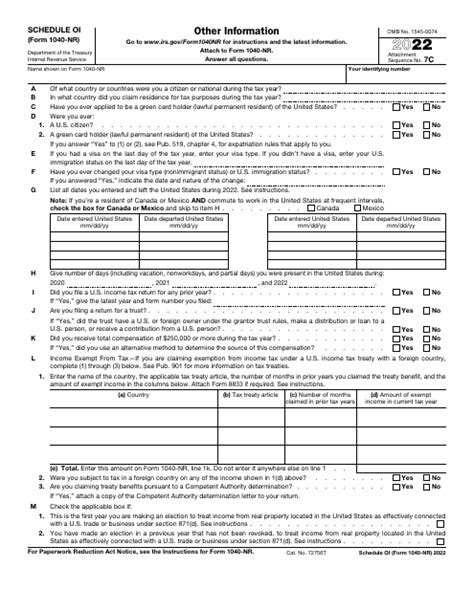

As a non-resident alien individual or a foreign corporation, you are required to file Form 1040NR, U.S. Nonresident Alien Income Tax Return, to report your income from U.S. sources. One of the schedules that may be attached to Form 1040NR is Schedule OI, Other Income. In this article, we will delve into the details of Schedule OI and explore what types of income are reported on this schedule.

What is Schedule OI?

Schedule OI, Other Income, is a schedule that is attached to Form 1040NR to report various types of income that do not fit into other categories. This schedule is used to report income that is not subject to withholding, such as prizes, awards, and other miscellaneous income.

Types of Income Reported on Schedule OI

The following types of income are reported on Schedule OI:

- Prizes and awards

- Other income (such as income from hobbies, freelance work, or self-employment)

- Rent or royalty income not reported on Schedule E

- Income from the sale of property other than capital assets

- Other gains or losses not reported on Schedule D

How to Complete Schedule OI

To complete Schedule OI, you will need to provide the following information:

- A description of the income

- The amount of the income

- The date the income was received

- Any applicable withholding taxes

You will also need to complete Part II of Schedule OI, which requires you to calculate the total amount of other income and subtract any applicable deductions.

Taxation of Other Income

The taxation of other income reported on Schedule OI depends on the type of income and the tax treaty between the United States and the taxpayer's country of residence. In general, other income is subject to a flat tax rate of 30% unless a tax treaty provides for a lower rate.

Examples of Other Income

Here are some examples of other income that may be reported on Schedule OI:

- Prize money from a U.S. golf tournament

- Royalty income from a U.S. publisher

- Rent income from a U.S. property not reported on Schedule E

- Income from the sale of a U.S. property other than a capital asset

Tips for Completing Schedule OI

Here are some tips to keep in mind when completing Schedule OI:

- Make sure to keep accurate records of all other income, including dates and amounts received.

- Consult with a tax professional to ensure that you are reporting all other income correctly.

- Review the tax treaty between the United States and your country of residence to determine the applicable tax rate.

Other Income and Tax Credits

In some cases, other income may be eligible for tax credits, such as the foreign earned income exclusion. However, this credit is only available to individuals who meet certain requirements, such as being a resident of a foreign country and having earned income from a foreign employer.

Impact of Other Income on Tax Liability

Other income reported on Schedule OI can have a significant impact on your tax liability. Depending on the type and amount of income, you may be subject to additional taxes or penalties.

Common Errors to Avoid on Schedule OI

Here are some common errors to avoid when completing Schedule OI:

- Failing to report all other income

- Incorrectly calculating the total amount of other income

- Failing to claim applicable deductions

- Incorrectly reporting withholding taxes

How to Amend Schedule OI

If you need to amend Schedule OI, you will need to file Form 1040X, Amended U.S. Nonresident Alien Income Tax Return. You will need to provide the corrected information and explain the reason for the amendment.

Conclusion

In conclusion, Schedule OI is an important schedule that is attached to Form 1040NR to report various types of other income. It is essential to accurately report all other income and claim applicable deductions to minimize your tax liability. By following the tips and guidelines outlined in this article, you can ensure that you are completing Schedule OI correctly and avoiding common errors.

FAQs

What is Schedule OI?

+Schedule OI is a schedule that is attached to Form 1040NR to report various types of other income.

What types of income are reported on Schedule OI?

+The following types of income are reported on Schedule OI: prizes and awards, other income, rent or royalty income not reported on Schedule E, income from the sale of property other than capital assets, and other gains or losses not reported on Schedule D.

How do I complete Schedule OI?

+To complete Schedule OI, you will need to provide a description of the income, the amount of the income, the date the income was received, and any applicable withholding taxes.