East Lansing, Michigan, is known for its vibrant community, excellent schools, and prestigious Michigan State University. As a resident, it's essential to understand your tax obligations and how to fill out the East Lansing city tax form accurately. In this article, we will guide you through the process, highlighting five ways to ensure you complete the form correctly.

Whether you're a new resident or a long-time East Lansing homeowner, understanding the city's tax requirements can save you time, money, and potential penalties. We will cover the necessary steps, provide practical examples, and offer valuable tips to make the process smoother.

Understanding the East Lansing City Tax Form

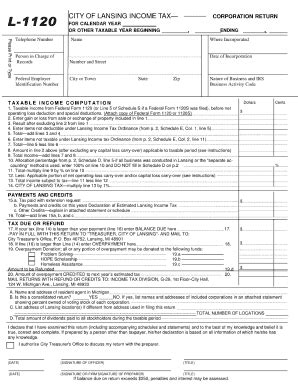

Before we dive into the five ways to fill out the East Lansing city tax form, it's crucial to understand the form itself. The city tax form is used to report and pay taxes on income earned within the city limits. The form typically includes sections for personal information, income, deductions, and tax calculations.

Why Accurate Completion Matters

Accurate completion of the East Lansing city tax form is vital to avoid penalties, fines, and potential audits. The city uses the information provided to determine your tax liability, so it's essential to ensure all sections are filled out correctly.

5 Ways to Fill Out the East Lansing City Tax Form

1. Gather Required Documents and Information

To fill out the East Lansing city tax form accurately, you'll need to gather the necessary documents and information. This includes:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your employer's name and address

- Your income statement (W-2 or 1099)

- Any deductions or exemptions you're eligible for

Make sure you have all the required documents before starting the form.

Tip: Keep All Documents Organized

Keep all your tax-related documents organized and easily accessible. This will save you time and reduce stress when filling out the form.

2. Use the Correct Filing Status

Your filing status determines your tax rate and deductions. The East Lansing city tax form typically includes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the correct filing status to ensure you're eligible for the right deductions and tax rates.

Example: Choosing the Correct Filing Status

If you're married and filing jointly, you'll report your combined income and claim deductions together. However, if you're married and filing separately, you'll report your individual income and claim deductions separately.

3. Report Income Accurately

Report all income earned within the city limits, including:

- Wages and salaries

- Tips and gratuities

- Self-employment income

- Interest and dividends

- Capital gains

Make sure to include all income sources, even if you're not required to report them on your federal tax return.

Tip: Use a Tax Calculator

Use a tax calculator to ensure you're reporting your income accurately. This will help you avoid errors and potential penalties.

4. Claim Deductions and Exemptions

The East Lansing city tax form allows for various deductions and exemptions, including:

- Standard deduction

- Itemized deductions

- Exemptions for dependents

- Exemptions for seniors or disabled individuals

Claim all eligible deductions and exemptions to reduce your tax liability.

Example: Claiming Itemized Deductions

If you itemize deductions, you can claim expenses like mortgage interest, property taxes, and charitable donations. Keep receipts and records to support your deductions.

5. Review and Sign the Form

Once you've completed the East Lansing city tax form, review it carefully for errors or omissions. Sign and date the form, and make sure to include any required attachments or supporting documents.

Tip: Use a Tax Professional

If you're unsure about filling out the form or have complex tax situations, consider consulting a tax professional. They can help you navigate the process and ensure accuracy.

Additional Tips and Reminders

- File your tax return on time to avoid penalties and fines.

- Keep a copy of your tax return and supporting documents for at least three years.

- Consider e-filing your tax return for faster processing and refunds.

- Stay informed about tax law changes and updates that may affect your tax liability.

Conclusion: Simplifying the East Lansing City Tax Form Process

Filling out the East Lansing city tax form can seem daunting, but by following these five ways, you can ensure accuracy and avoid potential penalties. Remember to gather required documents, use the correct filing status, report income accurately, claim deductions and exemptions, and review and sign the form carefully.

If you have any questions or concerns, don't hesitate to reach out to the City of East Lansing or a tax professional for guidance.

What is the deadline for filing the East Lansing city tax form?

+The deadline for filing the East Lansing city tax form is typically April 30th, but check the city's website for any updates or changes.

Do I need to file a tax return if I don't owe taxes?

+Yes, even if you don't owe taxes, you may still need to file a tax return to report income and claim deductions or exemptions.

Can I e-file my East Lansing city tax return?

+Yes, the City of East Lansing offers e-filing options for tax returns. Check the city's website for more information and to access the e-filing system.