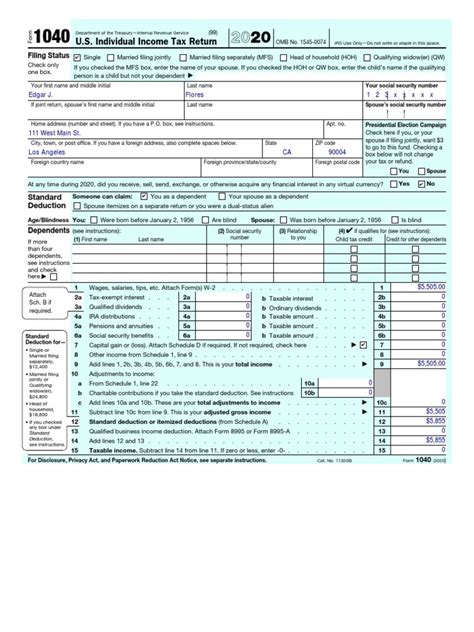

Completing tax forms can be a daunting task, especially for those who are new to the process. The Edgar Flores 1040 form is a commonly used tax form in the United States, and it's essential to understand how to fill it out accurately to avoid any errors or delays in receiving your refund. In this article, we will provide you with 7 tips to help you ace the Edgar Flores 1040 form answer key.

Understanding the 1040 Form

Before we dive into the tips, it's essential to understand what the 1040 form is and what it's used for. The 1040 form is a standard form used by the Internal Revenue Service (IRS) to report an individual's income and calculate their tax liability. The form is used to report income from various sources, such as employment, investments, and self-employment.

Tip 1: Gather All Necessary Documents

The first step to acing the Edgar Flores 1040 form answer key is to gather all the necessary documents. You will need to have the following documents ready:

- Your social security number or Individual Taxpayer Identification Number (ITIN)

- Your employer's name and address

- Your W-2 forms from all employers

- Your 1099 forms for freelance work or self-employment

- Your interest statements from banks and investments

- Your dividend statements from investments

- Your receipts for deductions and credits

Having all these documents ready will make it easier for you to fill out the form accurately.

Tip 2: Choose the Right Filing Status

Your filing status will determine which tax rates and deductions you are eligible for. You can choose from the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the filing status that best applies to your situation.

Tip 3: Report All Income

You must report all income earned during the tax year, including:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains

- Unemployment benefits

Make sure to report all income earned, even if it's not reflected on a W-2 or 1099 form.

Tip 4: Claim All Eligible Deductions

Deductions can help reduce your taxable income, which can result in a lower tax liability. You can claim deductions for:

- Charitable donations

- Medical expenses

- Mortgage interest

- State and local taxes

- Business expenses

Keep receipts and records for all deductions you claim.

Tip 5: Take Advantage of Tax Credits

Tax credits can directly reduce your tax liability, dollar for dollar. You may be eligible for credits such as:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

- Retirement savings contributions credit

Check if you qualify for any of these credits.

Tip 6: Review and Double-Check Your Form

Once you've completed the form, review it carefully to ensure accuracy. Double-check your math, and make sure you've reported all income and claimed all eligible deductions and credits.

Tip 7: Seek Help If Needed

If you're unsure about any part of the form or need help with calculations, don't hesitate to seek help. You can:

- Consult the IRS website or call the IRS help line

- Hire a tax professional or accountant

- Use tax software or online tools

Don't risk making errors or missing out on credits and deductions by trying to go it alone.

Get Help and Stay Informed

By following these 7 tips, you'll be well on your way to acing the Edgar Flores 1040 form answer key. Remember to stay informed about changes to tax laws and regulations, and don't hesitate to seek help if you need it.

Take Action and Share Your Thoughts

Now that you've read our article, we encourage you to take action and start preparing your tax return. Share your thoughts and experiences with tax forms in the comments section below. Have you ever had difficulty with tax forms? How did you overcome the challenges? Share your tips and advice with our readers.

What is the 1040 form used for?

+The 1040 form is a standard form used by the Internal Revenue Service (IRS) to report an individual's income and calculate their tax liability.

What documents do I need to complete the 1040 form?

+You will need to have your social security number or Individual Taxpayer Identification Number (ITIN), W-2 forms, 1099 forms, interest statements, dividend statements, and receipts for deductions and credits.

Can I claim deductions on the 1040 form?

+Yes, you can claim deductions on the 1040 form, including charitable donations, medical expenses, mortgage interest, state and local taxes, and business expenses.