Employers in the United States are required to file Form 941, also known as the Employer's Quarterly Federal Tax Return, with the Internal Revenue Service (IRS) on a quarterly basis. This form is used to report income taxes, social security taxes, and Medicare taxes withheld from employee wages, as well as pay the employer's portion of these taxes. In addition to Form 941, some employers are also required to file Schedule B, which provides more detailed information about the employer's tax liability.

In this article, we will guide you through the process of filing Form 941 with Schedule B, making it easier for you to comply with the IRS requirements.

What is Form 941?

Form 941 is a quarterly tax return that employers must file with the IRS to report their tax liability. The form requires employers to report the following information:

- Income taxes withheld from employee wages

- Social security taxes withheld from employee wages

- Medicare taxes withheld from employee wages

- The employer's portion of social security and Medicare taxes

- Any adjustments to the employer's tax liability

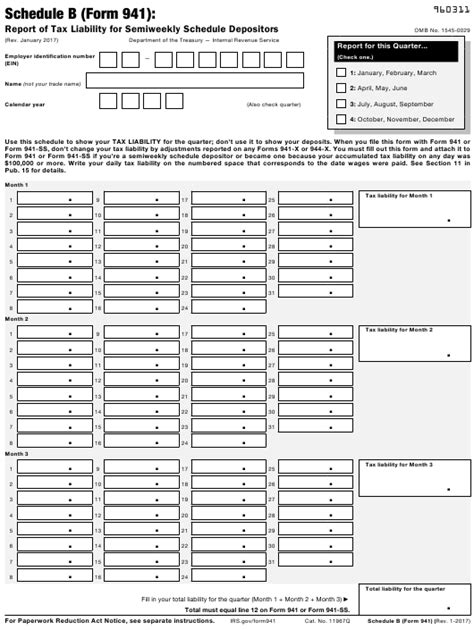

What is Schedule B?

Schedule B is an additional form that some employers are required to file with Form 941. This schedule provides more detailed information about the employer's tax liability, including:

- The total amount of taxes withheld from employee wages

- The total amount of taxes paid by the employer

- Any adjustments to the employer's tax liability

- The employer's tax liability for the quarter

Who needs to file Schedule B?

Not all employers are required to file Schedule B with Form 941. You need to file Schedule B if you are an employer who:

- Made deposits of $2,500 or more in a quarter

- Withheld taxes from employee wages

- Paid wages subject to social security and Medicare taxes

How to file Form 941 with Schedule B?

Filing Form 941 with Schedule B requires you to follow these steps:

- Gather all necessary information and documents, including:

- Employee wages and tax withholding records

- Social security and Medicare tax records

- Records of any adjustments to tax liability

- Complete Form 941, making sure to report all required information accurately

- Complete Schedule B, providing the detailed information required

- Sign and date the forms

- Submit the forms to the IRS by the required deadline (April 30th for Q1, July 31st for Q2, October 31st for Q3, and January 31st for Q4)

Tips for accurate filing

To ensure accurate filing of Form 941 with Schedule B, follow these tips:

- Use the correct form version and schedule

- Report all required information accurately

- Make sure to sign and date the forms

- Double-check calculations and tax liability

- File on time to avoid penalties and interest

Penalties for late or inaccurate filing

The IRS imposes penalties for late or inaccurate filing of Form 941 and Schedule B. These penalties can include:

- Late filing penalties: up to 47.6% of the unpaid tax

- Inaccurate filing penalties: up to 20% of the unpaid tax

- Interest on unpaid tax: calculated from the original due date

How to avoid penalties

To avoid penalties for late or inaccurate filing, follow these tips:

- File on time

- Double-check calculations and tax liability

- Use the correct form version and schedule

- Report all required information accurately

- Keep accurate records and documents

Electronic filing options

The IRS offers electronic filing options for Form 941 and Schedule B. These options include:

- E-file through the IRS website

- Use IRS-approved software

- Hire a tax professional or accountant

Electronic filing can help reduce errors and improve accuracy, making it easier to comply with IRS requirements.

Conclusion

Filing Form 941 with Schedule B can seem daunting, but by following these steps and tips, you can make the process easier and more accurate. Remember to gather all necessary information, complete the forms accurately, and file on time to avoid penalties and interest. Consider electronic filing options to improve accuracy and reduce errors. By taking these steps, you can ensure compliance with IRS requirements and avoid any potential issues.

We encourage you to share your experiences or ask questions about filing Form 941 with Schedule B in the comments below.

What is the deadline for filing Form 941?

+The deadline for filing Form 941 is April 30th for Q1, July 31st for Q2, October 31st for Q3, and January 31st for Q4.

Do I need to file Schedule B with Form 941?

+You need to file Schedule B if you are an employer who made deposits of $2,500 or more in a quarter, withheld taxes from employee wages, or paid wages subject to social security and Medicare taxes.

What are the penalties for late or inaccurate filing?

+The IRS imposes penalties for late or inaccurate filing, including late filing penalties of up to 47.6% of the unpaid tax, inaccurate filing penalties of up to 20% of the unpaid tax, and interest on unpaid tax calculated from the original due date.