential to stay organized and informed. Consider the following:

- Keep a copy of your Form 433-D and supporting documents for your records.

- Make timely payments according to your installment agreement.

- Review and update your financial information regularly to ensure that your payment plan remains affordable.

By following these easy ways to mail Form 433-D and staying organized and informed, you can establish a successful installment agreement with the IRS and take control of your tax debt.

Share Your Thoughts

Have you ever had to mail Form 433-D? Share your experiences and tips in the comments below!