Tax season can be a daunting time for many individuals, with the complexity of tax laws and forms often causing frustration and confusion. However, for those with simple tax situations, the IRS offers a simplified tax filing option: Form 1040A. In this article, we'll delve into the world of Form 1040A, exploring its benefits, eligibility requirements, and step-by-step instructions for completing the form.

The Importance of Simplified Tax Filing

Tax filing can be a time-consuming and overwhelming process, especially for those who are not familiar with tax laws and regulations. The IRS recognizes this challenge and has introduced Form 1040A as a way to simplify the tax filing process for individuals with straightforward tax situations. By using Form 1040A, taxpayers can avoid the complexity of the standard Form 1040 and reduce the time and effort required to file their taxes.

Benefits of Using Form 1040A

So, what are the benefits of using Form 1040A? Here are some of the advantages of this simplified tax filing option:

- Easier to complete: Form 1040A is designed to be more straightforward and easier to complete than the standard Form 1040. The form has fewer lines and schedules, making it less intimidating for taxpayers with simple tax situations.

- Faster processing: Because Form 1040A is less complex, the IRS can process it more quickly. This means that taxpayers who use Form 1040A can expect to receive their refunds faster.

- Reduced errors: The simplicity of Form 1040A reduces the likelihood of errors and mistakes. This can help taxpayers avoid delays and potential penalties associated with incorrect or incomplete tax returns.

Eligibility Requirements for Form 1040A

Not everyone is eligible to use Form 1040A. To qualify, taxpayers must meet certain requirements, including:

- Income: Taxpayers must have income that is only from wages, salaries, tips, interest, dividends, capital gain distributions, and unemployment compensation.

- Filing status: Taxpayers must file as single or married filing jointly.

- Dependents: Taxpayers can claim only one exemption for themselves and one exemption for their spouse.

- Itemized deductions: Taxpayers cannot itemize deductions on Schedule A.

- Credits: Taxpayers can only claim the earned income credit, child tax credit, and education credits.

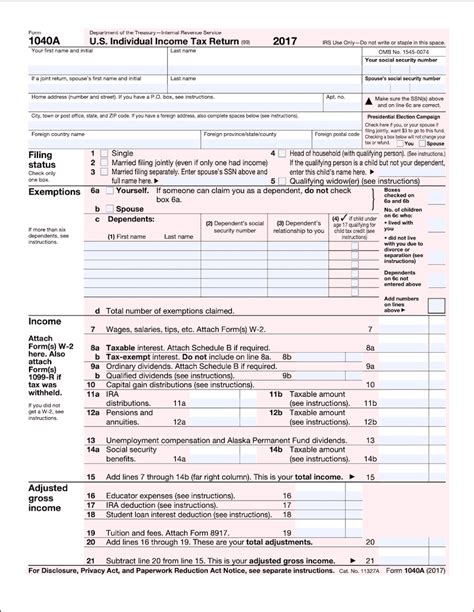

How to Complete Form 1040A

Completing Form 1040A is a relatively straightforward process. Here's a step-by-step guide to help you get started:

- Gather required documents: Before you begin, make sure you have all the necessary documents, including your W-2 forms, 1099 forms, and any other relevant tax documents.

- Fill out personal information: Start by filling out your personal information, including your name, address, and social security number.

- Report income: Report your income from wages, salaries, tips, interest, dividends, capital gain distributions, and unemployment compensation.

- Claim exemptions: Claim exemptions for yourself and your spouse, if applicable.

- Claim credits: Claim the earned income credit, child tax credit, and education credits, if applicable.

- Calculate tax: Calculate your tax using the tax tables or the tax computation worksheet.

- Sign and date: Sign and date the form, and make sure to include your social security number.

Form 1040A Schedules

Form 1040A has two schedules: Schedule 1 and Schedule 2. Here's what you need to know about each schedule:

- Schedule 1: Schedule 1 is used to report income from sources such as interest, dividends, and capital gain distributions.

- Schedule 2: Schedule 2 is used to report taxes withheld from sources such as wages, salaries, and tips.

Filing Form 1040A

Once you've completed Form 1040A, you can file it with the IRS. Here are your filing options:

- E-file: You can e-file Form 1040A using tax software or through the IRS website.

- Mail: You can mail Form 1040A to the IRS address listed in the instructions.

Tips for Filing Form 1040A

Here are some tips to keep in mind when filing Form 1040A:

- File electronically: E-filing is faster and more accurate than mailing a paper return.

- Use tax software: Tax software can help you complete Form 1040A accurately and efficiently.

- Double-check your math: Make sure to double-check your math to avoid errors and delays.

Conclusion

Form 1040A is a simplified tax filing option that can make the tax filing process easier and faster for individuals with straightforward tax situations. By understanding the benefits, eligibility requirements, and step-by-step instructions for completing the form, taxpayers can take advantage of this convenient option and avoid the complexity of the standard Form 1040.

We hope this article has provided you with valuable insights and information about Form 1040A. If you have any questions or comments, please feel free to share them with us.

What is Form 1040A?

+Form 1040A is a simplified tax filing option for individuals with straightforward tax situations. It is designed to be easier to complete than the standard Form 1040 and can help reduce errors and delays.

Who is eligible to use Form 1040A?

+To qualify for Form 1040A, taxpayers must meet certain requirements, including having income only from wages, salaries, tips, interest, dividends, capital gain distributions, and unemployment compensation. They must also file as single or married filing jointly and claim only one exemption for themselves and one exemption for their spouse.

How do I file Form 1040A?

+You can file Form 1040A electronically using tax software or through the IRS website. You can also mail the form to the IRS address listed in the instructions.