Taxpayers who have received retirement account distributions due to the COVID-19 pandemic or are impacted by qualified disaster distributions may need to file additional forms with the Internal Revenue Service (IRS). One such form is the Form 8915-F, which is used to report qualified disaster retirement plan distributions and repayments. In this article, we will delve into the definition and filing requirements of Form 8915-F.

What is Form 8915-F?

Understanding Form 8915-F

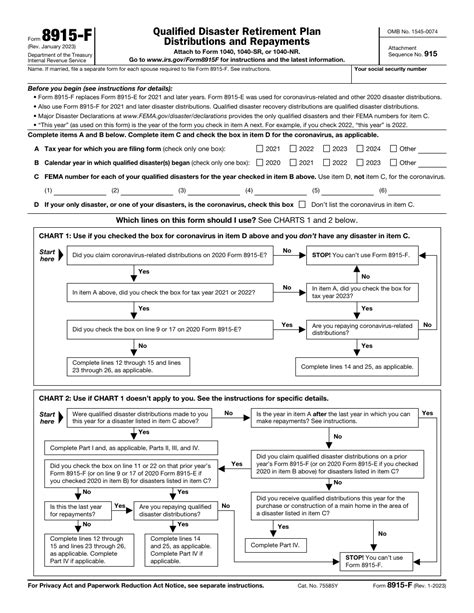

Form 8915-F is an IRS form used to report qualified disaster retirement plan distributions and repayments. The form is used by taxpayers who have received retirement account distributions due to qualified disasters, such as hurricanes, wildfires, or floods, or due to the COVID-19 pandemic. The form allows taxpayers to report these distributions and repayments and to claim any related tax relief.

Who Needs to File Form 8915-F?

Eligibility Requirements

Taxpayers who have received qualified disaster retirement plan distributions or COVID-19-related distributions must file Form 8915-F if they:

- Received a qualified disaster distribution or a COVID-19-related distribution from a qualified retirement plan, such as a 401(k) or an IRA.

- Repaid some or all of the distribution to the retirement plan.

- Are claiming a tax deduction or credit related to the distribution or repayment.

Filing Requirements

Filing Form 8915-F

To file Form 8915-F, taxpayers must follow these steps:

- Gather required information: Taxpayers need to gather information about the qualified disaster distribution or COVID-19-related distribution, including the date of the distribution, the amount of the distribution, and the amount of any repayments made.

- Complete Form 8915-F: Taxpayers must complete Form 8915-F, which includes providing information about the distribution and repayment, as well as claiming any related tax relief.

- Attach supporting documentation: Taxpayers must attach supporting documentation, such as a copy of the distribution check or a statement from the retirement plan administrator, to Form 8915-F.

- File Form 8915-F with the IRS: Taxpayers must file Form 8915-F with the IRS by the required deadline, which is typically the tax filing deadline for the tax year in which the distribution was received.

Tax Relief Available

Tax Relief for Qualified Disaster Distributions

Taxpayers who receive qualified disaster distributions or COVID-19-related distributions may be eligible for tax relief, including:

- Waiver of the 10% early withdrawal penalty: Taxpayers who receive qualified disaster distributions or COVID-19-related distributions may be eligible to waive the 10% early withdrawal penalty.

- Income tax relief: Taxpayers may be eligible to claim a tax deduction or credit related to the distribution or repayment.

Repayment Options

Repayment Options for Qualified Disaster Distributions

Taxpayers who receive qualified disaster distributions or COVID-19-related distributions have several repayment options, including:

- Repaying the distribution within three years: Taxpayers can repay the distribution within three years of the date of the distribution to avoid income tax and penalties.

- Repaying the distribution through an installment agreement: Taxpayers can repay the distribution through an installment agreement with the IRS.

- Repaying the distribution through a lump-sum payment: Taxpayers can repay the distribution through a lump-sum payment to the retirement plan.

Conclusion

Conclusion

In conclusion, Form 8915-F is an important form for taxpayers who have received qualified disaster retirement plan distributions or COVID-19-related distributions. By understanding the definition and filing requirements of Form 8915-F, taxpayers can ensure they comply with IRS regulations and claim any related tax relief. Taxpayers should consult with a tax professional or financial advisor to ensure they meet the eligibility requirements and follow the correct filing procedures.

FAQ Section

What is the deadline for filing Form 8915-F?

+The deadline for filing Form 8915-F is typically the tax filing deadline for the tax year in which the distribution was received.

Can I file Form 8915-F electronically?

+No, Form 8915-F cannot be filed electronically. Taxpayers must file the form by mail or through a tax professional.

What supporting documentation do I need to attach to Form 8915-F?

+Taxpayers must attach a copy of the distribution check or a statement from the retirement plan administrator to Form 8915-F.