Understanding the Importance of Form 1041

As a fiduciary or trustee, managing the financial affairs of an estate or trust can be a daunting task. One of the crucial responsibilities is filing the annual income tax return, which is where Form 1041 comes into play. The IRS Form 1041 is a critical document that requires accurate and timely submission to avoid penalties and ensure compliance with tax laws. In this article, we will delve into the world of Form 1041, providing a step-by-step guide to make the filing process easier and less intimidating.

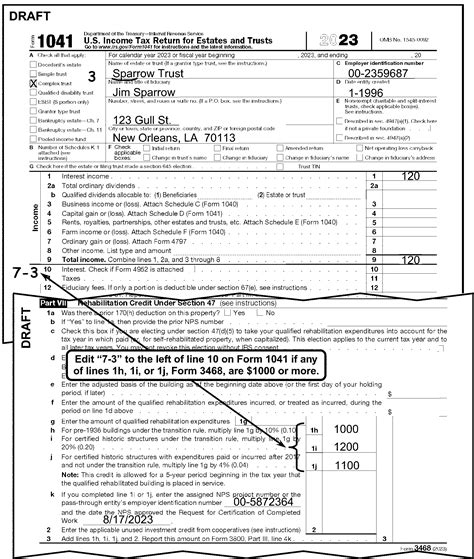

The IRS Form 1041 is used to report the income, deductions, and credits of an estate or trust. It's a complex form that requires careful attention to detail, making it essential to understand the filing requirements, deadlines, and the information needed to complete the form accurately. Failure to comply with the tax laws and regulations can result in severe penalties, fines, and even loss of tax benefits.

Who Needs to File Form 1041?

Form 1041 is required for estates and trusts that have a certain level of income, regardless of whether the income is distributed to beneficiaries or accumulated within the estate or trust. The following entities need to file Form 1041:

- Estates of deceased individuals

- Trusts, including revocable and irrevocable trusts

- Guardianships and conservatorships

- Estates of individuals who have been declared incompetent

The filing requirement is based on the gross income of the estate or trust, which includes income from various sources, such as:

- Interest and dividends

- Capital gains and losses

- Rents and royalties

- Business income

- Farm income

What is the Filing Deadline for Form 1041?

The filing deadline for Form 1041 is typically April 15th of each year, covering the income earned during the previous tax year. However, if the estate or trust has a fiscal year that ends on a date other than December 31st, the filing deadline will be the 15th day of the fourth month following the end of the fiscal year.

It's essential to note that the IRS may grant an automatic six-month extension of time to file, which can be obtained by submitting Form 7004. However, this extension does not extend the time to pay any tax due, and interest and penalties may still be applicable.

How to Complete Form 1041: A Step-by-Step Guide

Completing Form 1041 requires careful attention to detail and accurate reporting of the estate or trust's income, deductions, and credits. Here's a step-by-step guide to help you navigate the process:

- Gather necessary information: Collect all relevant documents, including financial statements, receipts, and invoices, to ensure accurate reporting of income and expenses.

- Determine the filing status: Identify the type of estate or trust and its filing status, which will determine the tax rates and deductions applicable.

- Report income: Complete Schedule A (Form 1041) to report the estate or trust's income from various sources, including interest, dividends, capital gains, and business income.

- Claim deductions: Complete Schedule B (Form 1041) to claim deductions, such as administrative expenses, charitable contributions, and mortgage interest.

- Calculate tax liability: Use the tax rates and tables provided in the instructions to calculate the estate or trust's tax liability.

- Claim credits: Complete Schedule G (Form 1041) to claim credits, such as the foreign tax credit or the credit for estimated taxes.

- Complete supporting schedules: Complete any additional schedules, such as Schedule D (Capital Gains and Losses) or Schedule E (Supplemental Income and Loss).

- Sign and date the form: Ensure the form is signed and dated by the fiduciary or trustee, as applicable.

Additional Tips and Considerations

- Seek professional help: If you're unsure about any aspect of the filing process, consider consulting a tax professional or attorney to ensure accuracy and compliance.

- Maintain accurate records: Keep detailed records of income, expenses, and supporting documentation to facilitate the filing process and potential audits.

- Take advantage of tax benefits: Ensure you're taking advantage of all eligible tax deductions and credits to minimize the estate or trust's tax liability.

Conclusion: Simplifying the Form 1041 Filing Process

Filing Form 1041 can be a complex and time-consuming process, but with the right guidance and support, it can be simplified. By understanding the filing requirements, deadlines, and necessary information, you can ensure accurate and timely submission of the form. Remember to seek professional help when needed, maintain accurate records, and take advantage of tax benefits to minimize the estate or trust's tax liability.

We encourage you to share your experiences and tips for filing Form 1041 in the comments below. If you have any questions or need further clarification, please don't hesitate to ask.

What is the purpose of Form 1041?

+Form 1041 is used to report the income, deductions, and credits of an estate or trust.

Who needs to file Form 1041?

+Estates and trusts that have a certain level of income, regardless of whether the income is distributed to beneficiaries or accumulated within the estate or trust.

What is the filing deadline for Form 1041?

+Typically April 15th of each year, covering the income earned during the previous tax year.