Understanding the W9 Form: A Comprehensive Guide

The W9 form, also known as the Request for Taxpayer Identification Number and Certification, is a crucial document used by the Internal Revenue Service (IRS) to gather information about a taxpayer's identity and tax status. This form is typically required by businesses and other entities that pay independent contractors, freelancers, and other non-employees. In this article, we will delve into the world of W9 forms, exploring what they are, why they are necessary, and how to fill them out accurately.

What is a W9 Form?

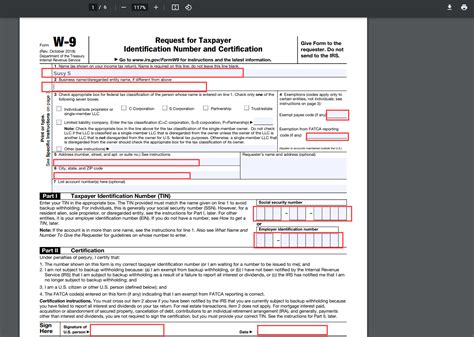

A W9 form is a simple, one-page document that provides the IRS with the necessary information to identify taxpayers and report their income. The form requires the taxpayer to provide their name, business name, address, and taxpayer identification number (TIN), which can be either a Social Security number (SSN) or an Employer Identification Number (EIN). The W9 form is an essential tool for businesses to maintain compliance with tax regulations and to avoid potential penalties.

Why is a W9 Form Necessary?

The W9 form serves several purposes, making it a vital document for both businesses and taxpayers. Some of the key reasons why a W9 form is necessary include:

- Tax Compliance: The W9 form helps businesses comply with tax regulations by providing the IRS with the necessary information to report income and tax withholding.

- Identity Verification: The form verifies the taxpayer's identity, reducing the risk of identity theft and tax-related scams.

- Accuracy: The W9 form ensures that taxpayer information is accurate, reducing errors and potential penalties.

Who Needs to Fill Out a W9 Form?

The following individuals and entities are typically required to fill out a W9 form:

- Independent Contractors: Freelancers, consultants, and other independent contractors who work with businesses.

- Self-Employed Individuals: Business owners who are not incorporated and report their income on their personal tax return.

- Single-Member LLCs: Limited liability companies (LLCs) with a single member.

- Trusts and Estates: Trusts and estates that receive income from businesses.

How to Fill Out a W9 Form

Filling out a W9 form is a straightforward process. Here are the steps to follow:

- Download the Form: Obtain a copy of the W9 form from the IRS website or from the business that requested it.

- Enter Your Name and Business Name: Provide your name and business name, if applicable.

- Enter Your Address: Provide your business address.

- Enter Your TIN: Provide your taxpayer identification number (TIN), which can be either a Social Security number (SSN) or an Employer Identification Number (EIN).

- Certify Your Taxpayer Status: Certify your taxpayer status by checking the applicable box.

- Sign and Date the Form: Sign and date the form.

- Return the Form: Return the completed form to the business that requested it.

Tips for Filling Out a W9 Form

Here are some tips to keep in mind when filling out a W9 form:

- Use Black Ink: Use black ink to fill out the form.

- Be Accurate: Ensure that all information is accurate and up-to-date.

- Use a Clear and Legible Handwriting: Use a clear and legible handwriting to avoid errors.

- Keep a Copy: Keep a copy of the completed form for your records.

Common Mistakes to Avoid

Here are some common mistakes to avoid when filling out a W9 form:

- Inaccurate Information: Providing inaccurate or outdated information.

- Missing Information: Failing to provide required information.

- Illegible Handwriting: Using an illegible handwriting.

- Failure to Sign and Date: Failing to sign and date the form.

Conclusion

The W9 form is a critical document that plays a vital role in maintaining tax compliance and verifying taxpayer identity. By understanding the purpose and requirements of the W9 form, taxpayers can ensure that they provide accurate and complete information, reducing the risk of errors and potential penalties. If you have any questions or concerns about filling out a W9 form, consult with a tax professional or the IRS website for guidance.

Let's Discuss

Have you ever filled out a W9 form? What was your experience like? Share your thoughts and questions in the comments section below.

FAQ Section

What is the purpose of a W9 form?

+The W9 form is used to gather information about a taxpayer's identity and tax status.

Who needs to fill out a W9 form?

+Independent contractors, self-employed individuals, single-member LLCs, and trusts and estates are typically required to fill out a W9 form.

What information is required on a W9 form?

+The W9 form requires taxpayers to provide their name, business name, address, and taxpayer identification number (TIN).