The E1 SSS form is a crucial document for employers in the Philippines, serving as a gateway to the Social Security System (SSS). As an employer, understanding the E1 SSS form is essential to ensure compliance with the SSS regulations and provide social security benefits to your employees. In this article, we will delve into the world of E1 SSS form, exploring its importance, purpose, and step-by-step guide on how to fill it out accurately.

The Importance of E1 SSS Form

The E1 SSS form, also known as the Employer Registration Form, is a mandatory document required by the Social Security System (SSS) for all employers in the Philippines. This form serves as a registration requirement for employers to obtain an SSS employer ID number, which is necessary for remitting social security contributions, reporting employee data, and accessing SSS benefits.

Purpose of E1 SSS Form

The primary purpose of the E1 SSS form is to register employers with the Social Security System (SSS). This form collects essential information about the employer, including business details, address, and contact information. By completing the E1 SSS form, employers can:

- Obtain an SSS employer ID number

- Remit social security contributions for their employees

- Report employee data to the SSS

- Access SSS benefits for their employees

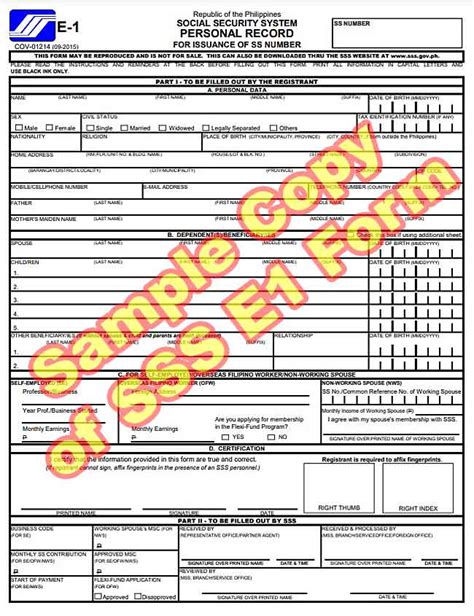

Step-by-Step Guide to Filling Out E1 SSS Form

Filling out the E1 SSS form can be a daunting task, especially for new employers. To make it easier, we have created a step-by-step guide to help you complete the form accurately.

Step 1: Download and Print the E1 SSS Form

The E1 SSS form can be downloaded from the SSS website or obtained from any SSS branch. Make sure to print the form on a clear and readable font.

Step 2: Fill Out Employer Information

- Employer's Name: Write the business name as registered with the Securities and Exchange Commission (SEC) or the Department of Trade and Industry (DTI).

- Business Address: Provide the complete address of the business, including street number, barangay, city, and province.

- Contact Number: Write the employer's contact number, including the area code.

Step 3: Fill Out Employer's Tax Identification Number (TIN)

- TIN: Write the employer's TIN, which can be obtained from the Bureau of Internal Revenue (BIR).

Step 4: Fill Out Employee Information

- Number of Employees: Write the total number of employees currently employed by the business.

- List of Employees: Attach a separate sheet of paper with the list of employees, including their names, dates of birth, and addresses.

Step 5: Sign and Date the Form

- Signature: Sign the form with your authorized signature.

- Date: Write the date the form was signed.

Step 6: Submit the Form

- Submit the completed E1 SSS form to the nearest SSS branch, along with the required supporting documents.

Required Supporting Documents

To complete the E1 SSS form, employers are required to submit the following supporting documents:

- Business registration certificate from the SEC or DTI

- TIN certificate from the BIR

- List of employees with their names, dates of birth, and addresses

Tips and Reminders

- Make sure to fill out the form accurately and completely to avoid delays in processing.

- Attach all required supporting documents to avoid rejection.

- Keep a copy of the completed form and supporting documents for future reference.

Common Mistakes to Avoid

To avoid common mistakes when filling out the E1 SSS form, keep the following in mind:

- Inaccurate or incomplete information

- Missing or incomplete supporting documents

- Failure to sign and date the form

Conclusion

The E1 SSS form is a vital document for employers in the Philippines, serving as a gateway to the Social Security System (SSS). By understanding the importance, purpose, and step-by-step guide to filling out the form, employers can ensure compliance with SSS regulations and provide social security benefits to their employees. Remember to fill out the form accurately and completely, attach all required supporting documents, and avoid common mistakes to ensure a smooth registration process.

We hope this comprehensive guide has helped you understand the E1 SSS form and its significance in the Philippines. If you have any questions or need further clarification, please feel free to ask in the comments section below.

FAQ Section

What is the purpose of the E1 SSS form?

+The primary purpose of the E1 SSS form is to register employers with the Social Security System (SSS).

What are the required supporting documents for the E1 SSS form?

+The required supporting documents include business registration certificate from the SEC or DTI, TIN certificate from the BIR, and list of employees with their names, dates of birth, and addresses.

What are the common mistakes to avoid when filling out the E1 SSS form?

+