In recent years, the COVID-19 pandemic has led to a significant increase in the number of people receiving unemployment benefits. If you're one of them, you might be wondering how to report this income on your tax return. The IRS has introduced Form 8915-F to help individuals report qualified disaster retirement plan distributions and repayments. In this article, we'll guide you on how to fill out Form 8915-F using TurboTax, a popular tax preparation software.

Understanding Form 8915-F

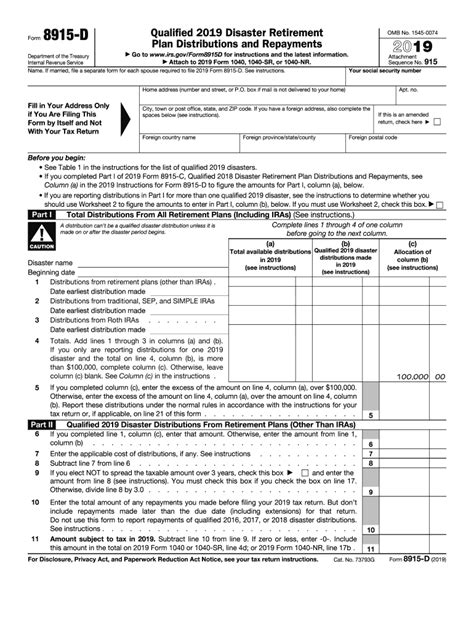

Form 8915-F is used to report qualified disaster retirement plan distributions and repayments. This form is specifically designed for individuals who received distributions from their retirement plans due to a qualified disaster, such as the COVID-19 pandemic. The form helps you calculate the tax on these distributions and determine if you're eligible for any tax relief.

Why Use TurboTax to Fill Out Form 8915-F?

TurboTax is a popular tax preparation software that makes it easy to fill out Form 8915-F. With TurboTax, you can:

- Easily import your W-2 and 1099 forms

- Automatically calculate your tax liability

- Get guidance on tax deductions and credits

- E-file your tax return directly to the IRS

Method 1: Using TurboTax's Guided Interview

TurboTax offers a guided interview that walks you through the process of filling out Form 8915-F. To use this method, follow these steps:- Log in to your TurboTax account and select the tax year you want to file.

- Click on "Start" and select "Unemployment and Retirement Income."

- Follow the prompts to enter your unemployment benefits and retirement plan distributions.

- TurboTax will guide you through the process of filling out Form 8915-F.

Method 2: Manually Entering Form 8915-F

If you prefer to manually enter Form 8915-F, you can do so by following these steps:- Log in to your TurboTax account and select the tax year you want to file.

- Click on "Forms" and select "Form 8915-F."

- Enter the required information, including your retirement plan distributions and repayments.

- TurboTax will calculate your tax liability and provide guidance on tax deductions and credits.

Method 3: Uploading Your 1099-R Form

If you received a 1099-R form for your retirement plan distributions, you can upload it to TurboTax to fill out Form 8915-F. To do this, follow these steps:- Log in to your TurboTax account and select the tax year you want to file.

- Click on "Upload" and select "1099-R."

- Enter the required information from your 1099-R form.

- TurboTax will automatically fill out Form 8915-F.

Tips and Reminders

When filling out Form 8915-F using TurboTax, keep the following tips and reminders in mind:

- Make sure you have all the required documents, including your 1099-R form and W-2 form.

- Double-check your entries to ensure accuracy.

- Take advantage of TurboTax's guidance on tax deductions and credits.

- E-file your tax return directly to the IRS to avoid delays.

By following these methods and tips, you can easily fill out Form 8915-F using TurboTax. Remember to take your time and ensure accuracy to avoid any errors or delays in your tax return.

Get Help from TurboTax Experts

If you need help filling out Form 8915-F or have questions about your tax return, TurboTax experts are here to assist you. With TurboTax, you can get help from experienced tax professionals who can guide you through the process.

Share Your Experience

Have you used TurboTax to fill out Form 8915-F? Share your experience in the comments below. If you have any questions or need help with your tax return, feel free to ask.What is Form 8915-F used for?

+Form 8915-F is used to report qualified disaster retirement plan distributions and repayments.

Can I file Form 8915-F manually?

+Yes, you can file Form 8915-F manually, but it's recommended to use tax preparation software like TurboTax to ensure accuracy and ease.

What documents do I need to fill out Form 8915-F?

+You'll need your 1099-R form, W-2 form, and any other relevant documents to fill out Form 8915-F.