Employers and health insurance providers are required to submit Form 1094 to the Internal Revenue Service (IRS) as part of the Affordable Care Act (ACA) reporting requirements. This form serves as a summary of the information reported on Form 1095, which details the health coverage offered to employees. A crucial component of Form 1094 is the USPS Form 1094 Key, a unique identifier used to track and process the form. If you have lost your USPS Form 1094 Key, it is essential to replace it promptly to avoid any delays or penalties in your ACA reporting.

Step 1: Understand the Importance of the USPS Form 1094 Key

Before replacing your lost USPS Form 1094 Key, it is crucial to understand its significance. The USPS Form 1094 Key is used to authenticate and track your Form 1094 submissions. Without it, you may encounter difficulties when submitting your ACA reports, leading to potential delays or penalties. The USPS Form 1094 Key is a vital component of the ACA reporting process, and replacing it promptly is essential.

Step 2: Gather Required Information

To replace your lost USPS Form 1094 Key, you will need to gather specific information. This includes:

- Your Employer Identification Number (EIN)

- Your business name and address

- The name and contact information of the authorized representative

- The reason for requesting a replacement key

Ensure you have all the necessary information readily available to expedite the replacement process.

Step 3: Contact the USPS

Reach out to the United States Postal Service (USPS) to request a replacement USPS Form 1094 Key. You can contact them via phone or email, providing the required information. The USPS will verify your identity and authenticate your request before processing a replacement key.

Phone: 1-800-ASK-USPS (1-800-275-8777) Email:

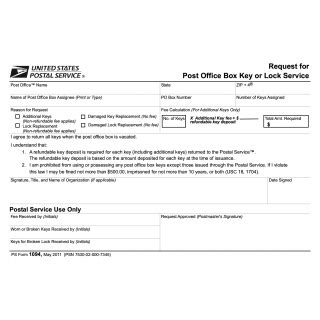

Step 4: Complete the Replacement Request Form

Once the USPS has verified your request, you will be required to complete a replacement request form. This form will ask for the information gathered in Step 2, as well as additional details about the lost key. Complete the form accurately and thoroughly to avoid any delays.

Step 5: Receive and Verify the Replacement Key

After submitting the replacement request form, the USPS will process and mail a new USPS Form 1094 Key to the authorized representative. Once you receive the replacement key, verify its accuracy and ensure it matches the information provided on the request form. If there are any discrepancies, contact the USPS immediately to resolve the issue.

Best Practices to Avoid Losing Your USPS Form 1094 Key:

- Store the USPS Form 1094 Key in a secure and easily accessible location.

- Make a copy of the key and store it in a separate location.

- Limit access to the key to authorized personnel.

- Regularly review and update your ACA reporting records to ensure accuracy and compliance.

By following these steps and best practices, you can replace your lost USPS Form 1094 Key efficiently and effectively, ensuring timely and accurate ACA reporting.

What is the purpose of the USPS Form 1094 Key?

+The USPS Form 1094 Key is a unique identifier used to track and process Form 1094 submissions, ensuring accurate and timely ACA reporting.

What information is required to replace a lost USPS Form 1094 Key?

+To replace a lost USPS Form 1094 Key, you will need to provide your Employer Identification Number (EIN), business name and address, the name and contact information of the authorized representative, and the reason for requesting a replacement key.

How long does it take to receive a replacement USPS Form 1094 Key?

+The time it takes to receive a replacement USPS Form 1094 Key may vary, but it is typically processed and mailed within 3-5 business days after the request is verified.

We hope this comprehensive guide has provided you with the necessary steps and information to replace your lost USPS Form 1094 Key efficiently. If you have any further questions or concerns, please don't hesitate to comment below or reach out to us. Share this article with your colleagues and friends who may benefit from this information, and stay up-to-date with the latest ACA reporting requirements and best practices.