Filing taxes is an essential part of any business, and as a corporation, you are required to file Form 1120 with the Internal Revenue Service (IRS) to report your income, deductions, and credits. However, the process of filing Form 1120 can be complex and overwhelming, especially for small businesses or those who are new to the tax filing process. In this article, we will provide a comprehensive guide on how to file Form 1120 correctly, highlighting five key steps to ensure that you comply with IRS regulations and avoid potential penalties.

Filing Form 1120 is a crucial task that requires attention to detail and a thorough understanding of tax laws and regulations. By following these five steps, you can ensure that your corporation's tax return is accurate, complete, and filed on time.

Why is it Important to File Form 1120 Correctly?

Filing Form 1120 correctly is essential for several reasons:

- To avoid penalties and fines: The IRS imposes penalties and fines on corporations that fail to file their tax returns on time or make errors on their returns.

- To ensure compliance with tax laws: Filing Form 1120 correctly ensures that your corporation is in compliance with tax laws and regulations.

- To take advantage of tax credits and deductions: By filing Form 1120 correctly, you can claim tax credits and deductions that your corporation is eligible for.

Step 1: Determine Your Filing Status

Before you can file Form 1120, you need to determine your corporation's filing status. This will depend on the type of corporation you have and the tax year you are filing for. The most common types of corporations are C corporations and S corporations.

- C corporations: These corporations are taxed on their profits and are required to file Form 1120.

- S corporations: These corporations are pass-through entities, meaning that the corporation's income is passed through to the shareholders. S corporations are required to file Form 1120S.

Step 2: Gather Required Documents

To file Form 1120, you will need to gather certain documents, including:

- Your corporation's financial statements, including the balance sheet and income statement

- W-2 forms for all employees

- 1099 forms for all independent contractors

- Depreciation schedules

- Any other supporting documentation that is required to complete the form

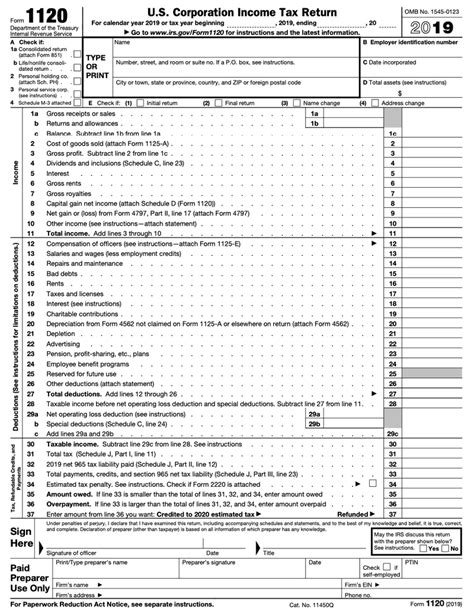

Step 3: Complete Form 1120

Once you have gathered all the required documents, you can begin completing Form 1120. The form is divided into several sections, including:

- Section 1: Income

- Section 2: Cost of Goods Sold

- Section 3: Operating Expenses

- Section 4: Tax Credits and Deductions

Make sure to complete all the required sections and attach any supporting documentation that is required.

Step 4: File Form 1120

Once you have completed Form 1120, you can file it with the IRS. You can file the form electronically or by mail. If you file electronically, you will need to use the IRS's Modernized e-File (MeF) system.

Step 5: Pay Any Taxes Due

If you owe taxes, you will need to pay them by the filing deadline to avoid penalties and interest. You can pay your taxes online, by phone, or by mail.

By following these five steps, you can ensure that your corporation's Form 1120 is filed correctly and on time.

Benefits of Filing Form 1120 Correctly

Filing Form 1120 correctly has several benefits, including:

- Avoiding penalties and fines

- Ensuring compliance with tax laws

- Taking advantage of tax credits and deductions

- Reducing the risk of audit

Common Mistakes to Avoid

When filing Form 1120, there are several common mistakes to avoid, including:

- Failing to file on time

- Making mathematical errors

- Failing to attach supporting documentation

- Claiming incorrect tax credits and deductions

Conclusion

Filing Form 1120 correctly is an essential task for any corporation. By following the five steps outlined in this article, you can ensure that your corporation's tax return is accurate, complete, and filed on time. Remember to gather all required documents, complete the form carefully, file on time, and pay any taxes due. By avoiding common mistakes and taking advantage of tax credits and deductions, you can minimize your tax liability and ensure compliance with tax laws.

What is Form 1120?

+Form 1120 is the U.S. Corporation Income Tax Return, which is used by corporations to report their income, deductions, and credits to the IRS.

Who needs to file Form 1120?

+C corporations and S corporations are required to file Form 1120. However, S corporations file Form 1120S instead of Form 1120.

What is the deadline for filing Form 1120?

+The deadline for filing Form 1120 is typically March 15th of each year, but it can vary depending on the type of corporation and the tax year.