The IRS Form 2210 is a crucial document for individuals who need to pay estimated taxes throughout the year. However, finding this form can be a daunting task, especially for those who are new to the world of tax filing. In this article, we will explore three ways to find Form 2210, making it easier for you to access and complete this essential tax document.

Understanding the Importance of Form 2210

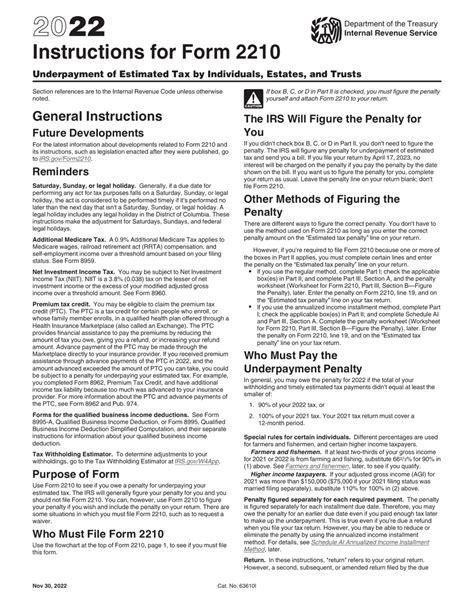

Before we dive into the methods of finding Form 2210, it's essential to understand its significance. The IRS requires individuals who expect to owe more than $1,000 in taxes for the year to make estimated tax payments. This includes self-employed individuals, freelancers, and those who receive income that is not subject to withholding, such as rent or interest income. Form 2210 is used to calculate the underpayment of estimated taxes and to determine if penalties are owed.

Method 1: Download from the IRS Website

The most straightforward way to find Form 2210 is to download it from the IRS website. The IRS provides a comprehensive repository of tax forms, including Form 2210, which can be accessed and downloaded in PDF format.

To download Form 2210 from the IRS website, follow these steps:

- Visit the IRS website at .

- Click on the "Forms and Publications" tab.

- Search for "Form 2210" in the search bar.

- Select the correct form from the search results.

- Click on the "Download" button to save the form to your computer.

Method 2: Use Tax Software

Another way to find Form 2210 is to use tax software, such as TurboTax or H&R Block. These software programs provide a comprehensive suite of tax forms, including Form 2210, which can be accessed and completed within the program.

To access Form 2210 using tax software, follow these steps:

- Log in to your tax software account.

- Search for "Form 2210" within the program.

- Select the correct form from the search results.

- Complete the form within the program.

- E-file or print the form as needed.

Method 3: Visit a Local IRS Office or Library

If you prefer to access Form 2210 in person, you can visit a local IRS office or library. Many IRS offices and libraries provide a comprehensive collection of tax forms, including Form 2210, which can be accessed and printed for free.

To access Form 2210 at a local IRS office or library, follow these steps:

- Visit the IRS website to find a local office or library near you.

- Call the office or library to confirm availability of Form 2210.

- Visit the office or library during business hours.

- Request Form 2210 from the staff.

- Print or complete the form as needed.

Benefits of Using Form 2210

Using Form 2210 can help you avoid penalties and interest on underpaid estimated taxes. By completing this form, you can calculate your underpayment and make timely payments to the IRS. Additionally, Form 2210 can help you identify areas where you may need to adjust your estimated tax payments for the next year.

Common Questions About Form 2210

Q: What is the purpose of Form 2210? A: Form 2210 is used to calculate the underpayment of estimated taxes and to determine if penalties are owed.

Q: Who needs to file Form 2210? A: Individuals who expect to owe more than $1,000 in taxes for the year, including self-employed individuals and those who receive income that is not subject to withholding.

Q: Where can I find Form 2210? A: You can find Form 2210 on the IRS website, through tax software, or at a local IRS office or library.

Q: What are the benefits of using Form 2210? A: Using Form 2210 can help you avoid penalties and interest on underpaid estimated taxes and identify areas where you may need to adjust your estimated tax payments for the next year.

Take Action

Now that you know the three ways to find Form 2210, take action to ensure you are in compliance with the IRS. Download the form from the IRS website, use tax software, or visit a local IRS office or library to access this essential tax document. By completing Form 2210, you can avoid penalties and interest on underpaid estimated taxes and ensure a smooth tax filing experience.

Share Your Thoughts

Have you had trouble finding Form 2210 in the past? Share your experiences and tips for accessing this form in the comments below. Your input can help others who are struggling to find this essential tax document.