The tax season is upon us, and with it comes the responsibility of filing various tax forms, including Form 1096. As a payer of freelancer or independent contractor services, you are required to file Form 1096 with the Internal Revenue Service (IRS) if you have paid at least $600 in a calendar year to a recipient. In this article, we will explore the importance of Form 1096, its components, and provide a step-by-step guide on how to fill it out accurately.

Understanding Form 1096

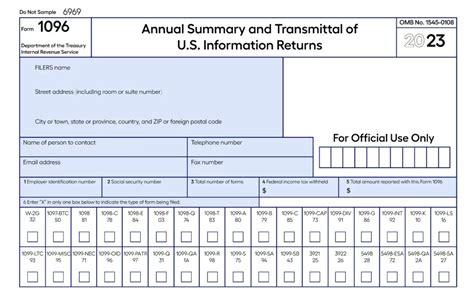

Form 1096 is an annual information return that is used to report the total amount of payments made to recipients, such as freelancers or independent contractors, during the calendar year. The form serves as a summary of all the payments made to recipients, and it is used by the IRS to verify the accuracy of the payments reported on the individual recipient's tax returns.

Who Needs to File Form 1096?

You are required to file Form 1096 if you have paid at least $600 in a calendar year to a recipient for services performed as a freelancer or independent contractor. This includes payments made to individuals, partnerships, and corporations. However, you do not need to file Form 1096 if you are a government agency or a tax-exempt organization.

Components of Form 1096

Form 1096 consists of several components, including:

- Payer's name, address, and taxpayer identification number (TIN)

- Recipient's name, address, and TIN

- Total amount of payments made to the recipient during the calendar year

- Type of payment made (e.g., non-employee compensation, dividends, etc.)

5 Ways to Fill Form 1096

Here are five ways to fill Form 1096 accurately:

1. Gather Required Information

Before you start filling Form 1096, make sure you have all the required information, including:

- Payer's name, address, and TIN

- Recipient's name, address, and TIN

- Total amount of payments made to the recipient during the calendar year

- Type of payment made

2. Fill Out the Payer's Information

Fill out the payer's information section, including your name, address, and TIN. Make sure to use your business name and address if you are a business entity.

3. Fill Out the Recipient's Information

Fill out the recipient's information section, including their name, address, and TIN. Make sure to use the recipient's business name and address if they are a business entity.

4. Report the Total Amount of Payments

Report the total amount of payments made to the recipient during the calendar year. Make sure to include all payments made, including cash, checks, and electronic payments.

5. Specify the Type of Payment

Specify the type of payment made, such as non-employee compensation, dividends, etc. Make sure to use the correct code from the IRS instructions.

Penalties for Not Filing Form 1096

Failure to file Form 1096 can result in penalties and fines. The IRS may impose a penalty of up to $270 per form for failure to file, with a maximum penalty of $3,275,000 per year. Additionally, the IRS may also impose a penalty for failure to furnish the recipient with a copy of the Form 1099.

Conclusion

Filing Form 1096 is an important requirement for payers of freelancer or independent contractor services. By following the steps outlined in this article, you can ensure that you file Form 1096 accurately and avoid any penalties. Remember to gather all required information, fill out the payer's and recipient's information sections, report the total amount of payments, specify the type of payment, and file the form on time.

Who needs to file Form 1096?

+You need to file Form 1096 if you have paid at least $600 in a calendar year to a recipient for services performed as a freelancer or independent contractor.

What is the deadline for filing Form 1096?

+The deadline for filing Form 1096 is January 31st of each year.

Can I file Form 1096 electronically?

+Yes, you can file Form 1096 electronically through the IRS's Filing Information Returns Electronically (FIRE) system.