Receiving a Fidelity 1099 R form can be a confusing experience, especially if you're not familiar with tax season or the specifics of retirement account distributions. However, it's essential to understand the information presented on this form, as it plays a critical role in your tax obligations and financial planning. In this article, we'll delve into the world of Fidelity 1099 R forms, explaining what they are, how to read them, and what actions to take upon receiving one.

A Fidelity 1099 R form is a tax document issued by Fidelity Investments, a leading financial services company, to report distributions from retirement accounts, such as 401(k), IRA, or annuity contracts. The form is used to inform the Internal Revenue Service (IRS) and the account holder about the distribution amount, which may be subject to income tax. As a recipient of a Fidelity 1099 R form, it's crucial to understand the information presented, as it will help you navigate the tax filing process and avoid any potential penalties.

What is a Fidelity 1099 R Form?

A Fidelity 1099 R form is a tax document that reports distributions from retirement accounts, including:

- 401(k) plans

- Individual Retirement Accounts (IRAs)

- Annuity contracts

- Pension plans

- Other qualified retirement plans

The form is typically issued by Fidelity Investments, but other financial institutions may also provide similar documents. The 1099 R form is used to report the distribution amount, which may be subject to income tax, and provide information about the distribution type, such as a lump-sum payment or an annuity.

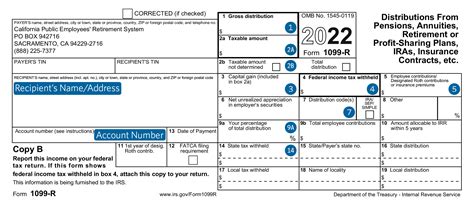

How to Read a Fidelity 1099 R Form

Reading a Fidelity 1099 R form can seem daunting, but it's essential to understand the information presented. Here's a breakdown of the key sections:

- Box 1: Gross Distribution: This section shows the total distribution amount from your retirement account.

- Box 2a: Taxable Amount: This section indicates the amount of the distribution that is subject to income tax.

- Box 2b: Taxable Amount Not Determined: This section is used if the taxable amount cannot be determined.

- Box 3: Capital Gain: This section reports any capital gains from the distribution.

- Box 4: Federal Income Tax Withheld: This section shows the amount of federal income tax withheld from the distribution.

- Box 5: Employee Contributions: This section reports any employee contributions to the retirement account.

- Box 6: Net Unrealized Appreciation (NUA) in Employer Securities: This section reports any NUA in employer securities.

- Box 7: Distribution Code: This section provides a code that indicates the type of distribution, such as a lump-sum payment or an annuity.

Understanding Distribution Codes

Distribution codes are critical in determining the tax implications of your retirement account distribution. Here are some common distribution codes:

- Code 1: Early Distribution: This code indicates that the distribution is subject to a 10% penalty for early withdrawal.

- Code 2: Normal Distribution: This code indicates that the distribution is not subject to a 10% penalty.

- Code 3: Disability: This code indicates that the distribution is due to disability.

- Code 4: Death: This code indicates that the distribution is due to the account holder's death.

What to Do Upon Receiving a Fidelity 1099 R Form

Upon receiving a Fidelity 1099 R form, follow these steps:

- Review the form for accuracy: Verify that the information presented on the form is accurate, including the distribution amount and tax withholding.

- Report the distribution on your tax return: Report the distribution on your tax return, using the information provided on the 1099 R form.

- Pay any taxes owed: Pay any taxes owed on the distribution, including any penalties for early withdrawal.

- Consult a tax professional: If you're unsure about the tax implications of your distribution, consult a tax professional for guidance.

Common Questions and Answers

Here are some common questions and answers related to Fidelity 1099 R forms:

Q: What is the purpose of a Fidelity 1099 R form? A: The purpose of a Fidelity 1099 R form is to report distributions from retirement accounts to the IRS and the account holder.

Q: How do I report a Fidelity 1099 R form on my tax return? A: Report the distribution on your tax return, using the information provided on the 1099 R form.

Q: Are Fidelity 1099 R forms subject to income tax? A: Yes, Fidelity 1099 R forms are subject to income tax, and the distribution amount may be subject to a 10% penalty for early withdrawal.

Q: Can I avoid paying taxes on a Fidelity 1099 R form? A: No, you cannot avoid paying taxes on a Fidelity 1099 R form. However, you may be able to reduce your tax liability by rolling over the distribution to another qualified retirement account.

Conclusion

Receiving a Fidelity 1099 R form can be a confusing experience, but it's essential to understand the information presented on the form. By following the steps outlined in this article, you can ensure that you're in compliance with tax regulations and avoid any potential penalties. Remember to review the form for accuracy, report the distribution on your tax return, and pay any taxes owed. If you're unsure about the tax implications of your distribution, consult a tax professional for guidance.

What is a Fidelity 1099 R form?

+A Fidelity 1099 R form is a tax document that reports distributions from retirement accounts, including 401(k) plans, IRAs, annuity contracts, and pension plans.

How do I report a Fidelity 1099 R form on my tax return?

+Report the distribution on your tax return, using the information provided on the 1099 R form.

Are Fidelity 1099 R forms subject to income tax?

+Yes, Fidelity 1099 R forms are subject to income tax, and the distribution amount may be subject to a 10% penalty for early withdrawal.