Understanding the Florida Rt 6 Form: A Comprehensive Guide

As a business owner or individual in Florida, you may have come across the Florida Rt 6 Form, also known as the "Reemployment Tax Quarterly Report." This form is used to report the amount of reemployment tax due to the state of Florida for each quarter. In this article, we will delve into the details of the Florida Rt 6 Form, its importance, and provide a step-by-step guide on how to fill it out.

Importance of the Florida Rt 6 Form

The Florida Rt 6 Form is a crucial document for businesses and individuals who are required to pay reemployment tax in the state of Florida. The form is used to report the amount of tax due for each quarter, and it is essential to file it accurately and on time to avoid penalties and fines. Failure to file the form or pay the required tax can result in severe consequences, including loss of business licenses and even court action.

Who Needs to File the Florida Rt 6 Form?

The Florida Rt 6 Form is required for businesses and individuals who meet the following criteria:

- Employers who have paid wages of $1,500 or more in a calendar quarter

- Employers who have paid wages to four or more employees in a calendar quarter

- Agricultural employers who have paid wages of $20,000 or more in a calendar quarter

- Domestic employers who have paid wages of $1,000 or more in a calendar quarter

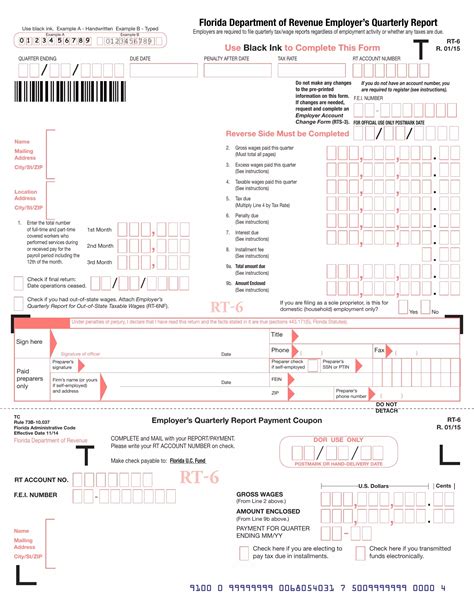

How to Fill Out the Florida Rt 6 Form

Filling out the Florida Rt 6 Form can seem daunting, but it is a straightforward process if you follow these steps:

- Gather required information: Before starting to fill out the form, make sure you have the following information:

- Your business name and address

- Your federal employer identification number (FEIN)

- The quarter and year for which you are filing

- The total amount of wages paid

- The total amount of reemployment tax due

- Complete the header section: Fill out the header section with your business name and address, FEIN, and the quarter and year for which you are filing.

- Report wages and tax: Report the total amount of wages paid and the total amount of reemployment tax due for the quarter.

- Calculate the tax rate: Calculate the tax rate based on your business's tax rate, which can be found on the Florida Department of Revenue's website.

- Sign and date the form: Sign and date the form to certify that the information is accurate and complete.

Florida Rt 6 Form Fillable Download Template

If you are looking for a fillable download template for the Florida Rt 6 Form, you can find it on the Florida Department of Revenue's website. The template is available in PDF format and can be filled out electronically or printed and filled out by hand.

Common Mistakes to Avoid When Filing the Florida Rt 6 Form

When filing the Florida Rt 6 Form, it is essential to avoid common mistakes that can result in penalties and fines. Some common mistakes to avoid include:

- Failing to file the form on time

- Failing to report all wages paid

- Failing to calculate the tax rate correctly

- Failing to sign and date the form

Conclusion

The Florida Rt 6 Form is a critical document for businesses and individuals in Florida who are required to pay reemployment tax. By understanding the importance of the form and following the steps outlined in this article, you can ensure that you file the form accurately and on time. Remember to avoid common mistakes and take advantage of the fillable download template available on the Florida Department of Revenue's website.

What is the Florida Rt 6 Form used for?

+The Florida Rt 6 Form is used to report the amount of reemployment tax due to the state of Florida for each quarter.

Who needs to file the Florida Rt 6 Form?

+The Florida Rt 6 Form is required for businesses and individuals who meet certain criteria, including employers who have paid wages of $1,500 or more in a calendar quarter.

How do I fill out the Florida Rt 6 Form?

+To fill out the Florida Rt 6 Form, gather required information, complete the header section, report wages and tax, calculate the tax rate, and sign and date the form.