Are you tired of the hassle and paperwork associated with submitting Form W-4V? With the advancement of technology, you can now easily submit Form W-4V online, saving you time and effort. In this article, we will guide you through the 4 simple steps to submit Form W-4V online, making it easier for you to manage your taxes.

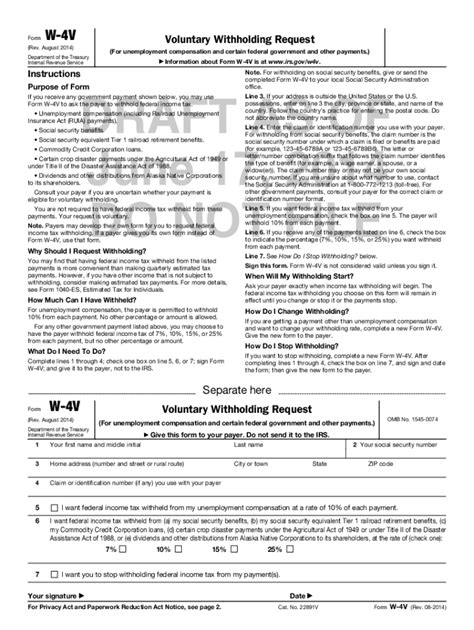

The importance of Form W-4V cannot be overstated. It is a crucial document that allows individuals to elect voluntary withholding on certain government payments, such as Social Security benefits, unemployment compensation, and certain other government payments. By submitting Form W-4V, you can ensure that the correct amount of taxes is withheld from your government payments, avoiding any potential tax liabilities.

Benefits of Submitting Form W-4V Online

Submitting Form W-4V online offers several benefits, including:

- Convenience: You can submit the form from the comfort of your own home, at any time of the day or night.

- Time-saving: The online submission process is quick and easy, saving you time and effort.

- Accuracy: The online form helps ensure that your information is accurate and complete, reducing the risk of errors.

- Environmentally friendly: By submitting the form online, you are reducing the need for paper and helping to protect the environment.

Who Can Submit Form W-4V Online?

Anyone who receives government payments, such as Social Security benefits, unemployment compensation, or certain other government payments, can submit Form W-4V online. This includes:

- Retirees

- Unemployed individuals

- Disability recipients

- Veterans

Step 1: Gather Required Information

Before you start the online submission process, make sure you have all the required information ready. This includes:

- Your name and address

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- The type of government payment you receive

- The amount of tax you want to withhold

Step 2: Access the Online Form

To access the online Form W-4V, you can visit the official website of the Social Security Administration (SSA) or the Internal Revenue Service (IRS). You can also use a tax software or a tax professional to help you with the submission process.

- SSA website:

- IRS website:

Step 3: Fill Out the Online Form

Once you have accessed the online form, fill out the required information, including your name, address, Social Security number or ITIN, and the type of government payment you receive. You will also need to specify the amount of tax you want to withhold.

- Make sure to review the form carefully to ensure that all the information is accurate and complete.

- If you need help filling out the form, you can contact the SSA or IRS for assistance.

Step 4: Submit the Online Form

Once you have completed the online form, submit it electronically. You will receive a confirmation number or a receipt, which you should keep for your records.

- Make sure to save a copy of the confirmation number or receipt, as you may need it for future reference.

- If you encounter any issues during the submission process, you can contact the SSA or IRS for assistance.

Common Mistakes to Avoid

When submitting Form W-4V online, there are several common mistakes to avoid, including:

- Inaccurate or incomplete information

- Failure to specify the correct amount of tax to withhold

- Not saving a copy of the confirmation number or receipt

Tips and Reminders

- Make sure to review the form carefully before submitting it.

- If you need help filling out the form, contact the SSA or IRS for assistance.

- Keep a copy of the confirmation number or receipt for your records.

Conclusion

Submitting Form W-4V online is a quick and easy process that can save you time and effort. By following the 4 simple steps outlined in this article, you can ensure that the correct amount of taxes is withheld from your government payments. Remember to review the form carefully, avoid common mistakes, and keep a copy of the confirmation number or receipt for your records.

We hope this article has been helpful in guiding you through the process of submitting Form W-4V online. If you have any questions or need further assistance, please don't hesitate to comment below.

What is Form W-4V?

+Form W-4V is a document that allows individuals to elect voluntary withholding on certain government payments, such as Social Security benefits, unemployment compensation, and certain other government payments.

Why do I need to submit Form W-4V?

+You need to submit Form W-4V to ensure that the correct amount of taxes is withheld from your government payments, avoiding any potential tax liabilities.

How do I access the online Form W-4V?

+You can access the online Form W-4V by visiting the official website of the Social Security Administration (SSA) or the Internal Revenue Service (IRS).