As a self-employed individual in Florida, navigating the complexities of health insurance for yourself and your family can be daunting. One option to consider is Florida KidCare, a program that provides affordable health insurance to children from birth through age 18. However, the self-employment form can be a hurdle for many. In this article, we will delve into the world of Florida KidCare self-employment forms, providing you with five valuable tips to make the process smoother.

Understanding the Basics

Before diving into the tips, it's essential to understand what Florida KidCare is and why the self-employment form is necessary. Florida KidCare is a health insurance program for children, and it includes four different programs: MediKids, Healthy Kids, Children’s Medical Services (CMS) Network, and Children’s Medical Services (CMS) Health Plan. The self-employment form is required to verify your income as a self-employed individual, which affects the premium you'll pay for the insurance.

Tips for Filling Out the Self-Employment Form

Tip 1: Gather All Necessary Documents

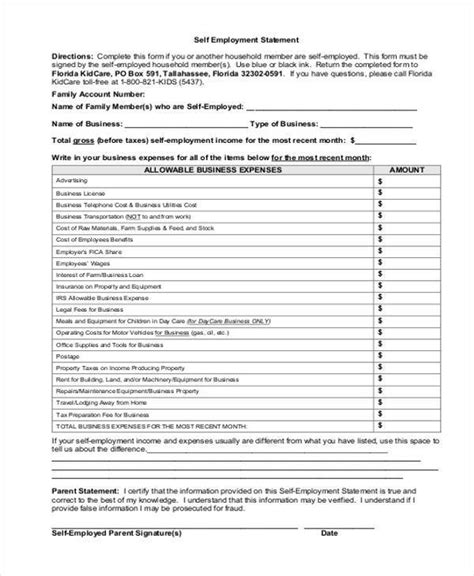

To fill out the self-employment form accurately, you'll need to gather specific documents. These typically include your most recent tax return, Schedule C (Form 1040), and any other documentation of your business expenses. Having these documents ready will save you time and ensure you report your income correctly.

Tip 2: Understand How to Calculate Your Net Income

Calculating your net income from self-employment is crucial. You'll need to subtract your business expenses from your gross income to get your net income. This figure is what Florida KidCare will use to determine your premium. Make sure to calculate this correctly, as it directly affects your premium payments.

Tip 3: Be Accurate and Honest

Accuracy and honesty are paramount when filling out the self-employment form. Inflating or deflating your income can lead to issues down the line, including potential penalties. Ensure that you report your income truthfully and accurately.

Tip 4: Consider Consulting a Professional

If you're unsure about any aspect of the self-employment form or how to calculate your net income, consider consulting a tax professional or accountant. They can provide valuable insights and ensure that your form is filled out correctly, saving you potential headaches in the future.

Tip 5: Review and Double-Check

Finally, before submitting your self-employment form, review and double-check all the information. A simple mistake can lead to delays or even denial of coverage. Take the time to ensure everything is accurate and complete.

The Benefits of Florida KidCare

While filling out the self-employment form might seem like a chore, it's worth remembering the benefits that Florida KidCare provides. These include comprehensive health insurance for your children, access to quality healthcare providers, and financial protection against the high costs of medical care.

Why Florida KidCare Matters

Florida KidCare is more than just an insurance program; it's a safety net for families. It ensures that children have access to the healthcare they need to grow and thrive. By providing affordable health insurance, Florida KidCare helps alleviate the financial burden on families, allowing them to focus on what matters most – their children's health and well-being.

Steps to Apply

Applying for Florida KidCare involves several steps:

- Determine Eligibility: Check if your child is eligible based on age, income, and other factors.

- Gather Documents: Collect all necessary documents, including the self-employment form.

- Fill Out the Application: Complete the application form accurately and honestly.

- Submit the Application: Send in your application and await a response.

Maintaining Coverage

Once you're enrolled in Florida KidCare, it's essential to maintain your coverage. This includes:

- Renewing Your Coverage: Renew your coverage annually to ensure continuous insurance.

- Reporting Changes: Inform Florida KidCare of any changes in your income or family status.

The Future of Healthcare

As healthcare continues to evolve, programs like Florida KidCare are at the forefront of ensuring that children have access to quality healthcare. By understanding the intricacies of the self-employment form and the benefits of Florida KidCare, you're taking the first step towards securing your child's health and well-being.

We hope this article has provided you with the insights and tips necessary to navigate the Florida KidCare self-employment form with ease. Remember, health insurance is a critical aspect of your child's health and future. Don't hesitate to reach out for help if you need it.

If you have any questions or concerns about the Florida KidCare self-employment form or the application process, please don't hesitate to comment below. Share this article with anyone who might find it helpful, and let's work together to ensure all children have access to the healthcare they deserve.

What is the Florida KidCare self-employment form?

+The Florida KidCare self-employment form is required for self-employed individuals to verify their income, which affects the premium they pay for the insurance.

How do I calculate my net income from self-employment?

+You calculate your net income by subtracting your business expenses from your gross income.

Why is accuracy important on the self-employment form?

+Accuracy is crucial to avoid potential penalties and to ensure you're paying the correct premium.