The DTF 802 form is a crucial document for individuals and businesses in the state of New York, serving as an application for a Certificate of Authority to Collect Sales Tax. This form is used by the New York State Department of Taxation and Finance (DTF) to verify the eligibility of applicants to collect sales tax on behalf of the state.

In this article, we will provide a comprehensive guide on how to download and complete the DTF 802 form, as well as offer instructions on the application process.

Why Do You Need the DTF 802 Form?

The DTF 802 form is required for any business or individual that intends to collect sales tax in the state of New York. This includes retailers, wholesalers, and other businesses that sell taxable goods or services. By completing and submitting the DTF 802 form, applicants demonstrate their eligibility to collect sales tax and obtain a Certificate of Authority.

Who Needs to Complete the DTF 802 Form?

The following individuals and businesses are required to complete the DTF 802 form:

- Retailers who sell taxable goods or services

- Wholesalers who sell taxable goods or services

- Businesses that provide taxable services

- Out-of-state businesses that sell taxable goods or services to New York residents

How to Download the DTF 802 Form

The DTF 802 form can be downloaded from the official website of the New York State Department of Taxation and Finance. To access the form, follow these steps:

- Visit the DTF website at .

- Click on the "Forms" tab at the top of the page.

- Select "Sales Tax" from the drop-down menu.

- Click on the "DTF-802" link to download the form.

Alternatively, you can search for "DTF 802 form" on your preferred search engine to find the form.

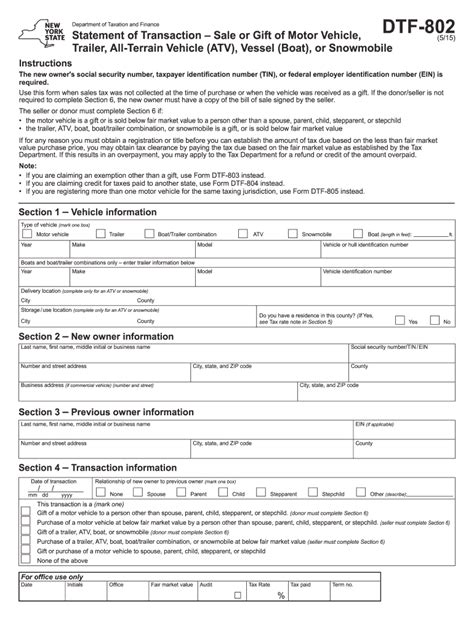

Completing the DTF 802 Form

Once you have downloaded the DTF 802 form, you can begin completing it. The form requires the following information:

- Business name and address

- Federal Employer Identification Number (FEIN)

- Type of business (retailer, wholesaler, etc.)

- Description of taxable goods or services sold

- Location of business

It is essential to complete the form accurately and thoroughly, as incomplete or inaccurate information may delay the processing of your application.

Submitting the DTF 802 Form

Once you have completed the DTF 802 form, you can submit it to the DTF via mail or online. To submit the form online, follow these steps:

- Visit the DTF website at .

- Click on the "Submit a Form" tab at the top of the page.

- Select "DTF-802" from the drop-down menu.

- Upload the completed form and submit it.

To submit the form via mail, send it to the following address:

New York State Department of Taxation and Finance DTF-802 Processing W.A. Harriman State Office Campus Albany, NY 12227

Processing Time and Certificate of Authority

The processing time for the DTF 802 form typically takes 2-4 weeks. Once your application is approved, you will receive a Certificate of Authority to Collect Sales Tax. This certificate is required for all businesses that collect sales tax in the state of New York.

In conclusion, the DTF 802 form is a critical document for businesses and individuals that collect sales tax in the state of New York. By following the instructions outlined in this article, you can ensure that your application is complete and accurate, and that you receive your Certificate of Authority in a timely manner.

Additional Resources

For more information on the DTF 802 form and the application process, you can visit the DTF website at . You can also contact the DTF customer service team at (518) 457-5387 or .

By providing this comprehensive guide, we aim to make the process of downloading and completing the DTF 802 form as smooth and efficient as possible.

FAQs

Q: What is the DTF 802 form used for? A: The DTF 802 form is used to apply for a Certificate of Authority to Collect Sales Tax in the state of New York.

Q: Who needs to complete the DTF 802 form? A: Retailers, wholesalers, and businesses that provide taxable services are required to complete the DTF 802 form.

Q: How do I download the DTF 802 form? A: The DTF 802 form can be downloaded from the official website of the New York State Department of Taxation and Finance.

Q: How long does it take to process the DTF 802 form? A: The processing time for the DTF 802 form typically takes 2-4 weeks.

What is the purpose of the DTF 802 form?

+The DTF 802 form is used to apply for a Certificate of Authority to Collect Sales Tax in the state of New York.

Who needs to complete the DTF 802 form?

+Retailers, wholesalers, and businesses that provide taxable services are required to complete the DTF 802 form.

How do I download the DTF 802 form?

+The DTF 802 form can be downloaded from the official website of the New York State Department of Taxation and Finance.