Traveling for business can be a significant expense, and one of the most substantial costs is often hotel stays. However, did you know that you may be eligible for a hotel tax exemption? In this article, we will explore the concept of a DTS hotel tax exempt form and provide a comprehensive guide on how to take advantage of this benefit.

Understanding Hotel Tax Exemption

Hotel tax exemption is a benefit that allows eligible travelers to waive or reduce the amount of taxes paid on their hotel stays. This can be especially beneficial for business travelers who spend a significant amount of time on the road. The tax exemption can vary depending on the location, with some states and cities offering more generous exemptions than others.

What is a DTS Hotel Tax Exempt Form?

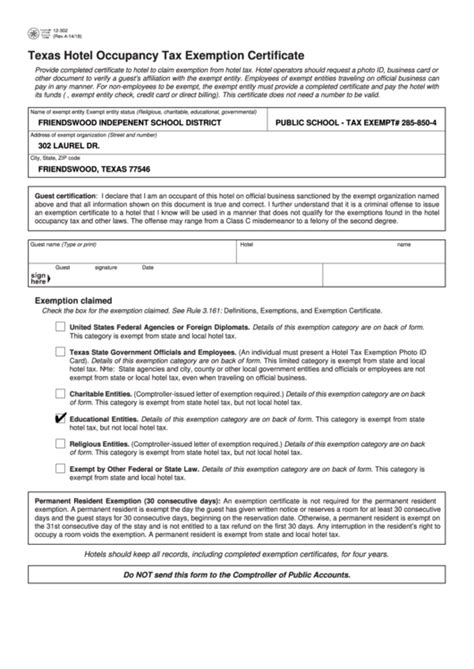

A DTS hotel tax exempt form is a document that allows eligible travelers to claim a hotel tax exemption. DTS stands for Defense Travel System, which is a web-based system used by the US Department of Defense to manage travel arrangements. The form is typically used by military personnel and government employees who are traveling on official business. However, it can also be used by other eligible travelers who meet specific requirements.

Eligibility Requirements

To be eligible for a hotel tax exemption, you must meet specific requirements. These requirements may vary depending on the state or city you are visiting, but here are some general guidelines:

- You must be traveling on official business, such as for work or education.

- You must be a US citizen or a resident of the state or city you are visiting.

- You must be staying in a hotel that is participating in the tax exemption program.

- You must have a valid DTS hotel tax exempt form or other documentation that supports your eligibility.

How to Obtain a DTS Hotel Tax Exempt Form

Obtaining a DTS hotel tax exempt form is relatively straightforward. Here are the steps to follow:

- Check your eligibility: Review the eligibility requirements to ensure you qualify for a hotel tax exemption.

- Gather required documentation: You will need to provide documentation that supports your eligibility, such as a letter from your employer or a copy of your government ID.

- Fill out the form: Download and complete the DTS hotel tax exempt form, which can usually be found on the website of the state or city you are visiting.

- Submit the form: Submit the completed form to the hotel where you will be staying, along with any required documentation.

Benefits of Using a DTS Hotel Tax Exempt Form

Using a DTS hotel tax exempt form can provide several benefits, including:

- Tax savings: By waiving or reducing hotel taxes, you can save a significant amount of money on your hotel stays.

- Increased travel budget: With the tax savings, you can allocate more funds to other travel expenses, such as food and transportation.

- Convenience: The DTS hotel tax exempt form is a convenient way to manage your hotel stays and reduce your tax liability.

Common Challenges and Solutions

While using a DTS hotel tax exempt form can be beneficial, there are some common challenges that you may encounter. Here are some solutions to these challenges:

- Difficulty obtaining the form: If you are having trouble finding the DTS hotel tax exempt form, try contacting the state or city's tax authority or the hotel directly.

- Eligibility issues: If you are unsure about your eligibility, review the requirements carefully and contact the relevant authorities for clarification.

- Hotel participation: If the hotel you are staying at does not participate in the tax exemption program, consider staying at a different hotel that does participate.

Best Practices for Using a DTS Hotel Tax Exempt Form

To get the most out of using a DTS hotel tax exempt form, follow these best practices:

- Plan ahead: Research the tax exemption program and requirements before your trip to ensure you are eligible and have the necessary documentation.

- Keep records: Keep a record of your hotel stays and tax exemptions to ensure you can claim the benefits.

- Communicate with the hotel: Inform the hotel about your tax exemption status and provide the necessary documentation to avoid any issues.

Common Mistakes to Avoid

When using a DTS hotel tax exempt form, there are some common mistakes to avoid:

- Ineligible stays: Make sure you are eligible for the tax exemption before claiming it.

- Insufficient documentation: Ensure you have the necessary documentation to support your eligibility.

- Late submission: Submit the form and documentation in a timely manner to avoid any issues.

Conclusion

Using a DTS hotel tax exempt form can be a great way to save money on your hotel stays. By understanding the eligibility requirements, benefits, and best practices, you can make the most out of this benefit. Remember to plan ahead, keep records, and communicate with the hotel to ensure a smooth and successful tax exemption experience.

What is a DTS hotel tax exempt form?

+A DTS hotel tax exempt form is a document that allows eligible travelers to claim a hotel tax exemption.

Who is eligible for a hotel tax exemption?

+Eligibility requirements may vary, but generally, you must be traveling on official business, be a US citizen or resident, and stay in a participating hotel.

How do I obtain a DTS hotel tax exempt form?

+Download and complete the form, gather required documentation, and submit it to the hotel where you will be staying.