Tax season is upon us, and with it comes the daunting task of navigating complex tax forms and deadlines. However, for residents of Georgia, there's a silver lining - the GA St-5 fillable form. In this article, we'll delve into the world of tax filing, exploring the benefits, mechanisms, and steps involved in using the GA St-5 fillable form to make your tax season a breeze.

What is the GA St-5 Fillable Form?

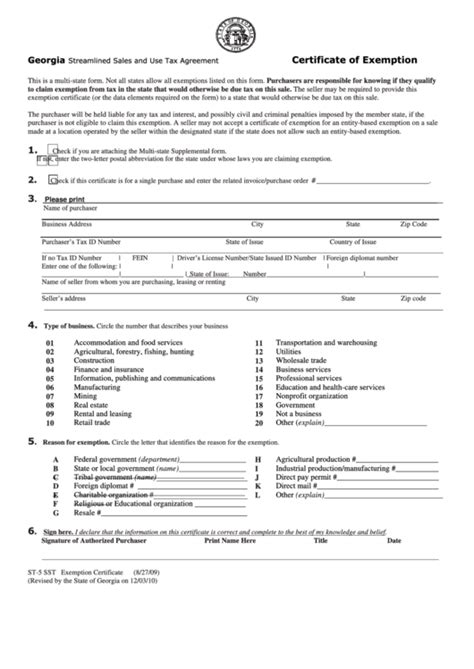

The GA St-5 fillable form is a digital version of the paper-based Form ST-5, which is used by Georgia residents to file their state tax returns. This fillable form is designed to make tax filing quicker, easier, and more accurate. With the GA St-5 fillable form, taxpayers can enter their information directly into the form, which automatically calculates taxes owed or refunds due.

Benefits of Using the GA St-5 Fillable Form

Using the GA St-5 fillable form offers several benefits, including:

- Convenience: The fillable form can be completed from the comfort of your own home, at any time, and from any device with an internet connection.

- Accuracy: The form's built-in calculations and validation rules reduce the risk of errors, ensuring that your tax return is accurate and complete.

- Speed: The fillable form allows you to quickly and easily enter your information, reducing the time it takes to complete your tax return.

- Environmentally friendly: By using a digital form, you're reducing your carbon footprint and helping to minimize waste.

How to Use the GA St-5 Fillable Form

Using the GA St-5 fillable form is a straightforward process. Here's a step-by-step guide to get you started:

- Download the form: Visit the Georgia Department of Revenue's website and download the GA St-5 fillable form.

- Gather required documents: Collect all necessary documents, including your W-2 forms, 1099 forms, and any other relevant tax documents.

- Enter your information: Fill in your personal and tax-related information directly into the form.

- Calculate your taxes: The form will automatically calculate your taxes owed or refund due.

- Review and submit: Review your form for accuracy and completeness, then submit it electronically or print and mail it to the Georgia Department of Revenue.

Tips and Tricks for Using the GA St-5 Fillable Form

To ensure a smooth tax-filing experience, keep the following tips and tricks in mind:

- Use the correct software: Make sure you have the latest version of Adobe Acrobat Reader or other compatible software to view and complete the form.

- Save frequently: Save your progress regularly to avoid losing your work in case of a technical issue.

- Use the help resources: The Georgia Department of Revenue offers a range of resources, including instructional videos and FAQs, to help you complete the form.

Common Mistakes to Avoid When Using the GA St-5 Fillable Form

While the GA St-5 fillable form is designed to be user-friendly, there are still some common mistakes to avoid:

- Incorrect or incomplete information: Double-check your personal and tax-related information to ensure accuracy.

- Failure to sign and date: Don't forget to sign and date your form, as this is a required step for electronic filing.

- Insufficient payment: Make sure to include payment for any taxes owed to avoid penalties and interest.

GA St-5 Fillable Form FAQs

Here are some frequently asked questions about the GA St-5 fillable form:

- Q: Can I use the GA St-5 fillable form if I have a complex tax situation? A: Yes, the form is designed to handle complex tax situations, but you may need to attach additional documentation or seek assistance from a tax professional.

- Q: Can I save my progress and come back later? A: Yes, you can save your progress and return to the form later, but be sure to save frequently to avoid losing your work.

- Q: Can I file my tax return electronically? A: Yes, the GA St-5 fillable form allows for electronic filing, which is faster and more secure than mailing a paper return.

Conclusion: Take the Stress Out of Tax Filing with the GA St-5 Fillable Form

Tax season doesn't have to be a source of stress and anxiety. With the GA St-5 fillable form, you can take control of your tax filing process and make it quicker, easier, and more accurate. By following the steps and tips outlined in this article, you'll be well on your way to a hassle-free tax-filing experience.

What's Next?

We'd love to hear about your experiences with the GA St-5 fillable form! Share your thoughts, tips, and questions in the comments below, and don't forget to share this article with your friends and family to help them make the most of tax season.

What is the deadline for filing my GA St-5 fillable form?

+The deadline for filing your GA St-5 fillable form is typically April 15th, but be sure to check the Georgia Department of Revenue's website for any updates or changes.

Can I use the GA St-5 fillable form if I have a business?

+Yes, the GA St-5 fillable form can be used for business tax returns, but you may need to attach additional documentation or seek assistance from a tax professional.

How do I get help with the GA St-5 fillable form?

+The Georgia Department of Revenue offers a range of resources, including instructional videos, FAQs, and phone support, to help you complete the form.