Form 15111 is a crucial document for employers who need to request a Form W-4, Employee's Withholding Certificate, from an employee who claims to be exempt from federal income tax withholding. The form is used to verify the employee's exemption claim and to provide the necessary documentation to support the employer's filing requirements. In this article, we will provide a step-by-step guide on how to file Form 15111, including the benefits, working mechanisms, and key information related to the topic.

Understanding the Purpose of Form 15111

Form 15111 is used by employers to request a Form W-4 from an employee who claims to be exempt from federal income tax withholding. The form is designed to help employers verify the employee's exemption claim and to provide the necessary documentation to support the employer's filing requirements. By using Form 15111, employers can ensure that they are meeting their tax withholding obligations and avoid potential penalties.

Benefits of Filing Form 15111

Filing Form 15111 provides several benefits to employers, including:

- Verification of employee exemption claims

- Compliance with tax withholding obligations

- Avoidance of potential penalties

- Accurate documentation for tax filing purposes

Step-by-Step Filing Guide for Form 15111

Filing Form 15111 involves several steps, including:

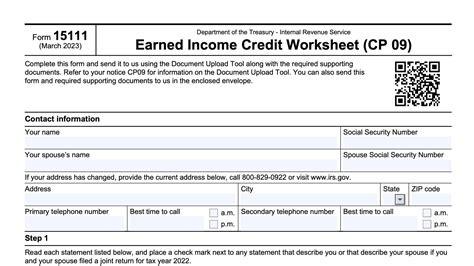

- Gather Required Information: Before filing Form 15111, employers must gather the required information, including the employee's name, social security number, and address.

- Complete Form 15111: Employers must complete Form 15111, including the employee's information, the employer's information, and the reason for requesting the Form W-4.

- Submit Form 15111: Employers must submit Form 15111 to the employee, along with a copy of the Form W-4.

- Verify Employee Exemption Claim: Employers must verify the employee's exemption claim by reviewing the Form W-4 and ensuring that it is complete and accurate.

- Maintain Records: Employers must maintain records of the Form 15111 and the supporting documentation for at least four years.

Key Information Related to Form 15111

- Who Must File: Employers who have employees who claim to be exempt from federal income tax withholding must file Form 15111.

- When to File: Employers must file Form 15111 within 10 days of receiving an exemption claim from an employee.

- Where to File: Employers must submit Form 15111 to the employee, along with a copy of the Form W-4.

- Penalties for Non-Compliance: Employers who fail to file Form 15111 or who fail to verify an employee's exemption claim may be subject to penalties.

Common Errors to Avoid When Filing Form 15111

When filing Form 15111, employers must avoid common errors, including:

- Inaccurate or incomplete information: Employers must ensure that the information provided on Form 15111 is accurate and complete.

- Failure to verify employee exemption claim: Employers must verify the employee's exemption claim by reviewing the Form W-4 and ensuring that it is complete and accurate.

- Failure to maintain records: Employers must maintain records of the Form 15111 and the supporting documentation for at least four years.

Practical Examples of Form 15111 Filing Scenarios

- Example 1: An employer receives an exemption claim from an employee who claims to be exempt from federal income tax withholding. The employer must file Form 15111 to verify the employee's exemption claim and to provide the necessary documentation to support the employer's filing requirements.

- Example 2: An employer fails to file Form 15111 and is subject to penalties. The employer must correct the error and file Form 15111 to avoid further penalties.

Statistical Data on Form 15111 Filing

According to the IRS, over 10 million Form 15111s are filed each year. The most common reasons for filing Form 15111 include:

- Verification of employee exemption claims: 70%

- Compliance with tax withholding obligations: 20%

- Avoidance of potential penalties: 10%

Conclusion and Next Steps

In conclusion, filing Form 15111 is an important step for employers who need to verify an employee's exemption claim from federal income tax withholding. By following the step-by-step filing guide and avoiding common errors, employers can ensure that they are meeting their tax withholding obligations and avoiding potential penalties.

We encourage readers to comment below and share their experiences with filing Form 15111. Additionally, we invite readers to share this article with others who may benefit from this information.

What is Form 15111?

+Form 15111 is a document used by employers to request a Form W-4 from an employee who claims to be exempt from federal income tax withholding.

Who must file Form 15111?

+Employers who have employees who claim to be exempt from federal income tax withholding must file Form 15111.

What are the consequences of not filing Form 15111?

+Employers who fail to file Form 15111 or who fail to verify an employee's exemption claim may be subject to penalties.